By Suhel Khan

In an interesting development, PPFAS (Parag Parikh Financial Advisory Services) has just revealed in their December 2024 factsheet a significant move that’s got everyone talking about it. The fund house, known for its conservative stock selection and value-focused philosophy, has acquired a substantial 2% stake in a well-known stock, which the market considers a momentum stock… Thus, raising a lot of questions.

PPFAS along with its lead fund manager, well known Rajeev Thakkar, has built its reputation following the principles of value investing – focusing on fundamentally strong companies trading below their intrinsic value. While the fund has also simultaneously picked up a 0.2% stake in a healthcare company further diversifying its portfolio, it’s the first pick that has warmed up the discussion groups.

The momentum stock in question is a well-known company playing across Logistics, Hospitality, Real Estate, Technology, Farm Equipment, Automobiles and more…

While the healthcare company is a leader in providing economical healthcare services, with a network of multispecialty and super specialty hospitals spread across multiple locations. In December 2023, it also incorporated a wholly owned subsidiary that marked its foray into the IT sector.

Let’s take a closer look at the two stocks PPFAS has added to their strategy.

Mahindra & Mahindra Ltd (M&M)

One of the most admired companies in India, M&M is a well diversified company with presence across various sectors. It has presence in automobiles, financial services, hospitality, infrastructure, logistics, IT businesses, and defence among others through its subsidiaries. Recently M&M has been in the news for the launch of its new electric vehicles.

With a market cap of Rs 3,84, 605 cr, the company’s stock is considered by most in the market as a “momentum stock” as it exhibits strong price momentum, with its stock price trading above key moving averages and showing significant recent gains, indicating positive market sentiment and potential for further upward movement.

The company has shown exceptional efficiency in using both its capital and shareholders’ money, generating returns that are significantly higher than most peers.

M&M delivered a ROCE (Return on Capital Employed) of 13.6% which means for every Rs 100 invested in the business (capital), the company generates Rs 13.6 in operating profit.

On the other hand, ROE (Return on Equity) was 18.4% which means shareholders earn Rs 18.4 for every Rs 100 they’ve invested.

The sales for M&M have seen quite a jump in the last few years as it grew at a CAGR of 6% from Rs 104,721 cr in FY19 to Rs 139,028 cr in FY24.

The net profits also saw a huge jump between its FY19 number of 6,017 cr to the FY24 number of 12,270 cr. That is an absolute growth of 104% and a compounded growth of 16%.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) grew from Rs 15,207 cr in FY19 to Rs 24,892 cr in FY24, which is a CAGR of almost 11%.

The share prices also mirrored the growth as they went form Rs 510 inn Dec 2019 to its current price of Rs 3,093 (10 Jan 2025 closing price). That’s a jump of over 506% in just 5 years. No wonder some may consider it to be a momentum stock.

The company’s stock is currently trading at a PE of 32x, while the industry median when compared to peers is 26x. The 10-year median PE for the stock is however 24x while the industry median for the same period is 38x. Using this metric alone, few would consider this to be a value stock.

According to the company’s annual report in March 2024, the MD & CEO Anish Shah said that the company has outlined a capex plan of Rs 37,000 cr for the next three years as they draw confidence from the cash generation across businesses, low debt levels, and a robust balance sheet.

Some of the other Domestic institutional investors holding stake in the company are LIC of India, SBI Nifty 50 ETF, UTI Nifty 50 ETF, HDFC Balanced Advantage Fund and SBI Life Insurance (As per September 2024 quarter ending).

Narayana Hrudayalaya Ltd (NHL)

Narayana Hrudalaya Ltd is a leading provider of economical healthcare services. It has a network of multispecialty and super specialty hospitals spread across multiple locations.

With a market cap of Rs 26,815 cr, the company also started its foray in the IT sector with the incorporation of a wholly owned subsidiary, MEDHA AI PVT LTD, in Dec,23, to conduct business in various IT services, encompassing software development, solutions, design, testing etc.

The company’s sales grew from Rs 2,861 cr in FY19 to Rs 5,018 cr in FY 2024, which is a compounded growth of 12%.

The net profits also displayed astounding growth between FY19 and FY24 as they grew at a compounded rate of 68% from Rs 59 in FY19 to Rs 790 cr in FY24.

EBITDA grew from Rs 295 cr in FY19 to Rs 1,173 in FY24, marking a CAGR of 32%

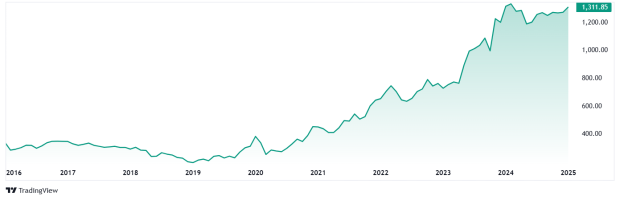

The share prices grew at a compounded rate of 41% from Rs 305 in December 2019 to current price of Rs 1,312 (10 Jan 2025 closing price)

For valuations, the company’s share is trading at 34x while he industry median when compared to peers is 59x. The 10-year median PE for the company is 53x while the industry median for the same period is about 34x.

According to the company’s annual report in March 2024, Chairman Dr. Devi Prasad Shetty conveyed the company’s decision to enter the health insurance space. He said that about 15% of heart surgeries in India are done by the Narayana group, so they would work towards keeping healthy as keeping people out of hospital is good for the health insurance business.

Other Domestic institutional investors holding stake in the company are Axis Mutual Fund, Nippon Life India, DSP Small cap fund and SBI Life Insurance.

Big Bet or Big Blunder: Which Way is This headed?

A 2% stake represents a significant conviction bet, especially for a fund house that traditionally maintains a cautious and measured approach to portfolio construction. This raises interesting questions: Is PPFAS seeing value where others see only momentum? Or is this prestigious value investor adapting its strategy to changing market dynamics, a highly unlikely scenario if we might add?

How this turns out is something only time will tell. But given the interest of PPFAS in these stocks, adding them to your watchlist might not be such a bad idea.

Disclaimer

Note: We have relied on data from www.Screener.in, www.trendlyne.com and www.tijorifinance.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.