While mainstream media focuses on Jhunjhunwala or Damani, investors like the founder of First Water Capital operate in stealth. With a concentrated portfolio of just three stocks held for nearly a decade, he sits on a holding value of over Rs 630 cr.

Ricky Kriplani, one of the Warren Buffetts of India. Kriplani is a value investor with over 3 decades of experience. He is the founder and CIO of First Water Capital, which focuses primarily on Indian Equities, as they believe India is on the path to big growth.

This ‘silent’ Warren Buffett of India, who currently holds only 3 stocks in his portfolio worth over Rs 630 cr, has held them for about a decade now. 2 of these 3 stocks have delivered over 800% gains for him, and he continues to hold them. Do they still have more potential?

Let us see if we can decode what strategy is at play here.

#1 Kama Holdings: The “compounder” hidden in a holding company

Incorporated in March 2000 as SRF Polymers Limited, the company changed its name to Kama Holdings Limited in April 2010.

With a market cap of Rs 8,719 cr, the company is a core investment company while the principal activities of its subsidiaries are manufacturing, purchasing, and sale of technical textiles, chemicals, packaging films, and other polymers.

Ricky Kriplani held a 4.9% stake in the company as per the filings for the quarter ending December 2015, as per Trendlyne. He could have bought the stake earlier, but that’s the oldest data available on Trendlyne. Currently he holds a 4.7% stake in the company worth Rs 410 cr.

Let us look at the company’s financials to try and find out what has kept Kriplani’s interest for a decade.

The sales of the company have grown at a compounded rate of 15% from Rs 7,270 cr in FY20 to Rs 14,828 cr in FY25. And for H1FY26, the sales were already Rs 7,529 cr.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) jumped from Rs 1,477 cr in FY20 to Rs 2,792 cr in FY25, logging a compound growth of 14%. And for H1FY26, the EBITDA of Rs 1,647 cr was already recorded.

Looking at the net profits, the company has recorded a compound growth of just 4% from Rs 1,196 cr in FY20 to Rs 1,254 in FY25. For H1FY26, profits of Rs 826 cr have been recorded.

While the sales and EBITDA are not too bad, the small growth in profits is something that could be treated by many investors as a red flag. But a look at the gains could decode why Kriplani has been with the company for a decade.

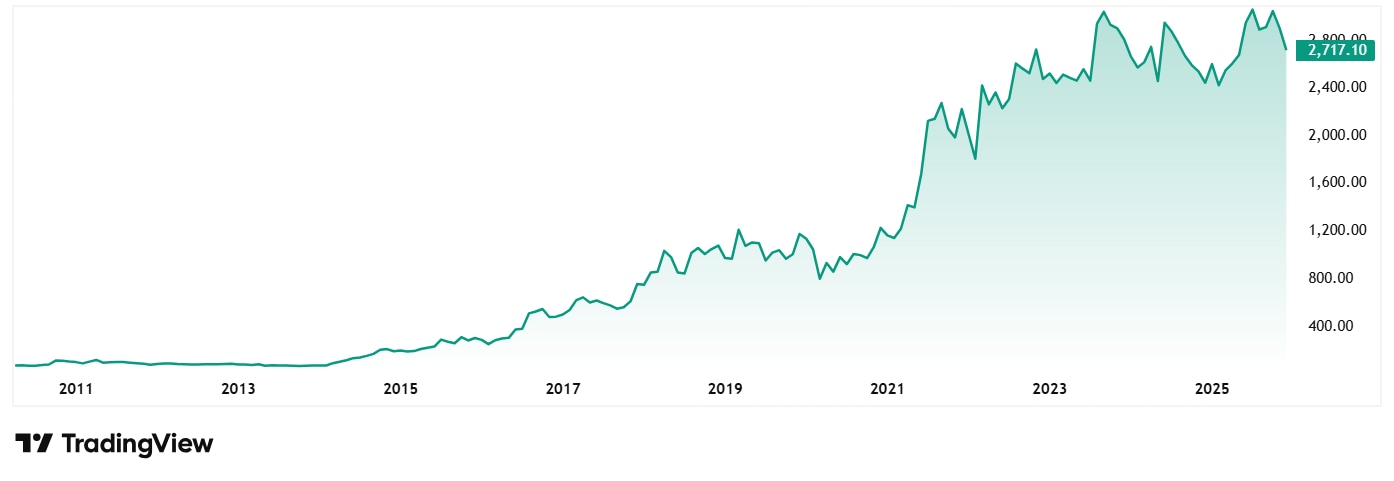

The share price of Kama Holdings Limited was around Rs 260 in December 2015 and as of closing on 5th December 2025 it was Rs 2,717, which is a jump of almost 950% in the last decade. Rs 1 lac invested in the company a decade ago would have been Rs 10.5 lacs today.

The company’s share is trading at a PE of 11x, and the current industry median is 19x. The 10-Year median PE for the company is 8x, while the industry median for the same period is 14x.

The company has a dividend yield of 1.24%, which is amongst the highest when compared to peers from the same industry. In the past 12 months, Kama Holdings has declared an equity dividend amounting to Rs 36 per share.

#2 Nalwa Sons: Deep value or just a “holding discount” trap?

Incorporated in 1970 as Jindal Strips Limited, the company changed its name to Nalwa Sons Investments Limited in February 2005. The company is a non-NBFC Company engaged in the business of investing in shares and granting loans to the group companies.

A part of the O.P. Jindal Group, the company has a current market cap of Rs 3,362 cr and holds significant investments in Equity Shares of O.P. Jindal Group of Companies, therefore the business prospects of the Company largely depend on the business prospects of O.P. Jindal Group of Companies and the steel industry.

Kriplani bought a 7.9% stake in the company as per the filings for the quarter ending March 2016. Currently he holds a 3% stake in the company worth Rs 100 cr.

Let us look at the financials for Nalwa Sons.

The sales of the company have grown at a compounded rate of 16% from Rs 59 cr in FY20 to Rs 125 cr in FY25. And for H1FY26, the sales were already Rs 62 cr.

EBITDA went from Rs 9 cr in FY20 to Rs 64 cr in FY25, logging a compound growth of 48%. And for H1FY26, the EBITDA of Rs 54 cr was already recorded.

The Net profits of the company have recorded a compound growth of 16% from Rs 19 cr in FY20 to Rs 46 cr in FY25. For H1FY26, profits of Rs 44 cr have been recorded already.

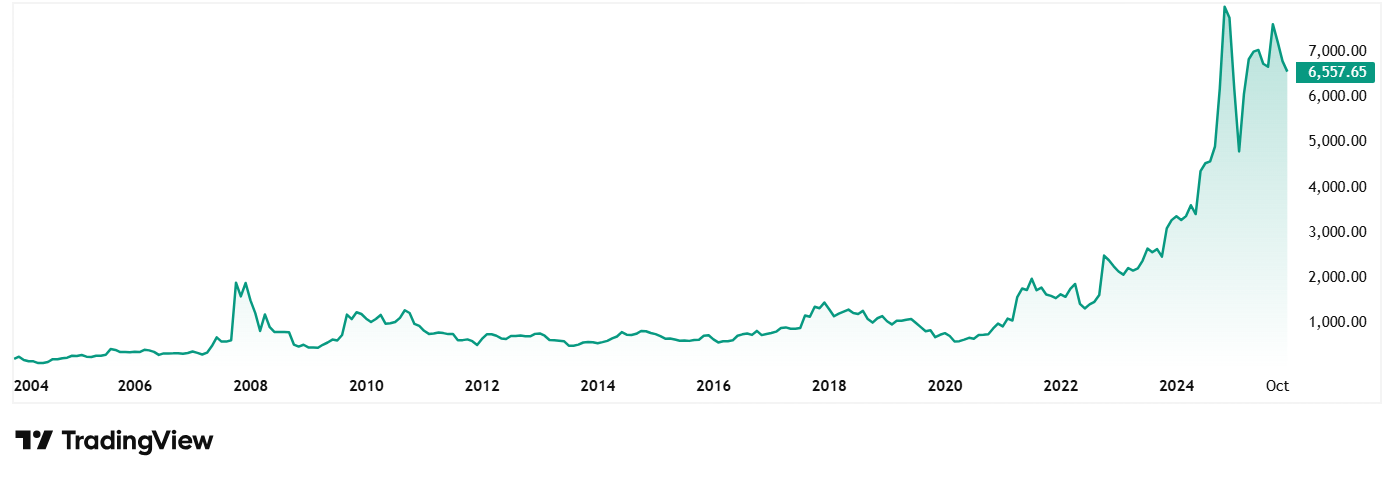

The share price of Nalwa Sons Investments Ltd was around Rs 700 in December 2015 and as of closing on 5th December 2025 it was Rs 6,540, which is growth of 835%. Rs 1 lac invested in the stock a decade ago would have been Rs 9.4 lacs today.

The company’s share is trading at a trailing P/E of 140x, optically high due to a one-off loss in the previous quarter. However, current earnings run-rate suggests a much lower forward valuation. The 10-year median PE of the company is however 24x, and the industry median for the same period is 19x.

The directors report in the annual report for FY25 says that the company is looking forward for a sustainable growth in its investee companies in the coming years which would enhance the shareholders’ value. Considering the forecasted growth in the economy as a whole and the steel industry in particular, the company expects to enhance its entrenched value for the benefit of the shareholders at large.

#3 Uflex Ltd: Betting on a GST-led consumption revival

The third holding of Kriplani, Uflex Ltd is a leading Indian multinational company which is engaged in the manufacturing and sale of flexible packaging products & offers a complete flexible packaging solution to its customers across the globe.

With a market cap of Rs 3,464 cr, the company is a leading global manufacturer of packaging films and one of India’s largest flexible packaging firms.

Kriplani bought a 2.4% stake in the company as per the filings for the quarter ending December 2015 per Trendlyne (the earliest available date in Trendlyne; the initial share purchase may have been earlier). Currently he holds a 3.5% stake in the company worth Rs 121 cr. First Water Funds also hold another 2.5% stake in the company.

The sales of the company have grown at a compounded rate of 15% between FY20 and FY25. EBITDA logged a compound growth of 9%.

The Net profits of the company have seen a rough ride, with signs of turnaround in FY25.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Rs Cr | 371 | 844 | 1,099 | 481 | -691 | 142 |

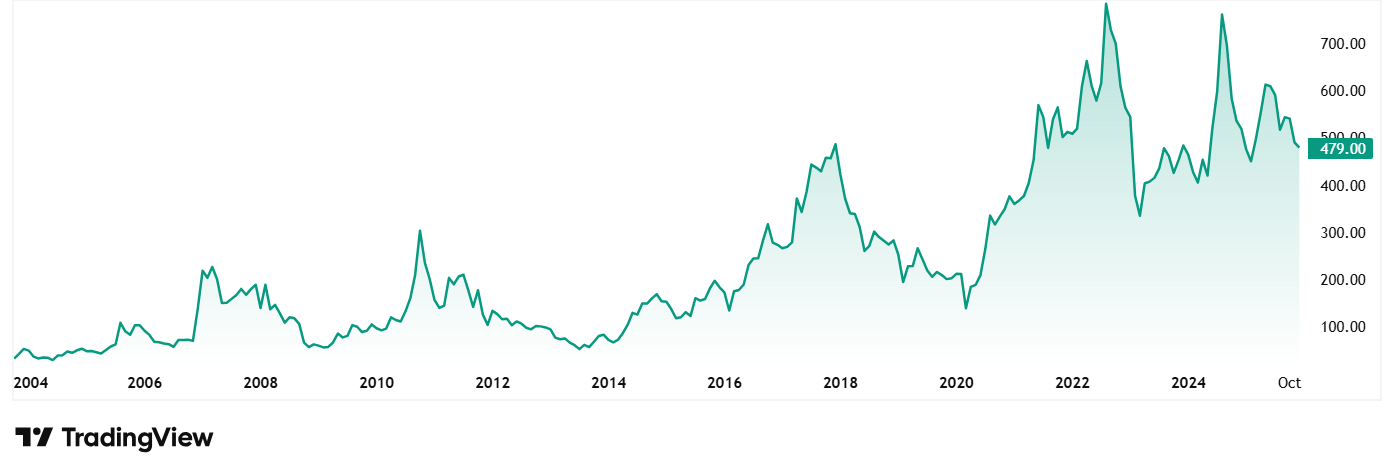

The share price of Uflex Ltd was around Rs 175 in December 2015 and as of closing on 5th December 2025 it was Rs 480, which is growth of 174%.

The company’s share is trading at a PE of 11x, while the current industry median is 21x. The 10-year median PE of the company is however 5x, and the industry median for the same period is 21x.

The company’s Chairman and Managing Director, Ashok Chaturvedi said in the investor presentation from November 2025 that, “Q2 FY26 was marked by tariff disruptions, GST transition, and a prolonged monsoon, which had an impact on operations. However, on a positive note, the tariff issues are likely to be settled soon, and GST rationalization will significantly boost consumption, which is positive for the industry, and will be a strong growth catalyst going forward. With the headwinds behind us, we strongly believe that the business is set for strong growth, and our ongoing capacity expansion programs will set the tone for positive momentum.”

Decade long of trust, still more to come?

While Kriplani might not be in the news like his other fellow super investors, he surely knows his game and is proving his mettle for over 30 years. The average investor and his clients at First Water trust him and his stock picking skills as they mimic the style of Warren Buffett, making him a true Value Investor.

He has only 3 stocks in his portfolio worth Rs 630 cr, and they have made him returns of like 950% in the last decade.

Note: He may own other stocks as well in his portfolio, but are not reported separately as the individual holding in the companies may be less than 1%.

While the financials of the companies all tell a different story, some worrisome and some building trust, Kriplani still holds them even after a decade. Which means this Warren Buffett of India still sees something in these stocks.

How these stocks will perform in 2026 and beyond will be interesting to watch, but at the same time no one wants to miss a good opportunity if at all it comes up. So, a smart thing to do would be to add these stocks to a watchlist and follow them closely.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.