Hindustan Unilever’s (HUL’s) weak March quarter (Q4FY23) earnings show that there are significant challenges to rural consumption, according to analysts tracking the company. This is even as commodity inflation moderates and peers such as Nestle and Tata Consumer Products have reported a turnover uptick in the March quarter, led by a mix of price and volume growth.

In contrast, HUL, which is the country’s largest consumer goods company remains “cautiously optimistic” about the domestic fast-moving consumer goods (FMCG) market. HUL reported a 10.6% year-on-year revenue growth in the March quarter, led mainly by price hikes. Volume growth was muted at 4% for the quarter, as rural consumers down traded to deal with inflationary pressures. Price growth came in at 7% for the March quarter.

While HUL CEO & MD Sanjiv Mehta said the sharp price hikes in Q4 would be the last ones taken by the company, sector experts say it may still take a while for rural consumption to recover fully.

“Overall, the FMCG market’s volume growth should be at least 4-5% even as commodity prices remain steady, only then the volatile scenario can turn a corner,” Mehta said on Thursday. FMCG market (urban and rural) registered flat volume growth in the March quarter, as per Nielsen data.

For the full year of FY23, Nielsen data shows that volume growth for the domestic FMCG market declined 4%, while price-led growth came in at 8% for the period.

“There are chances of an El Nino effect marring the monsoon season this year,” said G Chokkalingam, founder of Mumbai-based Equinomics Research and Advisory. “That will mean that rural incomes may get hit. I see a pickup in demand only by the third quarter of FY24, that too if rural consumers are not severely impacted by a weak monsoon. So, the rural recovery in my view will be slow,” he said.

A turnaround in rural consumption is critical for FMCG companies, and more so for HUL since it derives around 40% of its annual sales from rural areas. This is ahead of the industry average of a third of total sales coming from rural areas, say experts.

Also read: Rating: reduce; HCL Technologies: Margins in line with expectations

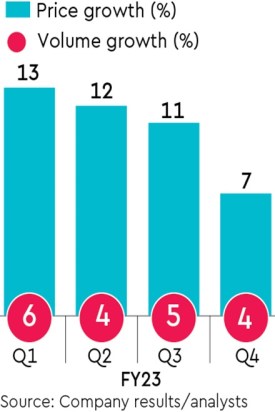

A look at the price and volume growth chart for HUL over the last four quarters of FY23 shows that the volume growth for the March quarter was amongst the lowest for the year. To be sure, the September quarter of FY23 also reported a 4% volume growth, however, this was against a backdrop of a sharp rural slowdown.

The March quarter, say analysts, was expected to shows sign of a rural uptick for HUL, as commodity prices were beginning to soften.

“HUL’s net material inflation in Q4 fell to 12% from 18% in Q3,” said Kaustubh Pawaskar, deputy vice-president, fundamental research at Mumbai-based brokerage Sharekhan. “While some commodities have softened such as soda ash, caustic soda and palm oil, inflationary pressures in some inputs such as barley and milk remain,” he said.

The price of Brent crude oil, for instance, has declined by 16%, soda ash by 6%, caustic soda by 25%, tea by 1%, and crude palm oil by 39% compared to the previous year, sector analysts said. These are key inputs for HUL. However, prices of other raw material, such as barley rose 8% and skimmed milk power increased by 18% versus the year-ago period.

Also read: Margins under stress, IT firms on slow track

As such, the sequential easing of commodity costs (reflected in net material inflation) has helped HUL’s gross margin expand to 48.7% in Q4 from 47.5% in Q3, analysts tracking the company said. However, gross margin fell by 84 basis points year-on-year, lagging some analysts’ estimates. One basis point is one-hundredth of a percentage point.

HUL’s operating margin, on the other hand, was flat sequentially at 23.3% led by higher advertising and promotion spends, though year-on-year, it was down by 80 basis points.