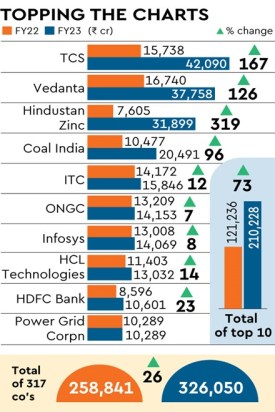

Riding on the optimism of a growing economy, increase in earnings and buoyant markets, India Inc has recommended a dividend payout of Rs 3.26 trillion for FY23. This is a whopping 26% higher than the nearly Rs 2.6 trillion that corporates shelled out to investors in the year-ago period.

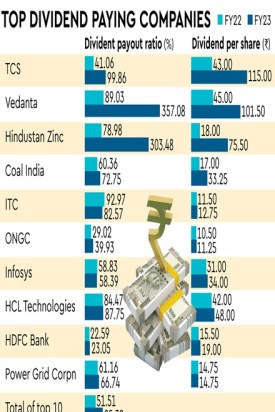

The Rs 3.26-trillion dividend payout is by 317 companies of the BSE 500 that have declared dividends. The payout ratio of these companies has also risen to 41.46% in FY23 from 34.66% in FY22.

IT major Tata Consultancy Services topped the charts with a total payout of Rs 42,090 crore, a 167.4% rise from that in the previous fiscal. Mining major Vedanta, a subsidiary of London-headquartered Vedanta Resources, followed with a total dividend recommendation of Rs 37,758 crore, a 126% rise from FY22, while Hindustan Zinc came in third with a 319% jump to Rs 31,899 crore.

Coal India with a payout of Rs 20,491 crore (95.6% rise), ITC with Rs 15,846 crore (11.8%), ONGC with Rs 14,153 crore and Infosys with Rs 14,069 crore were the others among the top 10, according to stock exchange data.

“During the Covid period, corporates had reduced their dividend, and now the increase is due to the bounce-back in revenues and earnings. This growth is expected to continue, as the conditions in India are conducive for growth,” Berger Paints India MD & CEO Abhijit Roy said.

The dividend per share recommended by the top three companies was more than double of last year’s, with TCS again topping the charts. The IT company recommended a dividend of Rs 115 per share for FY23, compared with Rs 43 per share in FY22. Vedanta recommended Rs 101.50 per share (against Rs 45), and HZL Rs 75.50 per share (up from Rs 18).

According to Geojit Financial Services executive director Satish Menon, the increase in dividend for FY23 is in line with India’s corporate earnings growth of 12-14% estimated for the fiscal. “Again, the sustenance of future dividend will depend on the earnings growth of FY24, which is anticipated to be mixed. This is because of the recessionary trend in the global market, which will have an effect on stocks and sectors. The effect will be more on the ones which are highly oriented to global demand,” Menon said.

Moreover, he said, India’s business correlation to global trade is expected to increase substantially in the future led by China and Europe-plus policy and supportive government industrial policy.

“Corporates are in capex mode, while the short-term demand outlook is subsiding. However, stable domestic demand and reduction in cost of operation due to drop in global commodity prices will help the corporates beat long-term earnings and maintain dividend growth in FY24,” he said.

Also read: Berger Paints sees revenues rising to Rs 20K-cr in 5 yrs

The rise in dividend outlay also comes at a time when corporates are expected to increase their capex spends by about 14% for FY24, and the rising trend is expected to continue for at least another three years.

Vedanta’s board has approved its first interim dividend of Rs 18.50 per share for FY24, with a total outgo amounting to Rs 6,877 crore, and May 30 as the record date. The move comes at a time when its parent Vedanta Resources is looking to shore up funds to trim debt.

Industry experts, meanwhile, have a word of caution for shareholders on relying entirely on dividends for investments.

“Shareholders should be mindful that investment premise should not be only based on dividends. Many PSUs have had significant cash on their balance sheet and are monopolistic businesses, but the stocks haven’t delivered significant total returns to their shareholders due to inefficient capital allocation in their businesses,” said Anurag Jhanwar, partner (family office advisory) at Upwisery Capital Advisors.

According to Rahul Bhutoria, director and founder at multi-family office Valtrust, maintaining a balance between dividend payments and retained earnings is crucial for the long-term sustainability of a company. “While paying dividends can be attractive to shareholders, it is essential to allocate adequate funds for reinvestment to support future growth and maintain financial stability,” Bhutoria said.

Despite a number of companies posting lower net profit in FY23, none of these 317 companies have recommended a lower dividend for the year.