The paper sector has always been a cyclical industry, driven by government policies, raw material prices such as wood, demand for virgin pulpboard, and even educational requirements. These factors make the financials of paper companies volatile in the short term. But zoom out, and the picture changes.

Despite volatility, paper stocks have consistently delivered strong returns over the long term, often with steady dividends. The same happened with paper stocks in FY25, as cheap imports of virgin pulp board weighed heavily. In response, they requested an import duty—a regulatory measure.

The government listened and gave the much-needed support by levying customs duty on the minimum import price (MIP) of virgin pulp board (VPB). Note that VPB is a key packaging material used in various industries, including pharmaceuticals, FMCG, electronics, cosmetics, liquor, and publishing.

The duty is expected to reduce the dumping of cheap imports. This could give domestic producers room for price hikes and margin improvement. The market has already caught on, as paper stocks have delivered a strong return over the past six months.

Moreover, according to CareEdge, which primarily provides credit ratings, the sector also stands to benefit from higher government spending on education, which may support its long-term growth trajectory.

On a similar note, here are three paper stocks that are poised to benefit from the sectoral tailwind. Let’s take a look…

#1 JK Paper

JK Paper is one of the largest companies in the domestic writing and printing paper industry and paperboard sector, with an installed capacity of 7.6 lakh tonnes per annum. The company is the market leader in the corrugated boxes segment.

Its strong market position is supported by leadership in the copier segment, premium products, a strong customer base, and a robust distribution network. In the last 10 years, JK Paper profits have compounded at 41% annually, more than three times the pace of sales growth at 12%.

During the same period, the stock price has grown at 26% compounded annual growth rate (CAGR). This is despite the cyclical nature of the sector, which has recently impacted the sector’s performance again. But this seems to be changing now.

Revenue under slight pressure, margins take a hit

In Q1FY26, JK Paper’s revenue growth decelerated by 2.3% year-over-year to ₹16.7 billion. Lower volumes and sales realisations due to cheap imports and ever-rising wood prices adversely impacted performance. The annual plant shutdown of Sirpur Mills during the quarter also affected performance.

As a result, margins fell 173 basis points (bps) to 16%. Profit after tax (PAT) declined 39.7% to ₹850 million. That said, the company’s operating efficiency is expected to improve from FY26 due to a fall in prices of raw materials, especially hardwood.

The market has already taken note, resulting in a 31% increase in JK Paper shares over the last six months to ₹378. JK also pays a dividend every year, with a dividend of ₹5 per share already announced in Q1 of FY26. This translates to a dividend yield of 1.3% as of FY26 to date.

Acquisition and capex to drive growth

The company has strengthened its position in the corrugated packaging sector by acquiring a 72% stake in Borkar Packaging for ₹2.3 billion in cash. The deal will help the company expand its presence in the folding carton manufacturing and corrugated packaging sectors.

Additionally, JK Paper plans to invest about ₹8 billion in FY26 for setting up a bleached chemi-thermomechanical pulp mill, among other purposes. This will facilitate backward integration and serve as an alternative to imported pulp. Most of the capital expenditure will be funded by long-term debt.

From a valuation standpoint, the company trades at an EV/EBITDA multiple of 8.2x, which is well-above the 10-year median of 6.7x. This valuation is in line with the paper sector median EV/EBIDTA multiple of 8x.

#2 West Coast paper mills

West Coast Paper is one of the oldest and largest paper producers in India, specializing in printing, writing, and packaging applications. The company operates in over 26 countries and has an annual operating capacity of 3.2 lakh metric tonnes. West Coast has also diversified into the manufacturing of optical fibre cables.

Capacity upgrades and focus on value-added products

Additionally, the company holds a 72.4% stake in Andhra Paper, one of India’s largest integrated paper and pulp manufacturers. Andhra has an annual production capacity of 2.5 lakh tonne of paper and 2 lakh tonne of virgin pulp. This makes West Coast the fifth-largest paper manufacturer in India.

The West Coast product mix is diversified, including maplitho, copiers, cupstock, and specialty papers. It has been increasing the proportion of value-added niche products in its portfolio over the last 2-3 years.

Revenue under pressure, margins take a hit

In Q1FY26, the company’s consolidated revenue declined 0.5% year-over-year to ₹9.5 billion. Of this, revenue from the paper segment fell 2.7% to ₹8.8 billion, accounting for 92.2% of the total revenue. The rest came from cable, which grew 34.5% to ₹739.4 million.

Lower volumes and higher imports of paper and paperboard impacted realisation. As a result, the company’s margin fell 400 bps to 12%, leading to a 50.8% decline in PAT to ₹600 million. That said, the company is focusing on operational efficiency and product mix improvements to protect its profitability.

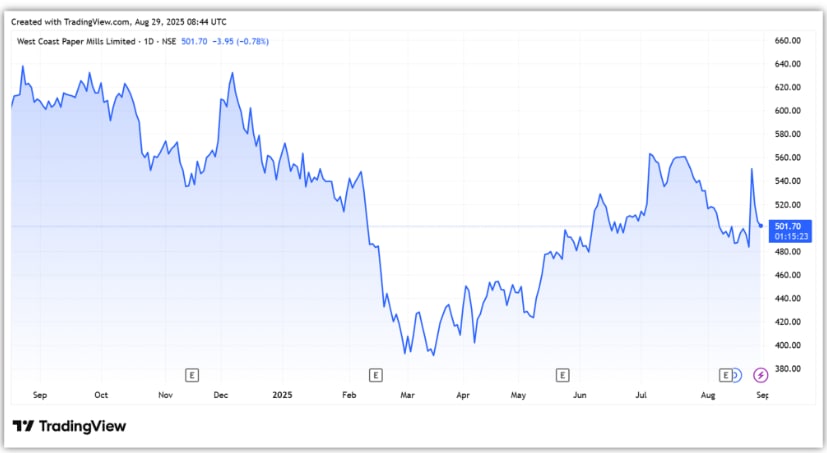

West Coast also rewards shareholders with dividend payments. It paid a dividend of ₹8 in FY25 and ₹5 in FY26 year-to-date. At the CMP of ₹498, the dividend yield stands at 1.6% (FY25) and 1% as of FY26 to date.

Its share price is up 29% to its current price of ₹507. Over the past seven years, the stock has delivered a return at 6% CAGR, weighed down by weak profit growth of 6%, which trails the 13% sales CAGR.

The company is investing ₹4.5 billion in upgrading Andhra Paper’s equipment to improve operational efficiency. It is also expected to benefit from import duty on imports, leading to margin recovery and higher sales realisation.

From a valuation standpoint, the company trades at an EV/EBITDA multiple of 5.9x, which is well-above the 10-year median of 4x. However, this valuation stands lower than the paper sector median EV/EBIDTA multiple of 8x.

#3 Seshasayee paper and boards

Seshasayee is also a leading company in the domestic writing and printing paper industry, as well as the paperboard sector, particularly in South India. It has an installed capacity of 2.5 lakh tonnes per annum. The company is known for reputable brands like Sprint, Sprint Plus, Swift, and Success.

The company’s operations are integrated. This is because it manufactures pulp at its Erode unit, and the excess pulp is transferred to the Tirunelveli unit, thereby reducing costs and creating synergies. About 85% of the pulp requirement is met through in-house wood, thereby reducing dependence on outside suppliers.

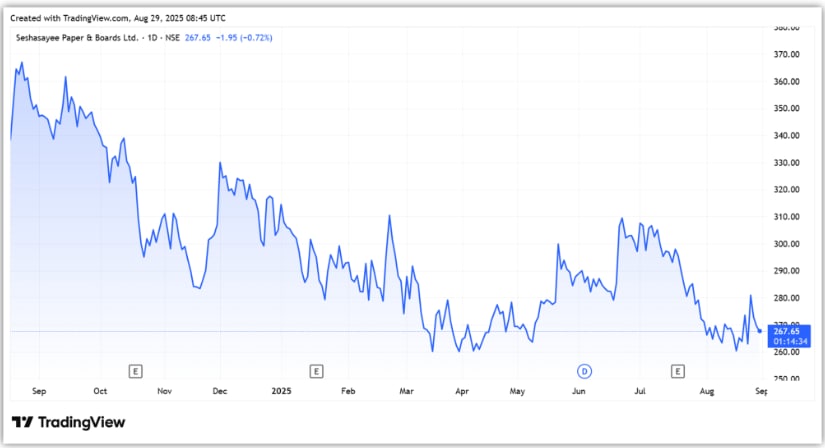

Additionally, about 70% of the energy at both its plants is derived from green sources, resulting in cost benefits. The company also has paid regular dividends, with ₹5 in FY25 and ₹2.5 in FY26 YTD. At the CMP of ₹263, the dividend yield stands at 1.9% (FY25) and 0.9% as of FY26 to date.

Financial performance hit by weak demand and imports

Revenue declined 9.6% year-over-year to ₹3.8 billion in Q1FY26. PAT declined 59.5% to ₹150 million, as margin fell 600 bps to 5%. This sluggish performance was due to global uncertainties, weak demand, and the continued flow of cheap imported paper into India.

The stock has declined 3.8% over the past six months. Yet, over the last decade, it has compounded at 22% annually. At the same time, profit rose at a 19% profit CAGR, while revenue grew at 6% during the period. With the import duty, Seshasayee also stands to benefit.

Capacity expansion and diversification are underway

Looking ahead, the company is expanding its pulp and paper production capacity by 20% at the Erode plant. The first phase costing ₹4 billion is likely to be funded entirely from internal sources.

Moreover, it is also diversifying into multi-layer boards, cup stock, carton board, and kraft liner board to reduce its dependence on printing and writing paper. It has also acquired Servalakshmi Paper (in liquidation) for ₹1 billion. This new unit is expected to have a capacity of 75,000 tonnes but has yet to commence operations.

From a valuation standpoint, Seshasayee trades at an EV/EBITDA of 6.8x, well-above the 10-year median of 5x. This valuation is at a discount to the paper sector median EV/EBIDTA multiple of 8x.

Conclusion

India is the fastest-growing paper market in the world, with demand growth at 6-7% per annum. However, paper is a cyclical sector whose performance hinges on raw material costs, import dynamics, and government regulations. The recent imposition of duty on the minimum import price of virgin pulp board is a positive for domestic producers, but global price movements and demand volatility will continue to play a role.

That said, structural tailwinds such as rising packaging demand, higher government spending on education, and capacity expansions by leading players are likely to support long-term growth. The sector, although volatile in the short term, delivers long-term return.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternative, but widely accepted, source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.