Ashish Dhawan is a very well known and highly followed super investor of India, who founded ChrysCapital. He has carved a niche when it comes to fast-growing sectors with strong outcomes. He is also the brain behind Central Square Foundation, an organisation doing some great work in pushing for better schools in India.

Dhawan’s strategic approach put together value and growth investing, earning him high respect from investors across the country. This Warren Buffett of India specialises in medium and small-sized company stocks, that usually turn out to be multibaggers. He currently holds 13 stocks in his portfolio worth over Rs 2,815 cr.

And two of these stocks have caught the attention of smart investors, for the sector beating dividend yield both are delivering. As 2025 ends soon, and investors start building their watchlist for 2026, will these 2 stocks find a place?

The “value” play: Quess corp’s hidden yield

Established in 2007, Quess Corp Limited is India’s leading business services provider, leveraging its extensive domain knowledge and future-ready digital platforms to drive client productivity through outsourced solutions.

With a market cap of Rs 3,179 cr, the company is a leading staffing player in India and amongst the top 5 Staffing companies globally by headcount, serving 3,000+ clients.

India’s Warren Buffett Ashish Dhawan has been holding a stake in Quess Corp since June 2020 (as per the data on Trendlyne.com). He currently holds 4.1% stake in the company which is worth almost Rs 130 cr.

Now, what makes it kind of the crown jewel of Dhawan’s portfolio, is the industry beating dividend yield that the company has been delivering. The company has a current dividend yield of 4.7% while the industry median is zero. The 5-year average dividend yield is 3.7%, while the industry median for the same period is again zero.

In the past 12 months, Quess Corp Ltd. has declared an equity dividend amounting to Rs 10 per share.

Looking at the financials, and the company’s sales have grown from Rs 10,991 cr in FY20 to Rs 14,967 cr in FY25, logging a compound growth of 6%.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) however has seen a downward spiral in the same period.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 650 | 449 | 624 | 589 | 237 | 263 |

Consequently, net profits have been a roller coaster ride.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | -432 | 74 | 251 | 223 | 280 | 46 |

Part of the sharp fall in net profit for FY25 can be explained by an exceptional item. Even adjusted for that, the profit for the year would have been Rs 178 cr, which is lower than the profits recorded in the previous year.

The share price of Quess Corp Ltd was around Rs 245 in November 2020, which has dropped to Rs 213 as on 24th November 2025.

At the current price of Rs 213, the stock is trading at 65% discount from its all-time high of Rs 616 and a discount of 44% from its 52-week high of Rs 380.

The company’s stock is currently trading at PE of a modest 15x, while the industry median is 23x. The 10-year median PE for Quess is 21x and the industry median for the same period is 27x.

In April 2025, the company split into 3 separate entities by means of a demerger. Quess Corp Ltd for Workforce Management, Digitide Solutions Ltd for BPM, Insurtech, and HRO, and Bluspring Enterprises Ltd for Facility Management, Industrial Services, and Investments.

The “Growth” Engine: M&M Finance’s Rural Dominance

Incorporated in 1991, Mahindra & Mahindra Financial Services Ltd, is an NBFC which is a part of the Mahindra Group and is primarily engaged in the business of financing purchase of new and pre-owned auto and utility vehicles, tractors, cars, commercial vehicles, construction equipment and SME Financing.

With a market cap of Rs 48,969 cr, the company offers a wide range of financing, investment and insurance solutions to customers across retail, small and medium enterprises and commercial customers with a significant presence in rural and semi-urban India.

Ashish Dhawan has held a stake in the company since March 2022 as per data on Trendlyne.com. Currently he holds 1.1% stake in the company worth Rs 515 cr.

The company has a current dividend yield of 1.9% and the industry median is zero. The 5-year average dividend yield is 1.2%, while the industry median for the same period is 0.01%. In the past 12 months, Mahindra & Mahindra Financial Services Ltd has declared an equity dividend amounting to Rs 6.50 per share.

Let us now look at the financials to get a better understanding of how the company maintains these dividend yields.

The company’s sales logged a compounded growth of 9% from Rs 11,995 cr in FY20 to Rs 18,519 in FY25.

Financing Profits improved from Rs 1,702 cr in FY20 to Rs 3,271 cr in FY25, logging a compound growth of 14%.

Looking at net profits, the compound growth of 16% was logged in the last 5 years from Rs 1,086 cr in FY20 to Rs 2,261 cr in FY25.

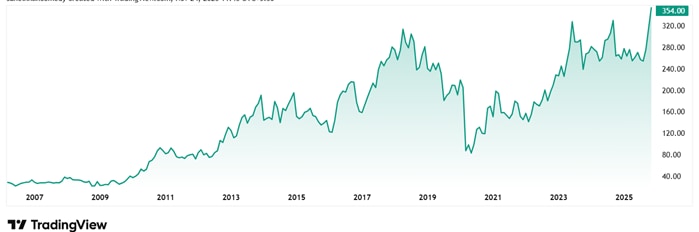

The share price of Mahindra & Mahindra Financial Services Ltd was around Rs 166 in November 2020 and as on 24th November 2025, it was Rs 352.

The stock is trading at a PE of 20x, which is close to the current industry median of 21x. The 10-year median PE for the company is also 20x which is same as the industry median in the same period.

In the company’s last annual report, Chairman Dr Anish Shah said, “At Mahindra Finance, we remain steadfast in our belief that growth must be underpinned by disciplined risk management and enduring impact. Through strong governance, robust risk frameworks, and transformative digital initiatives, we are establishing a resilient and scalable platform – one that embodies trust, dedication, and purpose while unwaveringly serving Bharat.”

Dividend trap or long-term bet?

The Ashish Dhawan stocks we saw today are leaders in their niche when it comes to dividend yields and otherwise. While both have different stories, they do have strong management focus and the willingness to give back to the investor at the forefront.

Quess Corp might be seeing some worrisome fluctuations in terms of financials while on the other hand Mahindra & Mahindra Financial Services has recorded steady growth with some ups and downs. But given Dhawan’s interest in these stocks which has been there for the last few years, these stocks definitely hold some qualities apart from the dividend yield, which the average investor is probably missing.

The big question everyone is asking now is – Will these stocks continue the dividend streak or will the numbers fizzle out. Only time can tell! For now, these stocks deserve a spot in the watchlist for 2026.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.