When mutual funds quietly start buying a stock, it usually means they see something others might have missed. Over the past year, two small-cap companies have seen steady buying from both mutual funds and FIIs— and their share prices have nearly doubled.

It’s easy to get excited when you see that kind of rally, especially with big institutions backing the move. But smallcaps aren’t always smooth rides — they can shoot up fast and fall just as quickly. So before getting swayed by the recent numbers, it’s worth pausing to ask: what’s driving this rally — and is there more to come? Let’s take a look..

#1 Anup Engineering

Incorporated in 1962, Anup Engineering specializes in the design and manufacture of process equipment, primarily including heat exchangers, pressure vessels, centrifuges, columns, towers, and small reactors. These are used in refineries, petrochemicals, chemicals, pharmaceuticals, fertilizers, and other allied industries.

Anup has built long-standing relationships with marquee clients due to the quality of its products and adherence to delivery schedules. Its clients include Reliance Industries, Indian Oil, GAIL, and Nayara Energy. Over the years, Anup has continued to expand its client base in both the domestic and export markets.

Heat exchangers contribute 70% of Anup’s total revenues, followed by vessels (13%), towers, and reactors (9%), among other items. Geographically, revenues remain well-diversified, with 59% coming from domestic clients and 31% from exports, including the Middle East, the Americas, and Australia.

After reporting robust revenue growth of over 40% in FY23, the company’s topline increased another 34% to ₹5.50 billion in FY24. This was supported by the strong execution of the order book and the commissioning of its new manufacturing facility.

With higher revenue growth, the company’s EBITDA margin expanded by 3 percentage points to 23%, resulting in a 101% increase in net profit to ₹1.0 billion.

The momentum remains intact in 9MFY25, with revenue increasing 28% to ₹5.0 billion, led by strong 68% growth in heat exchanger revenue. Net profit grew 45% to ₹0.88 billion, with margin holding steady at 23%. The company is on track to achieve 30% revenue growth guidance for FY25.

With a strong order book of ₹8.3 billion (as of January 2025), with the majority coming from heat exchangers, Anup is expected to maintain the growth momentum. This, along with additional capacity, could be a catalyst for future growth.

The ongoing capital expenditure of ₹0.5 billion for a new manufacturing unit is expected to be operational by October 2025. Once operational, it will start contributing to revenue. Notably, this capacity is crucial for Anup due to capacity constraints at its existing facilities, which have restricted the scale of its business.

In addition, Anup also acquired Mable Engineering in June 2024, strengthening its product portfolio, expanding its reach, and enhancing its capabilities. This acquisition is expected to contribute 10-12% to overall revenues.

From an industry perspective, Anup remains in a sweet spot to benefit from continued capital expenditures and maintenance by oil refineries, petrochemical plants, fertilizer producers, and chemical companies. In addition, management expects more opportunities from blue hydrogen, especially in Western markets.

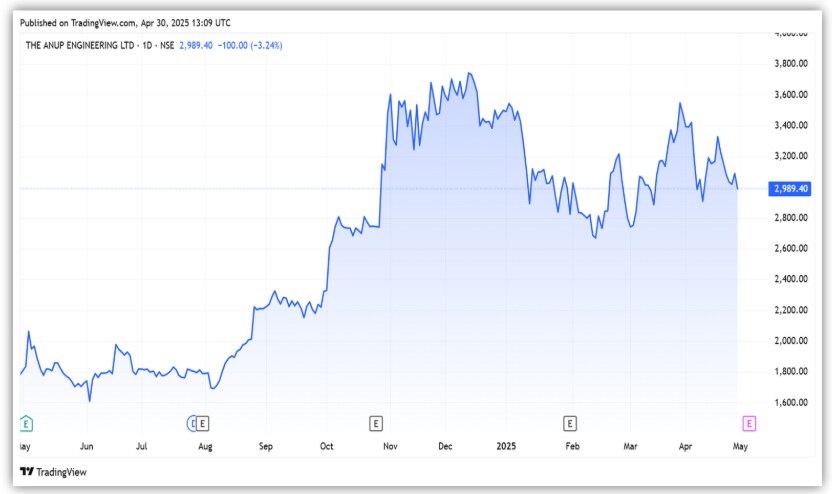

From a valuation perspective, the company’s share price has delivered a strong return due to continuous buying by FII and DII. FII holding increased from 1.2% in Q1FY25 to 4.6% in Q4FY25, while mutual funds increased from 3.5% to 9% during the period.

Anup trades at a price-to-equity ratio of 47, significantly higher than the 6-year median P/E of 17.

#2 LT Foods

LT Foods is the second-largest player in branded Basmati rice in India, with a market share of around 31%. It is also the largest-selling Basmati brand in the US, holding over 50% market share. In other regions, the company holds over 35% share in Indonesia, 30% in Northern Europe, 25% in Australia, and 11% in New Zealand.

The company generated around 30% of its revenues from India and around 40% from the US in FY24, making these its two largest markets. The remaining revenues came from Europe (20%), followed by the Middle East, East Asia, and other regions.

LT Foods has a strong product portfolio of over nine brands, with its flagship brand, Daawat, commanding a high brand recall. While primarily a basmati rice company, it has diversified into organic food and rice-based health and convenience products, which offer promising growth and margin potential.

These include organic staples and ready-to-eat packaged meals. Basmati rice contributes 87% to the revenue, followed by organic food at 10%. Geographically, LT Foods is well-diversified, with a presence in over 80 countries.

LT Foods’ financial performance remained strong in FY24. Revenue increased 12% from the previous year to ₹78 billion, driven by a rise in realisations per kg to ₹106 (from ₹ 96 in FY23) and volume growth of 6%.

The growth was supported by a substantial 54% increase in revenue from the Middle East, followed by 17% in Europe, 12% in the North American region, and 13% in India.

The EBITDA margin expanded by 1.9 percentage points, from 10.7% to 12.6%, driven by lower freight costs, operational efficiencies, and operating leverage. As a result, profit after tax increased strongly by 41% to ₹5.9 billion.

The company’s inventory days in FY24 were 242, slightly down from 245 the previous year. Working capital days also declined to 189 (from 193 in FY23). It also boasts a strong RoE of 19.2% (up from 18.4%) and a return on capital employed (RoCE) of 22% (up from 17.8%).

The momentum continued in 9MFY25, with revenue growing 14% to ₹65 billion, and margin sustaining at 12%. However, net profit growth remained flat at ₹4.5 billion due to lower contributions from joint ventures and associates.

Looking ahead, the company is targeting new markets to maintain its growth momentum. It has expanded to Tanzania, Namibia, Botswana, Zambia, and Zimbabwe, while widening its distribution channels.

In addition, it also plans to expand its product portfolio by introducing new products to increase appeal across all consumer segments. It also aims to expand its margin through operational efficiencies and premiumisation.

Although the ready-to-eat segment is small, the company expects it to grow at a compound annual growth rate of about 35% over the next five years. It believes that shifting to higher-priced basmati rice will support overall growth.

To support this, it is focusing on marketing initiatives to strengthen brand recall and gain incremental market share. The strategy has yielded positive results, with its market share in India increasing to 30% in FY24, up from 14% in FY16.

It also aims to expand its margin from the current 12.6% to about 15% over the next four years, driven by high-margin and premium products. With increasing disposable income and affluence, the demand for basmati rice is expected to rise, benefiting companies like LT Foods.

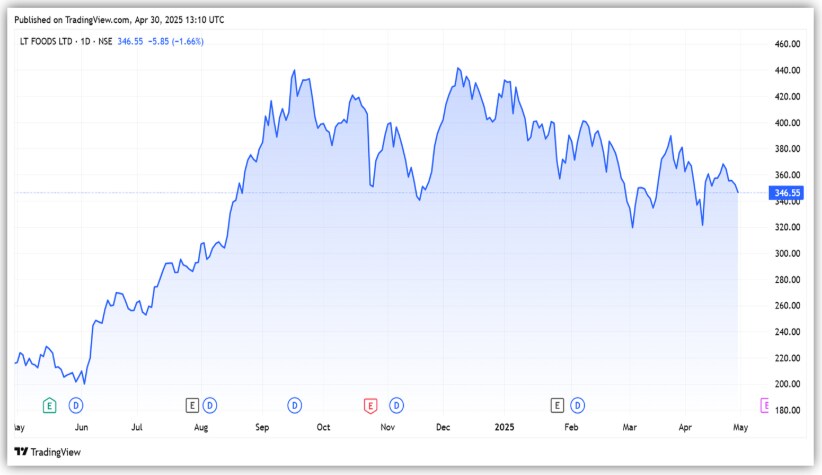

From a valuation perspective, the company’s share price has seen a big rerating due to continuous buying by FII and DII. FII holding increased from 5.9% in Q1FY25 to 9.8% in Q4FY25, while mutual funds increased from 4.6% to 5.2% during the period.

It’s currently trading at a P/E of 20, almost double the 10-year median of 9.

Conclusion

Both LT Foods and Anup Engineering have received significant interest from institutional investors. Their growth has been strong, supported by the industry’s secular trend. Anup has benefited from increased capital expenditure, while LT Foods is benefiting from the shift towards premium products. While they may want to continue the momentum, it’s worth considering the risks, especially since valuations appear elevated.

Disclaimer:

Note: We have relied on data from http://www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.