Vijay Kedia does not need an introduction. He is a well-known name in investor circles. An ace investor who we also call one of the Warren Buffetts of India, is often seen on social media and TV channels talking about his stock picking strategies or sometimes even singing his favourite songs.

Cited by many as an investment guru, Kedia is known for finding multibaggers early on. His strategy for picking stocks is backed by some solid research and that ignores the usual market noise. Many of his moves are a reason for envy for fellow investors, as to why they did not think of it first. Probably why he is aptly given the title of ‘Market Master.’

Kedia just added two new stocks to his portfolio, making his portfolio consist of 16 stocks worth over Rs 1,320 cr. Which are these two stocks that have caught the eye of the market master?

A case of rapid growth – Yatharth Hospital & Trauma Care Services Ltd

Incorporated in 2008, Yatharth Hospital and Trauma Care Services Limited is a multi-care hospital at Noida, Greater Noida, and Noida Extension, Uttar Pradesh.

With a market cap of Rs 7,757 cr, Yatharth Hospitals has the 8th and 10th largest private hospitals in the NCR, with 7 hospitals across North India with 87% of the beds in Metro.

Vijay Kedia just bought a 1% stake in the company worth Rs 78 cr. Apart from him ace investor and another Warren Buffett of India, Mukul Agarwal also holds a 1.14% stake in the company since June 2025.

The sales of the company have grown at a compounded rate of 45% from Rs 136 cr in FY20 to Rs 860 cr in FY25.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) jumped from Rs 38 cr in FY20 to Rs 225 cr in FY25, logging in a compound growth of 43%.

Net profits of the company have shown a solid turnaround, from losses of Rs 2 cr in FY20 to profits of Rs 131 cr in FY25.

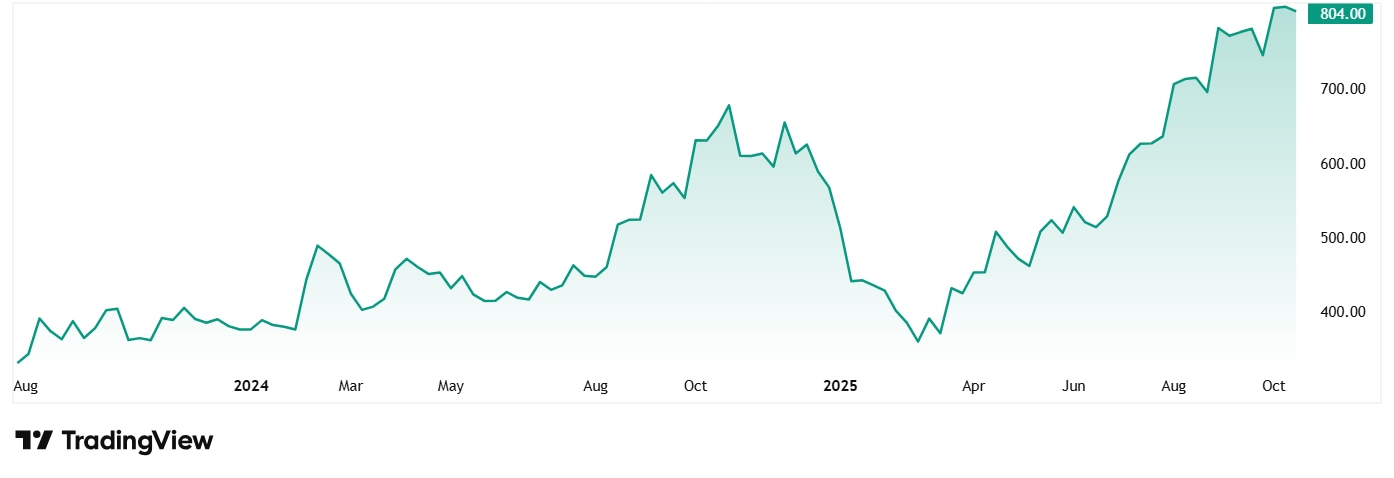

The share price of Yatharth Hospitals when it was listed in August 2023 was Rs 330, which as on 24th October 2025 is at Rs 805, which is a 144% jump in just 2 years. Rs 1 lac invested in the stock at listing would have turned to Rs 2.45 lacs today.

The company’s stock is trading at a PE of 55x, while the industry median is 59x. The 10-Year median PE for the industry is 48, while it would be too soon to look at the long-term median of Yatharth Hospital.

Yatharth Hospitals is currently investing heavily in expanding its capacity, which may put some short-term pressure on profit margins. However, as these new operations begin to mature, they are expected to enhance overall scale, average revenue per occupied bed (ARPOB), and cash flow generation. The management remains committed to operational efficiency, careful allocation of capital, and preserving a strong financial position. They have also provided clear guidance on sustaining margins and driving consistent growth over the long term.

Profit king – TechD Cybersecurity Ltd

Incorporated in January 2017, TechDefence Labs Solutions Limited is a cybersecurity firm specializing in safeguarding digital assets for organizations worldwide.

With a market cap of Rs 454 cr, TechD Cybersecurity Ltd is a CERT-In empanelled, ISO 27001-certified cybersecurity solutions provider, offering end-to-end services and training to domestic and international clients across BFSI, NBFCs, manufacturing, healthcare, aviation, IT/ITES, education, and government sectors.

The company was recently listed in September 2025 and Kedia bought a 5.26% stake in the company on listing, worth Rs 24 cr.

TechD’s sales have grown at a 118% CAGR from Rs 1.31 cr in FY21 to Rs 29.8 cr in FY25.

EBITDA grew from Rs 0.05 cr in FY21 to Rs 11.86 cr in FY25, logging in a compound growth of a staggering 292%.

As for the net profits, the company did not make any profits in FY21 and as for the FY25, the company recorded profits of Rs 8.4 cr.

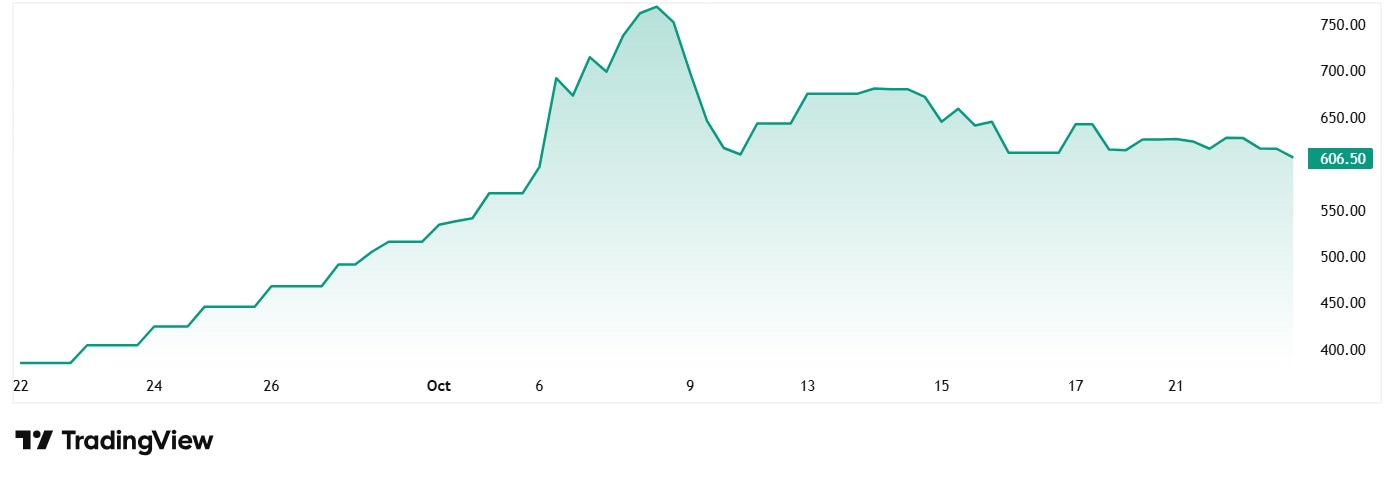

The share price of TechD Cybersecurity Ltd was around Rs 385 on listing in September 2025 and as of 24th October 2025, the price is at Rs 607, which is a 58% jump in just a month.

The company’s share is trading at a PE of 54x while the industry median is 35x. Also, the company is almost debt free and has a good return on equity (ROE) of 71% in the last 3 years.

Will Kedia sing his way to the bank this time?

Both the stocks that Kedia has added to his stock have shown solid promise and growth in the last few years, which could be the reason for Kedia’s interest in them. A triple digit compounded profit growth is not something seen very often, so these might be the market master’s big catches.

Vijay Kedia is known for picking multibaggers in the making and these 2 stocks look like they have all the numbers in place for that. However, one must always tread with caution, rather than blindly following moves of super investors. After all, the strategy behind these picks is only known to the super investors, and their buy and sell calls are backed by their own research.

However, one clever way not to miss out on any action would be to add these stocks to a watchlist and keep an eye on them.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.