Finding companies that are capable of delivering consistent growth and shareholder returns through all economic cycles, is a big green flag in the books of long-term investors. The Indian FMCG sector, with its solid consumer penetration and attractive product lines, offers a very fertile ground for such “all-weather” investments.

You see, while seasonal trends like winter sales can create short-term buzz, the real money lies in decades of brand-building, vast distribution networks, and the ability to consistently generate profits.

Here are 2 Indian personal care giants that check all these boxes. While they do dominate in seasonal categories, what makes them a compelling case for a long-term portfolio is their capital efficiency and commitment to sharing profits with investors.

The makers of BoroPlus, a 70% market share holder

There is probably no Indian household that hasn’t heard the name of BoroPlus and its range of products that we all need around winter. The first company is the maker of BoroPlus, one of the highest selling creams in India.

Incorporated in 1983, Emami Ltd is engaged in manufacturing & marketing of personal care & healthcare products with an enviable portfolio.

With a market cap of Rs 22,833 cr, the company is one of India’s leading FMCG companies engaged in the manufacturing & marketing of personal care & healthcare products.

With an enviable portfolio of brand names such as BoroPlus, Navratna, Fair and Handsome, Zandu Balm, Kesh King, Zandu Pancharishta, Mentho Plus Balm etc, making it a household name in India.

The company’s sales have grown at a compounded rate of 7% from Rs 2,655 cr in FY20 to Rs 3,809 cr in FY25. And between April and September 2025, the company has logged sales of Rs 1,703 cr already.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) grew from Rs 684 cr in FY20 to Rs 1,014 cr in FY25, which is a compounded growth of 8%.

When it comes to profits, the company’s profits have grown at a compounded rate of 21% from Rs 302 in FY20 to Rs 803 in FY25. Until the quarter ending September 2025, the company has recorded profits of Rs 312 cr.

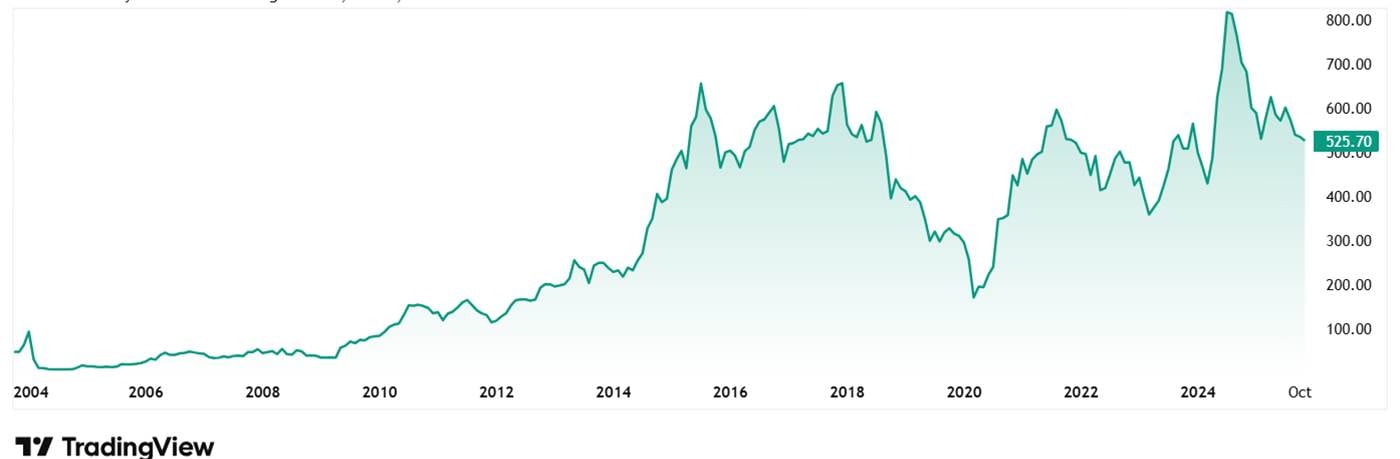

The share price of Emami Ltd jumped from around Rs 380 in November 2020 to its current day price of Rs 523 as on 11th November 2025.This is a jump of 38% in 5 years.

At the current price of Rs 523, the share is trading at a discount of almost 40% from its all-time high price of Rs 860.

The company’s share is trading at a PE of 30x while the current industry median is 51x. The 10-year median PE for Emami is 47x and the industry median for the same period is 49x.

The company has a current dividend yield of 1.53% while the industry median is 0.12%. As per the recent investor presentation from November 2025, the Board of Directors have declared an interim dividend of 400%, amounting to Rs 4 per share for FY26.

In the past 5 financial years, Emami Ltd. has declared an equity dividend amounting to Rs 48 per share. Take a look:

| Record Date | Instrument Type | Dividend Amount (Rs/Share) | Dividend Type |

| 14-Nov-25 | Equity Share | 4 | Interim |

| 22-May-25 | Equity Share | 2 | Special |

| 04-Feb-25 | Equity Share | 4 | Interim |

| 18-Nov-24 | Equity Share | 4 | Interim |

| 19-Feb-24 | Equity Share | 4 | Interim |

| 15-Nov-23 | Equity Share | 4 | Interim |

| 13-Feb-23 | Equity Share | 4 | Interim |

| 21-Nov-22 | Equity Share | 4 | Interim |

| 11-Feb-22 | Equity Share | 4 | Interim |

| 09-Nov-21 | Equity Share | 4 | Interim |

| 05-Feb-21 | Equity Share | 4 | Interim |

| 13-Nov-20 | Equity Share | 4 | Interim |

| 27-Mar-20 | Equity Share | 2 | Interim |

In the same presentation, the company’s Managing Director, Harsha Agarwal said, “We are happy that over 90% of our core domestic portfolio now falls under the lowest GST rate of 5%, making our products more affordable and accessible to consumers. The quarter’s performance was a temporary impact of trade disruptions linked to the pending GST revision and weak summer. With improving market sentiment and a favourable season ahead, we remain confident of strong growth in the coming quarters.”

World’s largest ayurvedic and natural health care company

Almost every Indian knows about the next company we talk about as it makes one of the most famous products, Chyawanprash. Something that builds immunity, which is needed around winters.

Incorporated in 1975, Dabur India Ltd is India’s leading FMCG, Ayurvedic and natural health care companies with wide network distribution across the world.

With a market cap of Rs 91,044 cr, the company is the fourth largest FMCG Company in India and the world’s largest ayurvedic and natural health care company with a portfolio of over 250 herbal/ayurvedic products.

The company’s sales grew at a compounded rate of 8% from Rs 8,685 cr in FY20 to Rs 12,563 in FY25. And between April and September 2025, sales of Rs 6,596 cr have been recorded already.

The EBITDA climbed from Rs 1,792 cr in FY20 to Rs 2,316 in FY25, which is a compounded growth of 5%.

As for the net profits, the company recorded Rs 1,448 cr profits in FY20 and in FY25 the figure had increased to Rs 1,740. That is a compounded growth of 3%. Between April and September 2025, the company has logged profits of Rs 953 cr.

The share price of Dabur India Ltd has shown flat growth as the price in November 2020 was around the same price as of 11th November 2025, which is Rs 514.

The company’s share is trading at a PE of 50x, which is closer to the current industry median of 51x. The 10-year median PE for Dabur is 52x and the industry median for the same period is 49x.

The company’s current dividend yield is 1.55% while the industry median is 0.12%. The board has declared an interim dividend of 275% in the November 2025 investor presentation, amounting to Rs 2.75 per share.

In the past 5 financial years, Dabur India Ltd. has declared an equity dividend amounting to Rs 33 per share. Take a look:

| Date | Instrument Type | Dividend Amount (Rs/Share) | Dividend Type |

| 07-Nov-25 | Equity Share | 2.75 | Interim |

| 18-Jul-25 | Equity Share | 5.25 | Final |

| 08-Nov-24 | Equity Share | 2.75 | Interim |

| 19-Jul-24 | Equity Share | 2.75 | Final |

| 10-Nov-23 | Equity Share | 2.75 | Interim |

| 21-Jul-23 | Equity Share | 2.7 | Final |

| 03-Nov-22 | Equity Share | 2.5 | Interim |

| 21-Jul-22 | Equity Share | 2.7 | Final |

| 11-Nov-21 | Equity Share | 2.5 | Interim |

| 29-Jul-21 | Equity Share | 3 | Final |

| 11-Nov-20 | Equity Share | 1.75 | Interim |

| 13-Aug-20 | Equity Share | 1.6 | Final |

Dabur was recently in the news again when Patanjali Ayurved approached the Delhi High Court challenging an order restraining it from running disparaging advertisements against Dabur Chyawanprash. The court orally observed that it was a case of generic disparagement and the statements made by Patanjali are an obvious reference to respondent Dabur. The court warned Patanjali that in case it finds it to be a luxury litigation and a useless appeal.

Does your portfolio need winter care?

The two stocks today honestly don’t need any introduction for any Indian. Entire generations have grown up using their products from lip balms, to creams to chyawanprash and much more. Both are the leaders in their niche product categories.

But what makes them leaders in their niche is not the temporary seasonal spurts, but their ability to shine in all weather. With a vast distribution network and a huge product portfolio, they have mastered the art of selling in any season.

The question is, will these companies continue their streak of profits and giving back to investors by means of dividends? Well, that is something only time can tell, but one can always add these stocks to a watchlist and keep an eye on them.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.