Porinju Veliyath is an Indian Super Investor who needs no introduction. He is the founder of Equity Intelligence India Pvt Ltd, a very highly skilled investor and fund manager known for his value-focused approach and swimming against the tide. Many investors follow him to try and get a piggyback ride to success.

So, when he makes changes to his portfolio, the investor community takes note to try to find out the reason behind the changes. Especially new investors, as they could benefit from following his proven track record.

Here are 4 stocks from his portfolio that have seen big changes….

Apollo Sindoori Hotels Ltd

Incorporated in 1998, Apollo Sindoori Hotels Ltd is in the business of managing food outlets at hospitals and reputed organizations.

With a market cap of Rs 396 cr, Apollo Sindoori Hotels also undertakes outdoor catering services, skilled manpower to hospitals, etc.

Porinju Veliyath bought a 1.35% stake in the company through his company Equity Intelligence India Private Limited as per exchange filings for the quarter ending September 2024, which went up to 1.67% at the quarter ending March 2025 and has gone further up to 2.12% as per the recent filings for the quarter ending June 2025.

The sales of the company grew at a compounded growth rate of 23% from Rs 193 cr in FY20 to Rs 542 cr in FY25. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) went from Rs 8 cr in FY20 to Rs 19 cr in FY25, logging in a CAGR of 19%.

Net profits however have seen a bumpy ride in the last 5 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profit/Cr | 15 | 10 | 15 | 17 | 11 | 8 |

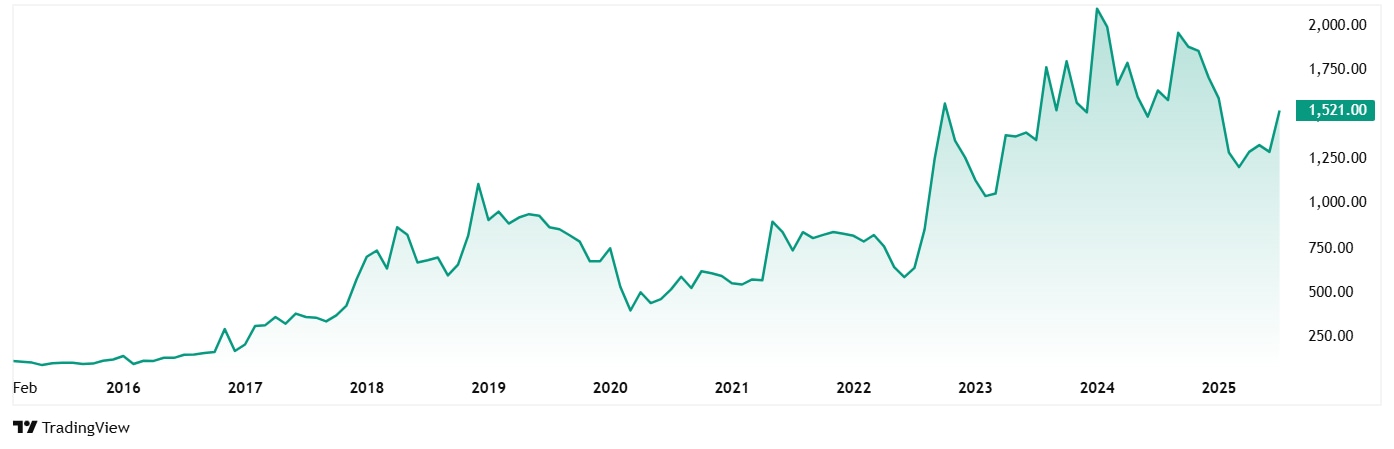

The share price of Apollo Sindoori Hotels was around Rs 455 in July 2020 and as of closing on 15th July 2025, it was Rs 1,521, which is a jump of 235% in 5 years. Rs 1 lac invested in the stock 5 years ago would have been about Rs 3.4 lacs today.

The stock is trading at a PE of 51x, while the industry median of 36x. The 10-year median PE of Apollo Sindoori Hotels is 18x, and the industry median for the same period is 28x.

The company saw a change in leadership when previous whole-time Director cum CEO, Mr. Chithambaranathan Natarajan was replaced by Mr. Munish Kumar as Group Chief Executive Officer (CEO) and Key Managerial Personnel.

Apart from Apollo Sindoori Hotels, Veliyath also raised stake in two of his other holdings:

Sundaram Brake Linings Ltd: Porinju Veliyath’s holding in this company went from 1.1% in the quarter ending March 2025 to 1.3% for the quarter ending June 2025, a holding worth almost Rs 4 cr.

M M Rubber Co Ltd: Veliyath’s holding in this company went from 1% in the quarter ending March 2025 to 1.3% for the quarter ending June 2025, a holding worth Rs 64.7 lacs.

Those were the additions made. Let us now see the big drop from his portfolio.

Ansal Buildwell Ltd

Incorporated in 1983, Ansal Buildwell Ltd is in the business of promotion, construction and development of integrated townships, residential and commercial complexes, multi storied buildings, flats, houses, apartments.

With a market cap of Rs 93 cr Ansal Buildwell has executed projects in many cities like Gurgaon, Kochi, Amritsar, Jaipur, Faridabad, Gwalior, Pathankot, Jhansi, etc.

Porinju had held a stake in Ansal Buildwell Ltd through his company Equity Intelligence India Private Limited at least since March 2016 as per Trendlyne.com. However, as per the recent exchange filings for June 2025, the holding has gone below 1%, meaning a partial or a complete sell off.

Let’s look at the financials for Ansal Buildwell to try find the reason for this sell-off.

The sales of the company have not been consistent or growing, making it difficult for investors to establish trust.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 63 | 73 | 188 | 33 | 41 | 49 |

EBITDA also saw jumps and falls in the last 5 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 11 | 15 | 23 | 3 | 19 | 14 |

The Net Profits were also on the same lines, with a jump from the 5-year-old number, but a fall from the last financial year.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profit/Cr | 0.5 | 6.7 | 11.4 | -2.8 | 14.5 | 8.0 |

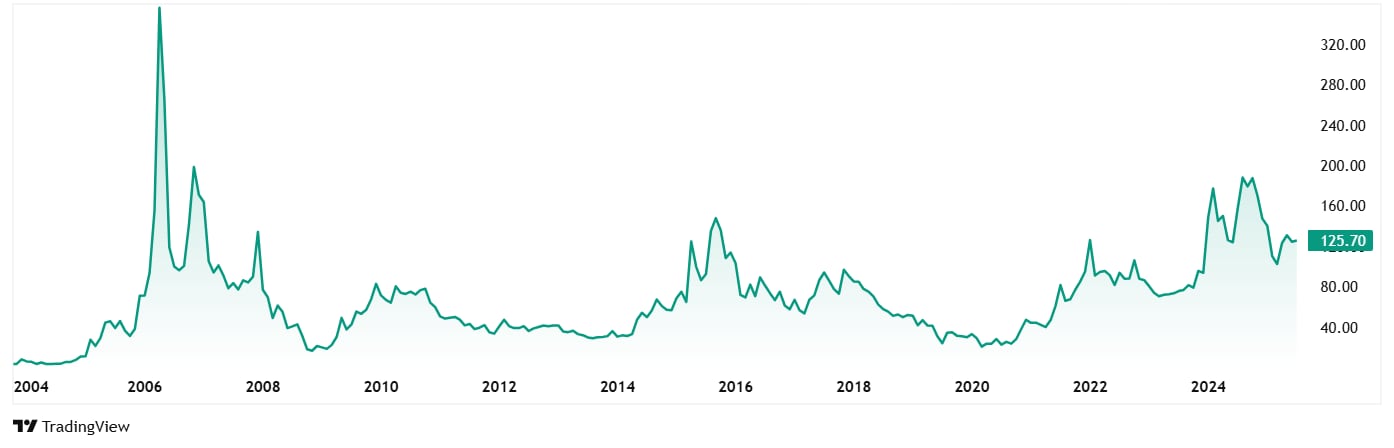

The share price of Ansal Buildwell Ltd was around Rs 25 in July 2020 and as of closing on 15th July 2025, the price was Rs 126, which is a jump of over 400%. Rs 1 lac invested in the stock 5 years ago would have been a little over Rs 5 lacs today.

The company’s stock is trading at a PE of 12, while the industry median is 43x. The 10-year industry median PE for the company is 7x and the industry median for the same period is 26x.

As per screener, the company’s Debtor days for FY25 were 1.5, the inventory days were 9,555 and the days payable were 360, making the cash conversion cycle a huge 9,197 days. This indicates a severe inefficiency in managing working capital. Such an extended cycle puts immense strain on their finances, requiring them to constantly seek new funding or rely heavily on their high days payable to survive, as their own cash is locked away for long periods.

The Way Forward

The stake rise in the 3 companies – Apollo Sindoori Hotels Ltd, Sundaram Brake Linings Ltd and M M Rubber Co Ltd followed by the sell off for Ansal Buildwell Ltd by Porinju Veliyath are some very interesting changes to study and dig into, given that Porinju’s movements usually cause ripples in the community.

No doubt the financials for these companies are a mix of challenges and opportunities, but the real reason for the addition of stakes and the selloff is something only Veliyath knows. Only time will tell if this was a strategic rejig, or a warning sign the markets and investors ignored.

But what is sure is that Porinju Veliyath does not make such big changes on a hunch, and there is more to it than meets the eye. There might be something deeper here. So, keeping an eye on these stocks wouldn’t hurt. Add to Watchlist?

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, he was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.