The founder of Param Capital Group and one of India’s most respected super investors, Mukul Agrawal is a household name for investors who track the markets closely., Known very well for his bold investment strategies, he has repeatedly proved that his stock picking acumen is one to follow.

Currently his portfolio has 70 stocks worth over RS 7,000 cr. But two of these stocks that he recently added to his portfolio have been seeing a lot of eyes. With 48% and 52% ROCE (Return on Capital Employed), these stocks deserve to be looked at if one is looking for additions to the Watchlist 2026.

The SME Risk: Navigating liquidity and manipulation warnings

A fair warning though, both these stocks have been listed in BSE’s SME Exchange. Buying SME stocks comes with a significant warning: buyer beware. The requirement to trade in fixed lots creates a liquidity bottleneck, often leaving investors stranded when prices crash. Additionally, the tiny equity base of these companies invites manipulation, fuelling ‘pump and dump’ schemes designed to trap retail capital. And lenient reporting standards frequently mask poor financial health, which the investors only come to know about when it’s too late.

#1 Unified Data- Tech Solutions Ltd: The IT specialist beating industry medians by 3x

Incorporated in 2010, Unified Data-Tech Solutions is a Mumbai-based IT service provider specializing in innovative and customized technology solutions.

With a current market cap of Rs 719 cr, the company is a technology firm specializing in system integration, with a core focus on delivering IT solutions. Its offerings include data center infrastructure, virtualization, cybersecurity, networking, and secure application delivery.

Mukul Agrawal bought a 5.3% stake in the company as per the exchange filings for the quarter ending September 2025. As on 21st December 2025, this holding is worth Rs 37.8 cr.

The company’s current ROCE is 48% while industry median when compared to peers is currently 16%. Which means for every Rs 100 the company uses as capital, it makes Rs 48 on it while its peers average around only Rs 16.

Let us look at the financials to try and find out what caught Agrawal’s attention.

The company’s sales have grown at a compound rate of 33% in the last 3 years from Rs 93 cr in FY22 to Rs 220 cr in FY25. For H1FY26, sales of Rs 149 cr have been logged.

The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) jumped from 11cr in FY22 to Rs 36 cr in FY25, logging a compound growth of about 49%. And for H1FY26, the EBITDA recorded is Rs 19 cr.

The net profits climbed from Rs 10 cr in FY22 to Rs 34 cr in FY25, logging a compound growth of 46%. And for H1FY26, the company recorded profits of Rs 17 cr.

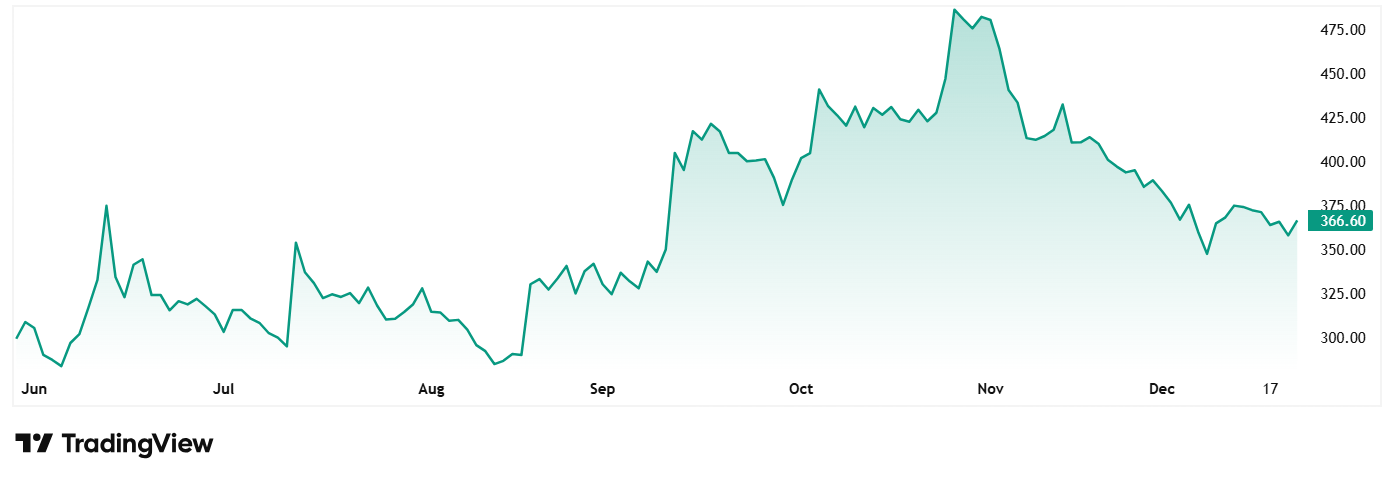

The share price of Unified Data-Tech Solutions was around Rs 300 at listing in May 2025 and as on 22nd December 2025 it was Rs 367. At the current price, the share is trading at a discount of over 25% from its all-time high price of Rs 495.

The company’s share is currently trading at a PE of 25x, while the industry median is at 31x. The company was listed recently, so it would be too soon to look at the 10-year median for it, but the industry median for a 10-year period is 29x.

According to the recent investor presentation in November 2025, the company has made a clear growth playbook. Their growth strategy is focussed on broadening services (cybersecurity, managed ops), deeper public-sector pursuits and geographic expansion, all of which improve recurring revenue mix.

#2 Zelio E-Mobility Ltd: A 52% ROCE outperformer in the EV Space

Incorporated in 2021 as Zelio Auto Private Limited”, the company changed its name to Zelio E-Mobility Limited in November 2024.

With a market cap of Rs 985 cr the company is primarily engaged in the business of manufacturing, assembling and supplying of electric vehicles, offering a range of electric two-wheelers (E-2Ws) and three-wheelers (3Ws), available in a variety of design, color, speed variants etc.

Agrawal bought a 2% stake in the company as per the exchange filings for the quarter ending September 2025, the holding value of which currently is Rs 20 cr.

The company’s current ROCE is 52x while the current industry median is 18x.

Before we look at the financials, please note that these are standalone figures as the consolidated ones are not available on screener.in.

The sales of the company have grown at a compounded rate of 137% from Rs 13 cr in FY22 to Rs 172 cr in FY25. For H1FY26, the company has logged sales of Rs 133 cr already.

EBITDA went from Rs 2 cr in FY22 to Rs 21 cr in FY25, logging in a compound growth of a huge 119%. The company has recorded EBITDA of Rs 15 cr in H1FY26.

As for the net profits, the company has logged a compound growth of 133% from Rs 1 cr in FY22 to Rs 16 cr in FY25. And for H1FY26, the company has already recorded profits of Rs 12 cr.

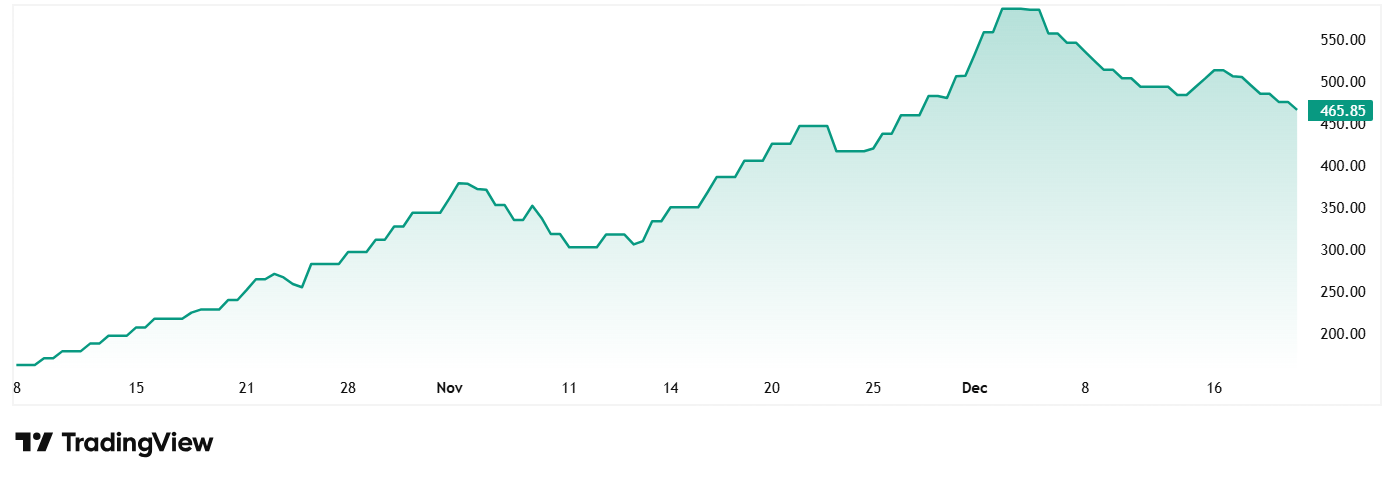

The share price of Zelio E-Mobility Limited when it was listed in October 2025 was around Rs 162. As on 22nd December 2025 the price was at Rs 466, which is a jump of 188% in just about 3 months.

At the current price, the stock is trading at a discount of 24% from its all-time high price of Rs 610.

The company’s stock is trading at a PE of 47x, while the industry median is 30x. The 10-Year median PE for the industry is 37x, but it will be to soon to look at the long-term valuation for Zelio.

In the latest investor presentation from November 2025, the Managing Director, Kunal Arya, said, “Guided by our vision “Har Ghar Zelio,” we remain committed to scaling capacity, enriching our product portfolio, and upholding strong governance to create long-term, sustainable value. We extend our sincere gratitude to our shareholders, customers, dealers, employees, and partners for their continued trust and support as we work toward making clean mobility a widespread reality across Bharat.”

Follow the capital efficiency in 2026

The two recent picks of Mukul Agrawal we saw today have caught the attention of smart investors, thanks to their high returns on capital employed. This capital efficiency that beats industry median is something investors look for.

While both Unified Data and Zelio have recorded impressive figures when it comes to core financials, both of them have seen a small drop from their all-time high prices and are trading at discounts of over 25%, raising questions if it would be a good time to get in on the stocks that have the trust of Agrawal.

We will have to wait and watch if these stocks will be the next multibaggers in Agrawal’s kitty, but just so that one does not miss out on any big opportunity if it comes up, it would be a smart move to add these stocks to a watchlist. Keeping a vigilant eye on them would make sense.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.