In a couple of weeks, we will bid farewell to 2025. Which is why smart investors have already started creating their watchlist for 2026. If you too are in the process of finding stocks to add to your watchlist, this one is for you.

The super investors of India, who we call the Warren Buffetts of India, are known for their stock picking skills. Because they have their checks and balances in place to ensure their picks are based on thorough research. So, when they back a stock, it is a green flag for investors who follow them with the intention to piggyback on their success.

So, here are 3 stocks currently backed by the Warren Buffetts of India, which are trading at a minimum 40% discount, making them good prospects to add to your watchlist.

Do note that all holding percentages and dates have been taken from Trendlyne. While the investors might have bought the stock earlier, the below dates are the oldest data available on trendlyne.

#1 BF Utilities: The ‘Hidden’ Infrastructure Bet

Incorporated in 2000, BF Utilities Ltd with a current market cap of Rs 2,196 cr is engaged in the generation of electricity through windmills and Infrastructure activities.

Radhakishan Damani, the retail king of India, has held a stake in the company since the quarter ending June 2020 and currently holds 1% worth Rs 22 cr.

The company’s sales and Earnings before interest, tax, depreciation and amortization (EBITDA) have seen a drop in the last few years, but the net profits are where the company is currently shining with a compounded growth of 39% in the last 5 years.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Rs Cr | 535 | 370 | 513 | 759 | 969 | 837 |

| EBITDA/Rs Cr | 297 | 229 | 320 | 498 | 581 | 297 |

| Profits/Rs Cr | 27 | -22 | 93 | 257 | 304 | 338 |

The share price of BF Utilities Ltd was around Rs 290 in December 2020, and as on 10th December 2025, it is Rs 583, which is a jump of over 100%.

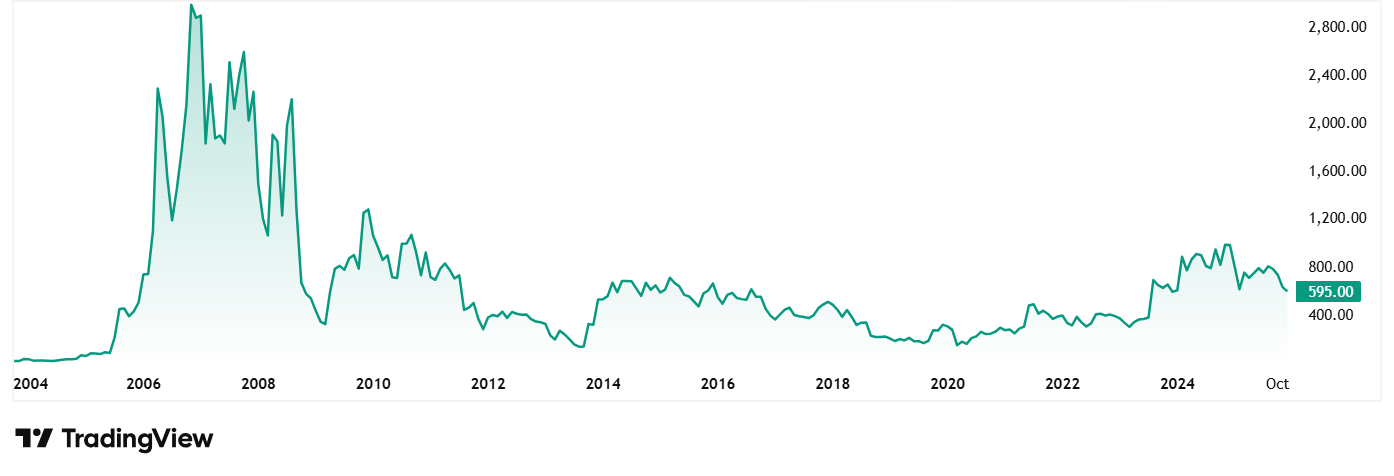

At the current price of Rs 583, the share is trading at a discount of 46% from its 52-week high of Rs 1080 and a discount of 78% from its all-time high price of Rs 2,628.

The valuations look a bit tricky with the current PE being at 287x while the industry median is 27x. The 10-Year median PE for the company is also a big 268x and the industry median for the same period is 41x.

#2 Tata Motors PV: The Turnaround Story

Established under the parent company Tata Motors Ltd, Tata Motors Passenger Vehicles Ltd was formed after a demerger and has a current market cap of Rs 127,114 cr is a leading global automobile manufacturer that is a part of the Tata group. The company offers a wide and diverse portfolio of cars, sports utility vehicles, trucks, buses and defence vehicles to the world.

Rekha Jhunjhunwala, has held a stake in the company since the quarter ending December 2022 and currently holds 1.4% worth Rs 1,720 cr.

In terms of the financials, the company has logged a compound growth of 11% in sales and 37% in net profits. The EBITDA grew at a compounded rate of almost 10%.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Rs Cr | 261,068 | 249,795 | 278,454 | 345,967 | 434,016 | 439,695 |

| EBITDA/Rs Cr | 17,987 | 32,287 | 24,720 | 31,816 | 57,824 | 55,216 |

| Profits/Rs Cr | -11,975 | -13,395 | -11,309 | 2,690 | 31,807 | 28,149 |

The share price of Tata Motors PV was around Rs 108 in December 2020, and as on 10th December 2025, it is Rs 345, which is a jump of 220%.

At the current price of Rs 345, the share is trading at a discount of 28% from its 52-week high of Rs 480 and a discount of 52% from its all-time high price of Rs 712.

The company has a current dividend yield of 1.72% while industry peers average just about 0.5%.

As for valuations the company’s share is trading at a current PE of 9x while the industry median is 34x. The 10-Year median PE for the company is also 9x and the industry median for the same period is 35x.

#3 Zodiac Clothing: A High-Risk, High-Reward Contrarian Play

Incorporated in 1984, Zodiac Clothing Company Ltd with a current market cap of Rs 227 cr is in the business of integrated apparel manufacturing and retailing. It operates in men’s formal wear through its flagship brand, Zodiac, in party /club wear through its sub-brand, ZOD!, and in relaxed casual wear through its sub-brand, Z3.

Nemish Shah, the stealth mode Value investor, has held a stake in the company since the quarter ending December 2015 and currently holds 1.6% worth Rs 3.6 cr.

This could be one of Shah’s riskiest bets yet, as the financials have a lot of red all over them. The company hasn’t seen profits in the last few years.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Rs Cr | 191 | 100 | 127 | 175 | 146 | 174 |

| EBITDA/Rs Cr | 9 | -22 | -17 | -5 | -18 | -19 |

| Profits/Rs Cr | -29 | -29 | -16 | 16 | -36 | -37 |

The share price of Zodiac Clothing Company Ltd was around Rs 103 in December 2020, and as on 10th December 2025, it is Rs 87, which is a considerable drop.

At the current price of Rs 87, the share is trading at a discount of 44% from its 52-week high of Rs 155 and a discount of 80% from its all-time high price of Rs 455.

As for valuations the company’s share is trading at a negative PE due to consistent losses while the industry median is 28x.

Worthy of Watchlist 2026?

Radhakishan Damani, Rekha Jhunjhunwala and Nemish Shah are 3 of the most widely known, followed and respected super investors of India. Perfect examples of value investing champions which makes them one of the Warren Buffetts of India. When they back stocks despite big falls in share prices, it says a lot about their trust and conviction in the stocks.

Damani’s BF Utilities is having a tough time when it comes to sales and operating profits, but it shines in net profits. On the other hand, Jhunjhunwala’s Tata Motors PV has staged a turnaround in Net profits. And finally Nemish Shah’s Zodiac Clothing, that has nothing going in its favour.

They all have different stories to tell, but they have one thing in common – the backing of the biggest Warren Buffetts of India. It would be fascinating to see how these super investor favourites do in the coming months and years. Which in turn them makes them solid contenders for the Watchlist 2026.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

Disclaimer:

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.