One of India’s most successful and very reclusive super investors, Nemish Shah deserves to be called a Warren Buffett of India. Any movement in his rarely changing portfolio, grabs the attention of everyone in the market.

Nemish Shah currently holds only 6 stocks in his portfolio worth over Rs 3,060 cr. But what has caught the attention of smart investors are 2 stocks that are currently trading almost at over 50% discount.

This decline however has not affected the value investor that Nemish Shah is. His portfolio rarely changes in terms of holdings. While the broader markets are inching upwards, these stocks are available at over 50% lower than their all-time high prices. This has given air to the debate about this being a buying opportunity or traps in plain sight.

What keeps Nemish Shah invested in these companies while the markets are hammering these stocks? Let us take a look at these stocks.

The Apparel Bet: A Decade of Patience Amidst Mounting Losses

Incorporated in 1984, Zodiac Clothing Company Limited deals in clothing and clothing accessories.

With a market cap of Rs 260 cr, the company operates in men’s formal wear through its flagship brand, Zodiac, in party /club wear through its sub-brand, ZOD! and in relaxed casual wear through its sub-brand, Z3. These brands are licensed by ZCCL from its group company, Metropolitan Trading Company, which is 100% owned by the promoters under a perpetual licensing arrangement.

India’s Waren Buffett, Nemish Shah, has been holding a stake in Zodiac Clothing since December 2015 (as per the data on Trendlyne.com shows). Currently he holds 1.6% stake in the company which is worth almost Rs 4 cr.

Now what makes this company interesting to look at is the fact that Nemish has been invested in it for almost a decade. Even with weak financials in the last few years.

The company’s sales have seen a lot of ups and downs in the last few years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 191 | 100 | 127 | 175 | 146 | 174 |

The EBITDA (earnings before interest, taxes, depreciation, and amortization) has recorded consistent losses.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 9 | -22 | -17 | -5 | -18 | -21 |

The net profits also faced the heat as all numbers faltered.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | -29 | -29 | -16 | 16 | -36 | -37 |

The share price of Zodiac Clothing Company Ltd was around Rs 118 in August 2020, and as of closing on 13th August 2025, it was Rs 100, which is a drop of 15%.

At the current price of Rs 100, the stock is trading at 78% discount from its all-time high of Rs 455.

The company’s current and 10-year median PE is in the negative owing to consistent losses. The industry median currently 29x while the 10-year industry median PE is 25x.

The company has still not filed the financials for the quarter ending June 2025 there are no investor presentations available for the company on screener.in or trendlyne.

The Auto Ancillary Play: An EV Future vs. Stagnant Sales

Incorporated in 1986, The Hi-Tech Gears Ltd is an auto components manufacturer primarily engaged in the business of manufacturing gears and transmission components.

With a market cap of Rs 1,172 cr, The Hi-Tech Gears Ltd has clientele which includes Hero MotoCorp Ltd, JCB, Cummins, Daimler Bharat, Tata, DANA, Mahindra, Wabco, Magna, etc.

Nemish Shah has held a stake in Hi-Tech Gears since December 2015 as per data on Trendlyne.com. Currently he holds 7.2% stake in the company worth Rs 85.3 cr.

The company’s sales inched up from Rs 722 cr in FY20 to Rs 927 cr in FY25 which is a compound jump of 5%.

EBITDA was Rs 84 cr in FY20 and in FY25 it jumped to Rs 186 cr, which is a 17% compound growth.

Looking at net profits, the company’s profits saw a bumpy ride.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | 8 | 29 | -1 | 23 | 114 | 40 |

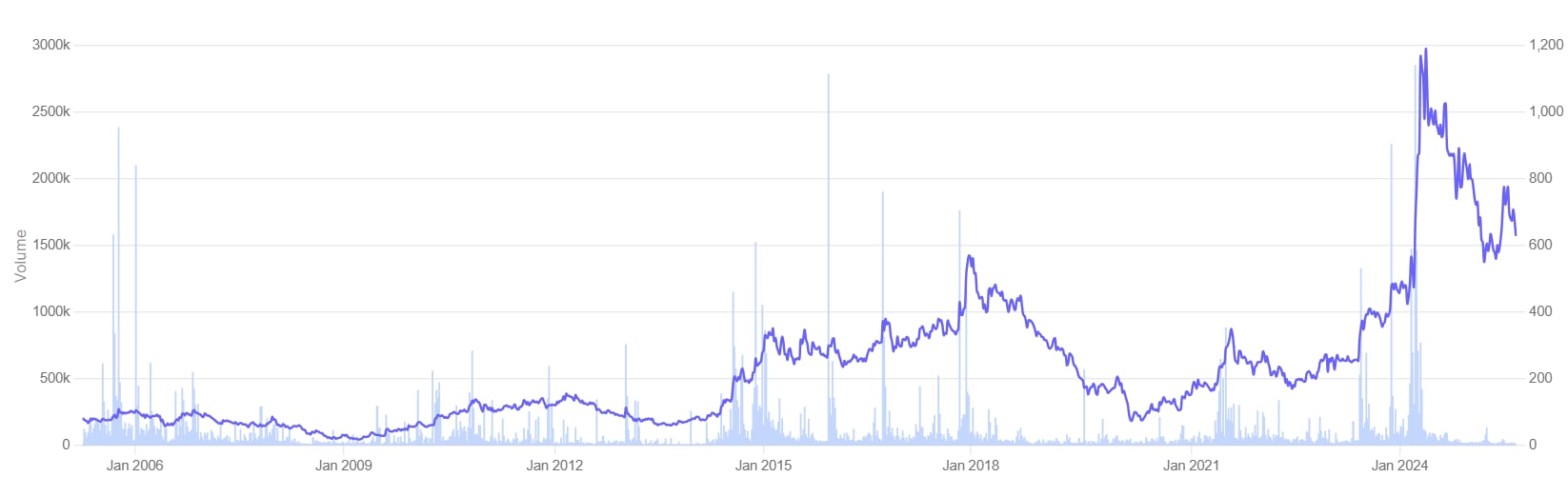

Hi-Tech Gears share price was around Rs 120 in August 2020 which has grown to its current price of Rs 633 as of closing on 13th August 2025. That is a jump of 428%.

At the current price of Rs 633, the company’s share is trading at a discount of a little over 50% from its all-time high of Rs 1,280.

The share is trading at a PE of 37x, while the industry median is 27x. The 10-year median PE of Hi-Tech Gears is 25x and the industry median for the same period is 24x.

As per the recent investor presentation form August 2025, the company is betting big on Electric Vehicles (EVs) and advanced technologies to drive growth. The company is diving deep into the EV market, producing differential assemblies for high-torque, high-speed applications, and securing EV business from giants like Hero MotoCorp and Dana, while actively quoting for more.

A Value Investor’s Insight or a Sunk Cost Fallacy?

Both the stocks that we saw today are Nemish Shah’s favourites and he has held them for about a decade. Although both companies tell a very different story, Shah has not changed his position on them. This speaks about the conviction he has in these stocks.

While Hi-Tech Gears has financials that could be called sustainable and strong, Zodiac Clothing’s financials are a red flag all over. But Shah’s solid conviction in these stocks makes us think if there is something in these stocks that the average investor cannot see.

Only time will tell how these bets turn out to be. For now, these Nemish Shah favourites deserve a place in the watchlist and a very close eye.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.