Promoter pledging, although not uncommon in India Inc., often draws scrutiny from investors due to the risks it poses to a company’s stock. High levels of pledging are typically viewed as a red flag, especially during volatile market conditions, as they can lead to forced selling in case of a price correction. However, the reverse also holds true. When promoters reduce or remove pledges, it can signal improved financial flexibility and governance.

In recent weeks, two listed companies have seen a sharp drop in promoter pledges. While this doesn’t necessarily reflect changes in fundamentals, it does alter how the market may perceive risk in these names. For investors, it raises an important question: Is this an early trigger for a potential re-rating?

#1 Aster DM Healthcare

Aster DM Healthcare is the holding company of the Aster Group, offering healthcare services through its network of hospitals, clinics, and pharmacies.

The group operates in India through its network of hospitals under names such as Aster Medcity, Aster MIMS, Aster Ramesh, Aster Prime, Aster Aadhar, and Aster CMI. Its current presence is concentrated in 15 cities across five states.

The company operates 19 hospitals with 5,159 beds. Within states, it is concentrated in South India, with 2,633 beds in Kerala, followed by Karnataka and Maharashtra (1,479 beds) and Andhra and Telangana (1,047 beds).

The company also operates 10 clinics, 262 labs and patient experience centres, and 203 pharmacies.

Promoter Pledge Cuts, Mutual Fund Interest Shift Narrative

According to Trendlin, as of December 2024, the promoters held a 41.9% stake in the company, of which 98.9% was pledged. However, in the March quarter, while the stake remained the same, the pledge fell to 40.7%.

Mutual funds are betting big on the company, with their shareholding set to triple from 7.1% in December 2023 to 23.3% in March 2025. In contrast, foreign institutional (FIIs) holdings will nearly halve from 41% to 21.7%.

Hospitals Drive Growth, Labs and Pharmacies Still Early

From a financial perspective, revenue in FY25 grew 12% year-on-year (YoY) to ₹41.4 billion. A combination of key performance indicators drove this growth. Average revenue per available bed (ARPOB) grew 12% to ₹40,100, and average occupied beds increased by 28%.

Hospitals and clinics remained the largest driver of revenue, accounting for 96.4% (₹39.9 billion) of revenue. Labs and pharmacies are newly established and contribute the rest.

The company margin also expanded by 270 basis points (bps) to 19.5%. Margins stayed strong at 22% in the hospital and clinics segment, but remained muted at 3% for the labs and pharmacy verticals. Net profit (excluding one-time impact) rose 49% to ₹3.6 billion.

Expansion Plans Signal Push Toward FY27 Scale

The company is also merging its business with another hospital chain, Quality Care India. The merged entity will become India’s third-largest hospital chain, creating significant synergies that will drive growth and enhance operational efficiency.

Post merger, the company plans to reach 13,600 beds by FY27. For this, it has allocated an investment of ₹19 billion to expand its hospital network.

From a valuation perspective, Aster DM trades at a price-to-equity multiple of 78x, well-above the 5-year median of 42x.

Aster DM Healthcare Share Price

#2 Walchandnagar Industries

With over 100 years of operational history, Walchandnagar Industries has a diversified global presence in projects, products, and High-tech Manufacturing. It has contributed to several landmark projects, including critical instruments for India’s first lunar missions, ‘Chandrayaan I’ and ‘Chandrayaan II’, as well as the ‘Akash Missile’.

While the company has been active in the Engineering, Procurement, and Construction (EPC) space, it is gradually exiting the segment after completing existing projects to shift its focus toward emerging sectors.

It is now focusing on strategic sectors such as Defence, Nuclear, Missiles, Aerospace (DNAM), and industrial products such as Gears, Centrifugals, Castings, and Gauges.

Promoter Pledge Cuts, FII’s Interest Shift Narrative

According to Trendlyne, as of December 2024, promoters held a 31.5% stake in the company, of which 60% was pledged. However, in the March quarter, promoters not only increased their stake to 31.8%, but also reduced pledge to 49.2%.

Although mutual funds do not hold a stake in the company, FIIs’ holdings have increased from 0% in September 2023 to 0.6% in March 2025. Among notable public shareholders, ace investor Ashish Kacholia also holds a 2.6% stake in the company.

The company’s revenue declined 16% year-on-year to ₹2.6 billion in FY25. The decline was mainly due to a slowdown in the foundry business, delays in the supply of raw materials for nuclear projects, and disruptions in the delivery of finished goods.

Its losses also doubled to ₹860 million, from ₹420 million in FY24.

Strong Order Book, but Focus on Scaling Defence Business

As of April 30, 2025, its order book stood at ₹6.0 billion (excluding sugar and boiler orders of ₹3.3 billion pending from Tendaho Sugar). This provides revenue visibility of over 2 years. It also expects to win major orders from a strong order pipeline of ₹10 billion.

Looking ahead, the company plans to upgrade its existing facilities for defense, nuclear, and aerospace (DNA) projects, which are expected to be operational by late FY26 or early FY27. It also expects to benefit from India’s shift towards clean energy solutions.

Within the aerospace industry, it is well-positioned to benefit from an increase in ISRO’s launch activity, given its prior contributions to several of ISRO’s missions.

From a valuation perspective, we have used the market capitalization-to-sales ratio, as the company is loss-making. The company is trading at a market capitalisation-to-sales multiple of 5.3x, which is well above the 5-year median of 1x.

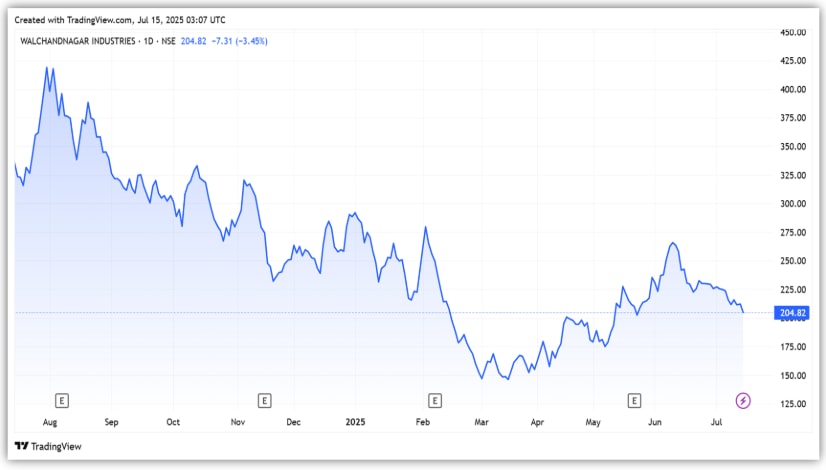

Walchandnagar Industries Share Price

Conclusion

Falling promoter pledges in both companies have improved sentiment, but the outlook differs. Aster DM, backed by steady growth and an upcoming merger, looks better placed. In contrast, Walchand remains in turnaround mode, with a focus on defence, but weak financials remains a concern.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternative, but widely accepted, source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.