The Ministry of Ports, Shipping, and Waterways has notified the guidelines for two shipbuilding programs worth ₹44,700 crore. The initiatives, the Shipbuilding Financial Assistance Scheme and the Shipbuilding Development Scheme, aim to strengthen India’s domestic shipbuilding capacity and improve global competitiveness.

The Subsidy Floor: How ₹44,700 Crore De-risks the Yard Lifecycle

The government will provide financial assistance of 15-25% for each ship under the Shipbuilding Financial Assistance Scheme, with a total budget of ₹24,736 crore. Also, this scheme plans to support shipbuilding projects worth ₹96,000 crore.

The scheme introduces graded support for small normal, large normal, and specialised vessels, with stage-wise disbursement linked to defined milestones and backed by security instruments.

The budget for shipbuilding development is ₹19,989 crore, with a complete focus on building shipbuilding capacity. The scheme funds the development of greenfield shipbuilding clusters and the expansion and modernisation of existing brownfield shipyards. Both the schemes will remain valid till FY36.

The scheme’s outlay is substantial, but these three companies are expected to be the main beneficiaries of the budget. We will also look at their current order book and the large order pipeline that is gaining shape.

#1 Mazagon Dock: The Sub-Surface Dominator

Mazagon is India’s oldest and largest defence shipyard company. It serves as the Indian Navy’s principal partner in the construction of complex warships and conventional submarines. As the largest, there is no doubt that Mazagon will benefit the most, especially given that shipbuilding is a complex, high-cost business.

The ‘Make in India’ Premium: Why Indigenization Pays

Mazagon is a key driver of the Atmanirbhar Bharat initiative and is continuously increasing indigenous content on its platforms. The indigenous content in older destroyers was 42%, which has now increased to 75% in the current P-17A frigates. It aims to achieve 80% or more indigenization for upcoming programs such as the P-75(I) and the next-generation destroyers.

Full-Spectrum Dominance

Mazagon is the sector’s “flagship beneficiary” due to its rare full-spectrum capability.

- Destroyers: Mazagon has constructed the Delhi, Kolkata, and Visakhapatnam classes, which are heavily armed frontline warships for offensive multi-mission roles.

- Frigates: The yard builds versatile stealth frigates, including the Shivalik and Nilgiri (Project 17A) classes, focused on anti-submarine and surface warfare.

- Submarines: MDL is the only facility in India capable of serial production and integration of modern conventional submarines, such as the Scorpène-class (Project 75).

- Other Vessels: It also delivers missile boats, corvettes, offshore patrol vessels, and specialized commercial vessels, such as dredgers and multipurpose cargo ships.

The ₹3 Lakh Crore Order Pipeline

As of 30 September 2025, Mazagon had an order book of ₹27,415 crore. With FY25 revenue of ₹9,467 crore, the order book provides revenue visibility of nearly 3 years. Beyond this order book, Mazagon is approaching a major ordering cycle, with the pipeline exceeding ₹3 lakh crore.

Mazagon is in advanced negotiations for 3 additional Scorpene submarines, valued at ₹36,000 crore. It is also the lead contender for the ₹70,000 crore P-75(I) project, which features next-generation air-independent propulsion. In the surface ships, it is eyeing large programs, including ₹70,000 crore worth of Project 17 Bravo frigates, Project 15(C) next-gen destroyers (₹ 70,000 crore), and Landing Platform Docks (₹35,000 crore).

To fulfill its long-term shipbuilding order book, the company has devised a 10-year capex roadmap worth ₹18,000 crore. This includes a new greenfield shipyard in Thoothukudi with an initial investment (Phase-1) of ₹5,000 crore over the next four to five years to build Very Large Crude Carriers.

Commercial Pivots: De-risking the Defence Cycle

To reduce dependency on the Ministry of Defence, Mazagon is expanding into commercial and international markets. It is executing ONGC contracts worth ₹6,500 crore for offshore platform construction. This helps to utilize yard capacity and stabilize revenue seasonality.

In FY25, it acquired a 51% stake in Colombo Dockyard PLC. This marked the first time an Indian shipyard had established an international presence for repair and refit work.

#2 Garden Reach Shipbuilder and Engineer: From Hull-Building to Autonomous Mastery

Garden Reach Shipbuilders & Engineers (GRSE) is one of India’s most versatile defence public sector shipyards. It has evolved from a basic workshop into a technology-driven maritime solutions provider capable of constructing the full spectrum of surface combatants, from stealth frigates to specialized research ships.

The Balanced Revenue Engine

Unlike peers that focus solely on hull construction, GRSE operates four integrated business segments, providing a balanced revenue profile.

- Shipbuilding (88% of FY25 revenue): The core segment responsible for warships, patrol vessels, and survey ships.

- Ship Repair and Refit (8% of revenue): A high-margin, short-cycle business that provides maintenance and mid-life upgrades, which scaled to ₹390 crore in FY25.

- Engineering Division (3% of revenue): Manufactures Bailey bridges, deck machinery, and weapon-handling systems.

- Engine Division (1% of revenue): Operates a plant in Ranchi for the assembly and testing of marine diesel engines.

The 4-Year Horizon

As of September 2025, GRSE had a robust order book of ₹20,205 crore. With FY25 revenue of ₹5,076 crore, this order book provides visibility into revenue for over 4 years. Its current execution workload includes several high-value programs, including:-

- P-17A Frigates: Three stealth frigates are in advanced stages, with one already delivered ahead of schedule and the others progressing through sea trials and outfitting.

- ASW Shallow Water Craft: A program for eight vessels, with two already delivered and the remainder targeted for completion by FY27.

- Next-Gen Offshore Patrol Vessels: Four vessels under construction, with sequential launches expected in 2026.

- Export Multipurpose Vessels: GRSE has a sizeable ₹1,460 crore export backlog, primarily consisting of multi-vessel contracts for a European client in Germany.

Furthermore, like Mazagon Dock, GRSE is also a strong contender for upcoming naval contracts, with the potential to secure orders worth approximately ₹1.8 lakh crore. Even if the company secures just 20% of these orders, its revenue visibility is expected to extend for more than a decade.

Pioneering the Autonomous and Hydrogen Frontier

GRSE is investing heavily in Shipyard 4.0 and next-generation platforms to maintain its competitive edge. It currently handles 28 vessels simultaneously and plans to increase this to 32 vessels by 2026. Eventually, it aims for 40 vessels through a proposed greenfield shipyard on the West Coast.

It is also developing advanced autonomous systems, including the autonomous USV and the Neerakshi V2 underwater vessel. GRSE is an early mover in sustainable tech, having developed India’s first fully electric 150-passenger ferry and hydrogen fuel-cell vessel prototypes.

Like Mazagon, GRSE achieves high localisation levels and targets over 85% indigenous product for the upcoming Next-Gen corvettes.

#3 Cochin Shipyard: The Dual Engine of Repair and Green Tech

Cochin Shipyard is a premier maritime institution in India. For over five decades, CSL has served as a leader in India’s maritime industry, specializing in both shipbuilding and ship repair for the defence and commercial sectors. The company’s business is broadly categorized into two main segments.

- Shipbuilding (55% of FY25 revenue): Cochin has a history of building complex vessels, notably the construction of India’s first Indigenous Aircraft Carrier, INS Vikrant. Its current portfolio includes aircraft carriers, oil tankers, bulk carriers, offshore patrol vessels, and green technology vessels, hybrid-electric and hydrogen fuel-cell catamarans.

- Ship Repair (42% of revenue): It is the market leader in India for ship repairs, handling everything from routine maintenance to complex conversions and upgrades of naval and commercial ships. In FY25, CSL successfully handled 187 projects across its various repair units.

The company has structurally transformed its revenue mix to reduce cyclicality and dependence on any single major project. It had an order backlog of ₹21,100 crore, providing revenue visibility for 4–5 years. The order book is dominated by defence contracts, including the ₹9,800 crore NGMV project and the ₹3,700 crore ASW-SWC program.

Doubling Capacity for a ₹2.2 Lakh Crore Pipeline

In addition to its existing backlog, Cochin Shipyard is working on a defence pipeline worth ₹2.2 lakh crore. This includes the ₹40,000 crore Mine Countermeasure Vessels program, the P-17 Bravo frigates (₹70,000 crore), and Landing Platform Docks (₹35,000 crore). The company has also expanded its capacity to fulfill the demand.

Capturing Europe’s Zero-Emission Transition

Cochin is a pioneer in sustainable maritime technology, particularly for the European export market. It is executing on hybrid-electric ferries, zero-emission feeder container ships, and autonomous surface vessel pilots.

Green vessels currently account for 39% of its commercial shipbuilding order book. It is also developing India’s first hydrogen fuel-cell electric vessel and supporting maritime startups through its USHUS accelerator program.

The ₹3,300 Crore Capex Payoff

Cochin Shipyard has recently completed a ₹3,300 crore capital expenditure cycle, positioning it for utilization-driven growth. The recently commissioned stepped dry dock enables it to build large Suezmax-scale tankers and large offshore assets.

This new facility features a 6,000-ton ship lift and can handle 82 vessels annually, effectively doubling its repair capacity. The goal of this expansion is to double its turnover by FY31 through increased utilization of these new assets.

The Premium Trap?

As the country’s largest shipbuilder, Mazagon has strong return ratios, including return on capital employed (RoCE) and return on equity (RoE). GRSE also has robust return ratios, while Cochin Shipyard’s return ratios are comparatively modest due to a volatile bottom line.

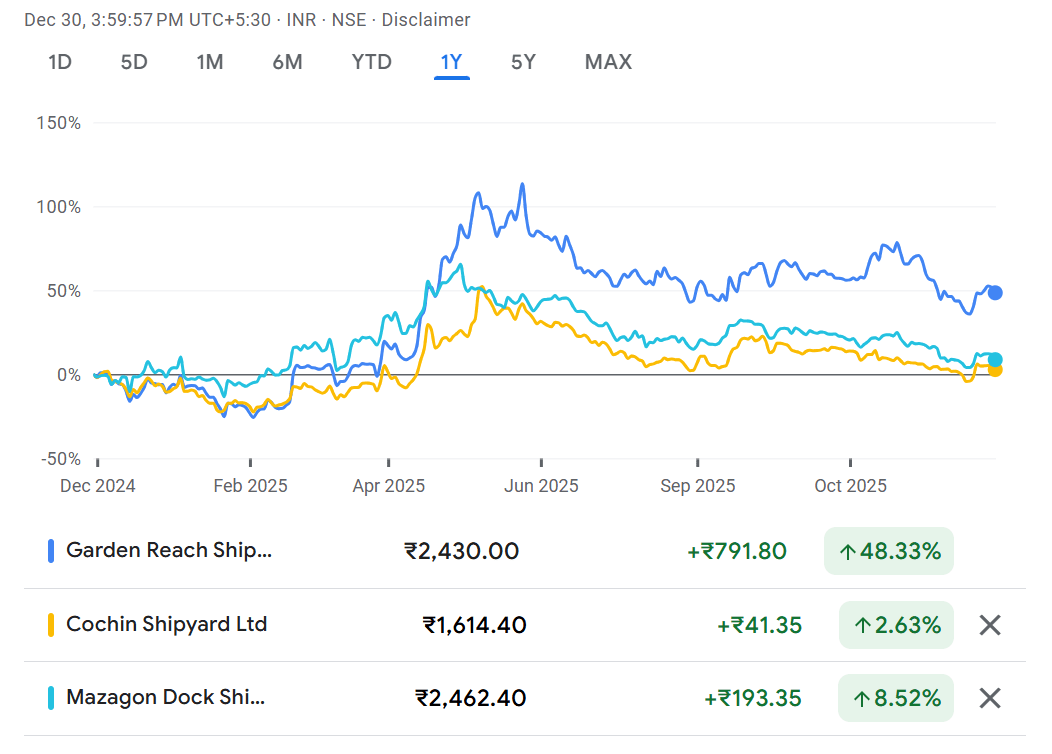

Share Price of GRSE, Cochin, and Mazagon

Valuation-wise, all three, Mazagon, GRSE, and Cochin, are trading at a big premium to their own 5-year median price-to-earnings multiples. Although after the recent correction, GRSE offers a better margin of safety as it trades at a discount to the industry multiple.

| Valuation Comparison (X) | |||||

| Company | Existing P/E | 5-Year Median | Industry P/E | RoCE (%) | RoE (%) |

| Mazagon | 42.6 | 23.1 | 42.6 | 43.2 | 34.0 |

| Garden Reach | 44.9 | 28.9 | 61.3 | 36.6 | 27.6 |

| Cochin Shipyard | 56.1 | 26.4 | 42.6 | 20.4 | 15.8 |

| Source: Screener.in | |||||

Mazagon Dock’s valuation is broadly in line with the industry average, while Cochin Shipyard’s valuation remains higher. This means that their existing order, which is already strong, has already been factored into their current valuation. For fresh impetus, the budgetary outlay signals that shipbuilding is being treated as a long-term structural theme. And Mazagon, GRSE, and Cochin Shipyard sit at the centre of this policy shift.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data were unavailable have we used an alternate, widely accepted, and widely used source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.