Ashish Kacholia who is called the Big Whale in the market, is one of the most widely followed investors. This makes him worthy of being in our closely guarded list of the Warren Buffets of India. And currently 2 of his favourite underdog microcap holdings are trading at over 70% discounts from their all-time high prices. However, despite the steep fall in their prices Kacholia still stands by them and hasn’t moved away.

Kacholia currently holds 49 stocks across diverse sectors like hospitality, education, infrastructure and manufacturing etc in his portfolio worth Rs 2,631 cr. However, these two microcap stocks, which have declined more than 70% from their all-time high prices are the talk of the town.

What will be Kacholia’s next move is what smart investors are trying to decode, in a race to make the most of any hidden opportunity Kacholia is seeing? Let us try to find the reason behind Kacholia’s continued interest and investment.

Brand Concepts: A High-Fashion Bet with a Ticking Clock

Incorporated in 2017, Brand Concepts Ltd specializes in the manufacturing of bags, backpacks and fashion accessories for the Indian & International markets.

With a market cap of Rs 370 cr, the company collaborates with top international and domestic brands through exclusive license agreements to develop, market, and sell lifestyle and fashion accessories. Some of the brands under its umbrella are Tommy Hilfiger, United Colors of Benetton, Juicy Couture, Aeropostale etc.

Ashish Kacholia has been holding a stake in Brand Concepts since December 2023 as per data available on Trendlyne.com. Currently he holds a 1.6% stake in the company worth Rs 5.4 cr.

The company’s sales have grown from Rs 71 in FY20 to Rs 292 cr in FY25, which is a compounded growth of 33% in 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Brand Concepts in the same period grew from Rs 4 cr to Rs 32 cr, logging in a compound growth of almost 52%.

As for the net profits, the company saw quite a few shockers and good news along the way.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | -1 | -6 | 1 | 10 | 11 | 5 |

FY25 saw over a 50% drop in profits from the previous financial year.

The share price of Brand Concepts Ltd was about Rs 15 in August 2020 and as of closing on 14th August 2025, it was at Rs 298, which is a jump of 1,887%. Rs 1 lac invested in the stock 5 years ago would have been close to Rs 20 lacs today.

At the current price of 298, the stock is trading at a discount of 70% from its all-time high of Rs 966.

The company’s share is trading at a current PE of a huge 250x, while industry median is 48x.

The highest revenue contributor for Brand Concept is Tommy Hilfiger, that accounts for about 80% of the revenue. However, the exclusive licensing agreement with Tommy Hilfiger is only up to December 2026, which sounds worrisome. However, the company expects to reduce the concentration risk, by increasing sales of its own brand i.e., Bagline.

The company has hence set up a hard luggage and soft luggage manufacturing plant in Indore

and which is expected to produce 150,000 hard luggage in a month and in Phase 2, they will produce 200,000 luggage per month.

Universal Autofoundry: A Microcap caught between Star Investors

Incorporated in 2009, Universal Autofoundry Ltd does manufacturing and sales of cast iron Castings.

With a market cap of Rs 84 cr the company is a global manufacturer and exporter specializing in the production of Grey Iron, Ductile Iron, and SG Iron Casting.

Kacholia has been holding a stake in the company since September 2023 and currently holds 2.4% stake in the company worth Rs 2 cr.

Madhulika Agarwal, wife of another Warren Buffett of India, Mukul Agarwal, also held a 3.4% stake in the company, which she has sold off as per the filings made for the quarter ending June 2024. Another super investor, Dheeraj Kumar Lohia has however bought a fresh 1.9% stake as per June 2025 filings.

The company’s sales jumped from Rs 88 cr in FY20 to Rs 193 cr in FY25, logging in a compound growth of 17% in the last 5 years.

EBITDA for Universal Autofoundry has grown at a compound rate of 18% from Rs 7 cr in FY20 to Rs 16 cr in FY25.

When it comes to the net profits, Universal Autofoundry also has seen its share of ups and downs.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | -4 | 2 | -3 | 10 | 5 | 2 |

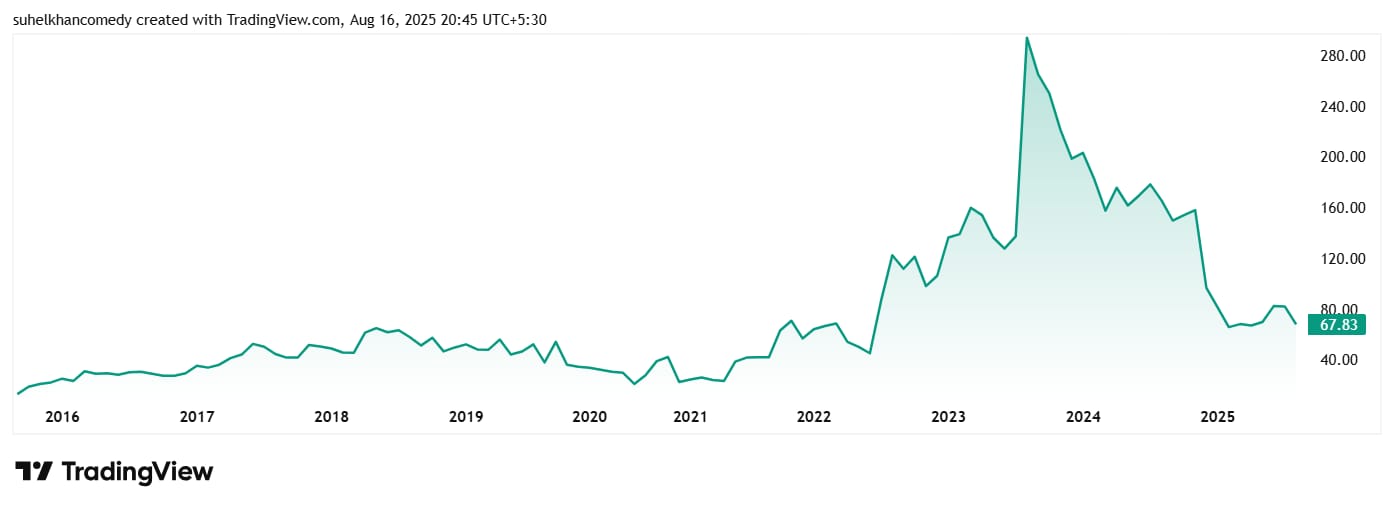

The share price of Universal Autofoundry Ltd was around Rs 23 in August 2020, which has now grown to Rs 68, which is a jump of about 196%.

At the current price of Rs 68, the company’s share is trading at a discount of 78% from its all-time high of Rs 309.

The share is trading at a PE of 43x, while the industry median is 26x. The 10-year median PE for the company is 25x and the industry median for the same period is 24x.

As per the company’s latest investor presentation from August 2025, the core areas of focus for the companies are focus on high growth sectors, improving capacity utilization, drive operational efficiency and diversify across new geographies.

A Contrarian Masterstroke or a Microcap Minefield?

Ashish Kacholia is in the news many a times, but never for reckless decision. He is not known to be someone who is swayed by the market sentiments. So, the decision to hold on to these 2 underdogs in his portfolio, despite of the big fall from all time high prices does raise a lot of questions in the minds of the investors.

What will be his next action? Will he dump the stocks or will he act greedy while other are being fearful and buy more? Now we might never come to know why or if at all he decided to keep or sell stocks. But it will be no doubt interesting to watch how things work out.

For now, it is advisable to add these Kacholia favourites to you watchlist and keep a keen vigilant eye on them, to ensure you don’t miss any big opportunity coming your way.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.