The Market Master Vijay Kedia is known widely and followed by many for his strong stock picking skills. When he makes moves in his portfolio, the market takes notice. His current portfolio has 16 stocks with worth almost Rs 1,248 cr. After starting investing at the age of 19, when most people are trying to ensure they have a steady job, Kedia has come a long way to becoming a guru figure.

Kedia’s SMILE strategy is very well known. In his own words, it is “small in size, medium in experience, large in aspiration, and extra-large in market potential’”. No wonder his moves have smart investors across the spectrum taking notes.

So, when two of his holdings, which he has held for 7 years, fall closer to their 52-week lows, it deserves attention. Especially because Kedia still holds them despite the drop, pointing at solid trust on the company by him. Which are these two stocks and are they a good buy opportunity or a disaster waiting to happen.

The robotics bet: Why Kedia trimmed his stake

Incorporated in 2009, Affordable Robotic & Automation Ltd is a Turnkey Automation Solution provider for all kind of Industrial Automation.

With a market cap of Rs 245 cr, the company is the 1st robotic BSE-listed company that provides automation solutions for welding lines using robotics and related designing services.

Ace investor Vijay Kedia has held a stake in the company since the filings made for the quarter ending September 2018. Currently he holds almost a 7.4% stake in the company worth Rs 18.1 cr.

What’s notable is that he held 10% till the end of the quarter ending June 2025, which has dropped in the quarter ending September 2025.

Let us look at the financials to try and find out what makes Kedia stay around despite sharp fall in the share prices.

The company’s sales have grown from Rs 102 cr in FY20 to Rs 163 cr in FY25, which is a compound growth rate of 10% in the last 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) took a fall in FY25 as the company recorded losses of Rs 3 cr.

The net profits fell in FY25 again, after showing some promise in the years before that.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Cr | 3 | -4 | 2 | 2 | 6 | -12 |

The company posted a loss in 1QFY26 too. However, in 2QFY26, the company has declared a profit.

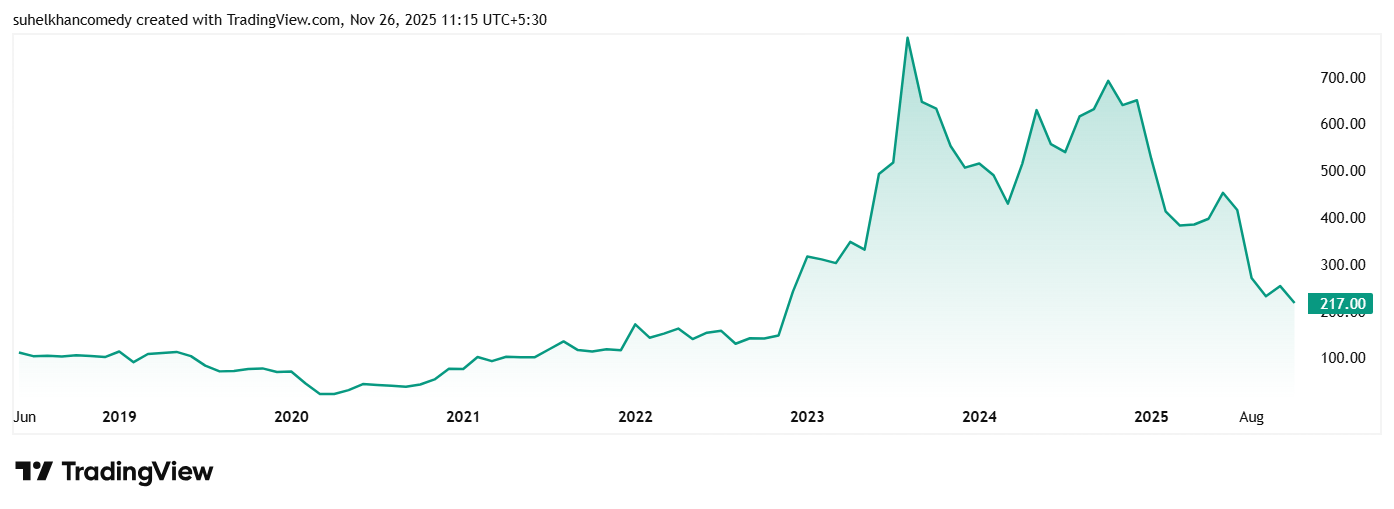

The share price of Affordable Robotic & Automation Ltd was about Rs 55 in November 2020, and as on 26th November 2025 it was Rs 218, which is a jump of almost 300% in just 5 years. Rs 1 lac invested in the stock 5 years ago, would have been close to Rs 4 lacs today.

The 52-week low price for the company is Rs 208, so the current price is hovering above the 52-week low. Plus, at the current price, the stock is trading at a discount of almost 75% from its all-time high of Rs 851.

The stock is trading at a PE of 161x, which is much higher than the current industry median of 34x. The 10-year median PE for the company is 67x, while industry median is for the same period is 29x.

As per the recent earnings call in November 2025, the company has delivered a notable turnaround in H1 FY26, with both standalone and consolidated profitability returning after prior losses, driven by cost/engineer-to-order mix optimization and initial traction in export-led mobile robotics.

However, screener.in says in its analysis, “Several financial and order-book data points in the call were internally inconsistent. Investors should cross-check final numbers against the company’s official results and upcoming investor presentation”

The turnaround play: Innovators facade’s 540% surge

Incorporated in 1999, Innovators Façade Systems Ltd is in the Business of design, engineering, fabrication, supply, and installation of facade systems.

With a market cap of Rs 365 cr, the company is an aluminium façade contractor and execution of specialized facade work with designing, engineering, fabrication and installation of all types of façade systems.

Vijay Kedia has held a stake in the company since June 2018 as per data on Trendlyne.com. Currently he holds 10.7% stake in the company worth Rs 38.5 cr.

Let us look at the financials to see if we can find the reason behind Kedia’s continued interest in the company.

The company’s sales jumped from Rs 141 cr in FY20 to Rs 221 cr in FY25, logging a compound growth of 9% in the last 5 years. In the last 3 years however, the sales have seen a compound growth of 35%.

EBITDA jumped from Rs 16 cr in FY20 to Rs 32cr in FY25, which is a compound jump of 15%.

As for the net profits, the company has shown a turnaround from losses of Rs 8 cr in FY20 to profits of Rs 16 cr in FY25, which is a compound jump of 15%. In the last 3 years however, the profits have seen a 135% compounded growth in profits.

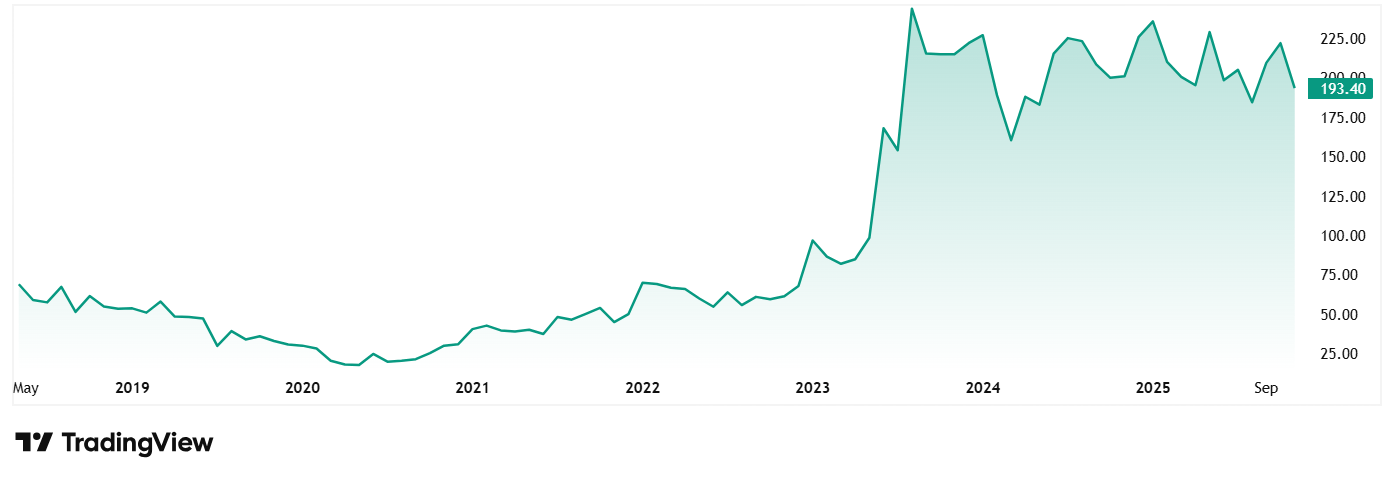

The share price of Innovators Facade Systems Ltd was Rs 30 in November 2020 and as on 26th November 2025 it was Rs 193, which is a jump of over 540% in 5 years. Rs 1 lac invested in the stock 5 years ago would be today almost around Rs 6.5 lacs.

The 52-week low price for the company is Rs 180, which is close to the current price of the stock. At the current price, the stock is trading at a discount of almost 35% from its all-time high of Rs 295.

The stock is trading at a PE of 28x, while the current industry median is 34x. The 10-year median PE for the company is 25x, while industry median is for the same period is a 29x.

According to the last annual report, the company’s management said that they see a significant scale up and further advancement in leadership in the emerging façade industry of India. Management said that their strength lies in their robust and end to end façade solution integrated with strong design, manufacture and execution capabilities. The company is also in process of bidding of various new prestigious projects marking a significant improvement in order bookings. In H1FY26, the company has already booked orders of over Rs 200 cr.

Opportunity v/s Trap – The next move

When we look the financials of both the stocks we saw today, they both have some things in common. Though both have seen a rocky road in terms of profits, they have both shown that they can turn things around. Probably the reason Kedia still trusts them even after big falls.

As they both trade at big discounts, it makes one wonder if this is a good get in opportunity to stocks that an investor like Kedia has trusted for years. After all, Kedia is known to laugh his way to the bank with his stock picks often.

While it would be pure speculation to make any comments on how these 2 stocks could or would fare in the near- and long-term future, smart investors must keep an eye on them. It would be a good idea to add these stocks to a watchlist and follow them with a vigilant eye.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.