India Inc’s performance for the three months to December 2019 has been abysmal with companies struggling to grow revenues.

Maruti Suzuki’s net revenues,for instance, rose by just 5% year-on-year (y-o-y) with the carmaker reporting only a 2% rise in volumes during a festive period. At Asian Paints the growth in domestic decoratives was a dull 3% y-o-y since volumes grew in low double digits that implied realisations must have weakened. At the other end of the spectrum, L&T reported a 3% y-o-y fall in core E&C revenues. Even where volumes grew reasonably well, like at Godrej Consumer’s local operations, the sharp fall in realisations resulted in revenues growing by just 1% y-o-y.

Profits are up but that’s more thanks to falling costs and lower tax outflows. At Bajaj Auto, the Ebitda margin expanded 230 basis points y-o-y on better gross margins led by lower raw material prices. But managements remain cautious as prices of some key commodities are rising whereas demand, especially in rural India, remains weak and key sectors such as construction and real estate show no signs of recovery.

Given the slowdown in markets overseas, managements of IT firms like TCS are conservative while speaking on the outlook, noting that it would not be easy to replicate the growth rates of the past.

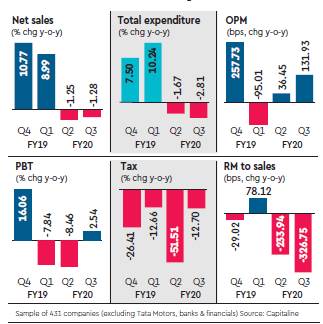

That State Bank of India’s corporate loan book contracted during the quarter is evidence of the sluggishness in industry. Sales for a group of 431 companies contracted 1% year-on-year; operating profit margins rose 132 basis points y-o-y as costs contracted by over 2% y-o-y. Some large commodity players like JSW Steel posted a sharp drop in profits of 88% y-o-y.

Manufacturers of consumer goods say rural demand is yet to show a resurgence, and in some pockets, has slowed further. Nonetheless, Hindustan Unilever managed to grow volumes by 5% y-o-y during Q3FY20 on a high base. Colgate, however, reported a 19th straight quarter of sub-10% topline growth and over this time the simple average volumes growth has been sub 3% y-o-y; in Q3FY20 volumes grew just 2.3% y-o-y.

At Tata Motors, smaller wholesale volumes resulting from inventory corrections and an adverse product mix resulted in an Ebitda loss for the stand-alone business; M&HCV volumes were down 43% y-o-y. At UltraTech revenue growth was virtually flat, although realisations shot up, because volume growth was weak. Analysts pointed out that, adjusting for Binani’s volume, the standalone cement volumes declined 8% y-o-y led by weak industry demand. JSW Steel also posted poor revenue numbers with sales falling 12% y-o-y. At PVR, the growth in footfalls was only 1% y-o-y while same-store footfalls actually contracted 6% y-o-y. At Avenue Supermarts, same-store sales rose by 6-7% y-o-y. Large companies such as Reliance Industries reported very ordinary numbers across businesses — except for retail. The accelerated fall in capex, however, enabled the company to turn free-cash-flow positive.