The first quarter of this fiscal, Q1FY25, has ended and investors across board are getting ready for the next one, scrutinising and dissecting stocks and investments by the Warren Buffetts of India. Most of them want to get their hands in stocks that could be the next big thing.

Now finding the ‘Next Big Thing’ is almost next to impossible. But it always helps to look for stocks that have a solid history of operational and financial sturdiness. It proves the management pedigree and builds investor confidence.

We looked for companies who have brought their debt to zero, have a solid current ROCE (Return on Capital Employed) of over 40% and profit growth in the last 5 years of over 100% CAGR. How many companies met this criteria? Just these two.

These two stocks that can be called profit masters, have shown excellent operational finesse, logging in stellar ROCE. Plus, they have recorded compounded profits growth of as high as 150% in the last 5 years, while bringing their debt to Zero.

Shilchar Technologies Ltd

Incorporated in 1986, Shilchar Technologies Ltd is in the business of manufacturing Electronics & Telecom and Power & Distribution transformers. Recently, the company has also ventured into the manufacturing of Ferrite transformers.

With a market cap of Rs 6,086 cr, the company is a leading manufacturer of power & distribution transformers and electronics & telecom transformers in India.

The company has been recording solid capital efficiency in the last few years. It is 5-year ROCE (Return on Capital Employed) is 47% and the current ROCE is 71%. All this while the current industry median is just 19%. So, in simple words, for every Rs 100 Shilchar spends as capital, it makes a profit of Rs 71 on it currently, while the overall industry averages just Rs 19.

Moving to financials, the company’s sales have grown from Rs 71 cr in FY20 to Rs 623 cr in FY25, logging in a compound growth rate of 54% in the last 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Shilchar grew from Rs 3 cr in FY20 to Rs 185 cr in FY25, which is a 128% compounded growth.

As for the net profits, the company has shown some solid growth, from Rs 2 cr in FY20 to Rs 147 cr in FY25, logging in compounded growth of a huge 151%.

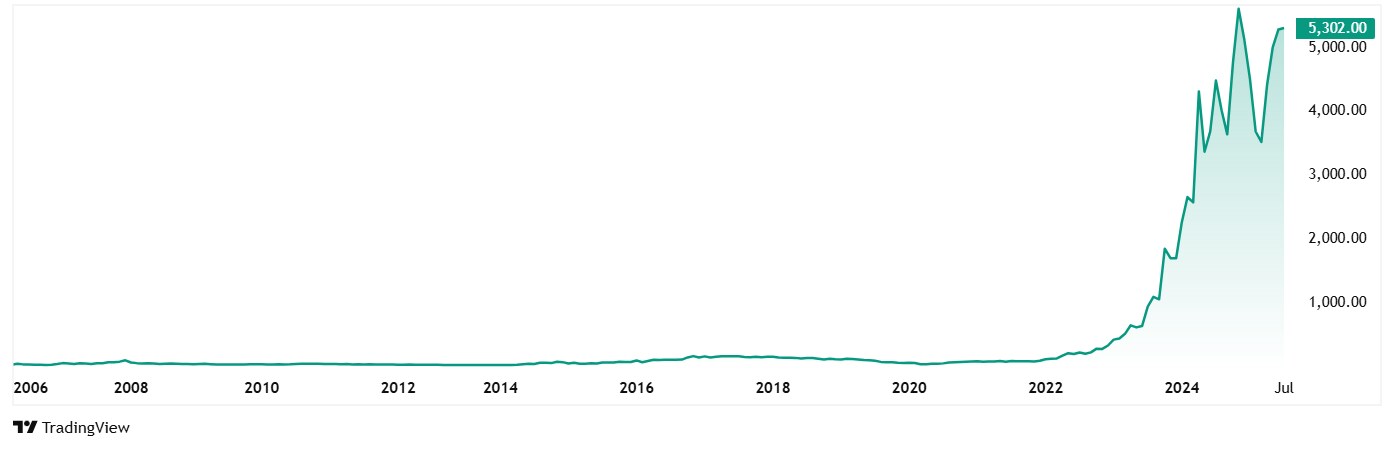

These numbers have helped the share prices of Shilchar Technologies, which was around Rs 37 in July 2020 and as of 2nd July 2025, it is Rs 5,320. That is a jump of almost 14,300%. Rs 1 lac invested in the stock 5 years ago would be about Rs 1.43 cr today.

Even at the current jump, the stock is trading at a small discount of about 13% from its all-time high price.

As for valuations, the company’s current PE is 41x, while the current industry median is 46x. The 10-year median PE for Shilchar Technologies is however a modest 16x while the industry median for the same period is 26x.

The company has reduced its debt in the last 5 years and is debt free. The company had a revenue target of Rs 550 Cr for FY25, which it overachieved by logging in Rs 623 cr in sales. It now plans achieve a turnover of Rs 750–800 cr in FY26.

According to Shilchar’s latest investor presentation, FY25 was an exceptional year for them, as the company delivered its highest-ever topline and bottom-line both on a quarterly and annual basis. Also, the company’s board has recommended a final dividend of Rs 12.5 per share (subject to shareholder approval) and a bonus issue of 1 new fully paid-up equity share for every 2 shares held.

Amic Forging Ltd

Incorporated in 2007, Amic Forging Ltd is in the business of manufacturing forged components.

With a market cap of Rs 1,886 cr the company manufactures steel forgings and machined heavy precision parts catering to various industries.

Amic Forging is also capital efficient like Shilchar, as the current ROCE for the company is a whopping 48% and the 10-year is also a good 35%. Which means, for every Rs 100 it spends as capital currently, the company makes a profit of Rs 48 which is probably one of the highest when compared to industry peers. The current Industry median ROCE is 19%.

The company’s sales jumped from Rs 13 cr in FY20 to Rs 121 cr in FY25, logging in a compound growth of 55% in the last 5 years.

EBITDA for Amic Forging has grown at a compound rate 95% from Rs 1 cr in FY20 to Rs 28 cr in FY25.

As for the net profits, the company was not making any profits in FY20 (no loss either) and in FY25, the recorded profits were Rs 36 cr, logging in compounded growth of 142%.

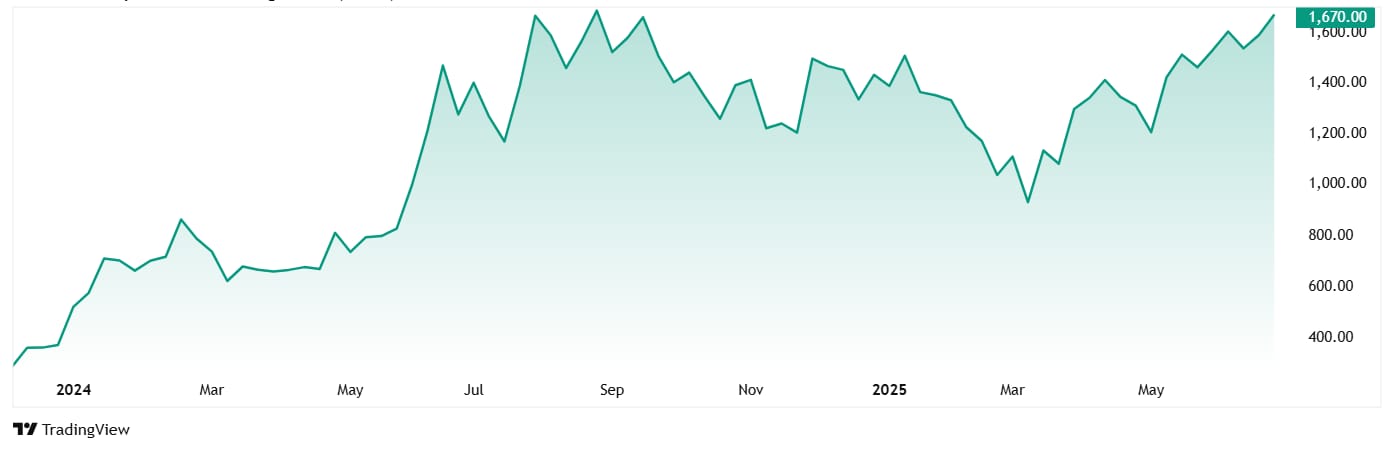

The share price of Amic Forging Ltd was about Rs 277 when it was listed in December 2023. And as of 2nd July 2025, the price is Rs 1,671, which is a jump of 503%.

Rs 100,000 invested in Amic Forging 5 years ago would have been a little over to Rs 6 lacs today.

Valuation wise, the company’s share is trading at a PE of 53x, while the industry median is 33x. the 10-year median PE for Amic Forging is 4×9 while the industry median for the same period is 30x.

The company has also reduced debt and is almost debt free. However, despite repeated profits, Amic Forging is not paying out dividends.

Recently in June 2025, Amic Forging announced the acquisition and renovation of a 129,600 sqft. factory unit in Eastern India, one of the region’s largest rolling mills. This facility, acquired from Bengal Hammer Industries Pvt. Ltd. is set to commence commercial production by December 15, 2025, with a daily production capacity of 150 tons. The expansion significantly boosts the company’s capabilities like the Forging Capacity from 18,000 MTPA to 30,000 MTPA and Machining Capacity from 700 MTPA to 24,000 MTPA.

Do they have steam left?

Shilchar Technologies and Amic Forging are both currently on the radar for many investors, thanks to their solid performance. Sales, profits, EBITDA, ROCE, gains… It is all working in the favour of these stocks. The question is, will both these companies be able to sustain and/or grow their financial performance? Or Will the steam fizzle?

But one thing is sure, these stocks deserve to be watched closely, as they have the potential to repeat what they have been ding in the last few years, making room for more potential growth and gains. Add to Watchlist?

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.