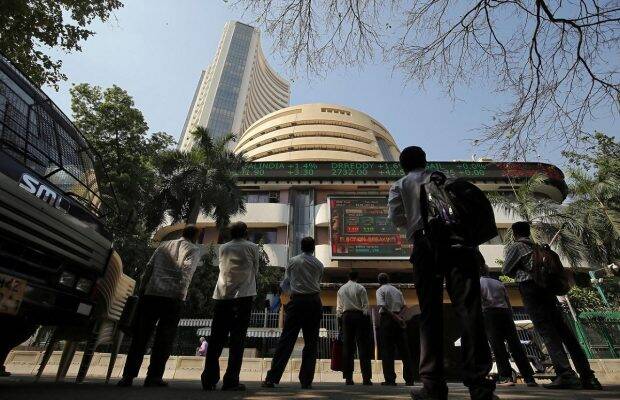

Share Market News Today | Sensex, Nifty, Share Prices Highlights: Domestic equity markets closed with gains for the third straight trading session. S&P BSE Sensex ended 157 points or 0.27% higher at 58,807 while the NSE Nifty 50 index closed 47 points or 0.27% higher at 17,516. Bank Nifty closed 0.54% in the red while broader markets edged higher. The volatility index continued to move lower, slipping 3.88%. ITC was the top Sensex gainer, up 4.85%, followed by Larsen & Toubro, Asian Paints, and Reliance Industries. HDFC Bank was the top laggard, down 1.72%, followed by Titan, Nestle India, and NTPC.

Share Market Highlights: Sensex closes 157 points higher, regains 58,800, Nifty ends above 17500 resistance

Share Market News Today | Sensex, Nifty, Share Prices Highlights: Domestic benchmark indices closed with gains for third consecutive trading session on Thursday.

Written by FE News Desk

This article was first uploaded on December nine, twenty twenty-one, at zero minutes past eight in the morning.

Bulls moved between gains and losses on the weekly futures & options expiry session before closing in the green. S&P BSE Sensex ended 157 points or 0.27% higher at 58,807 while the NSE Nifty 50 index closed 47 points or 0.27% higher at 17,516. ITC was the top Sensex gainer, up 4.85%, followed by Larsen & Toubro, Asian Paints, and Reliance Industries. HDFC Bank was the top laggard, down 1.72%, followed by Titan, Nestle India, and NTPC. Bank Nifty closed 0.54% in the red while broader markets edged higher. The volatility index continued to move lower, slipping 3.88%.

Read full story

Domestic benchmark indices closed with gains for the third consecutive trading session on Thursday. Bank Nifty closed in red along with India VIX.

Sensex soared past 58,800 with minutes left before the closing bell. Nifty 50 index was 17,500 as the headline indices looked set to end in green for third consecutive day.

Mukesh Ambani’s new energy push might set Reliance Industries Ltd on a growth path for several decades, prompting RIL share price to rise as much as 80%, said global brokerage Goldman Sachs. The firm has reiterated its ‘Buy’ call on RIL, raising its bull case target price to Rs 4,400 per share. Goldman Sachs analysts said they see significant expansion in the total addressable market for solar, battery and hydrogen manufacturing globally as well as in India and expect RIL to capitalise on the same with its new-energy venture. RIL was the top gainer on Sensex on Thursday, trading at Rs 2,454 per share, up 1.5%.

Read full story

Bank Nifty index was still in red, although Nifty and Sensex were up with marginal gains. The banking index was down more than half a percent.

IPO of C.E. Info Systems Ltd. (CIES), a data and technology products and platforms company that owns the MapmyIndia portal, will open for subscription on 9 December and close on December 13. The company is looking to raise Rs 1,039.6 crore, at the upper end of the price band, from the issue, which is entirely an offer for sale (OFS). Shares are likely to be listed on stock exchanges BSE and NSE on December 21.

Read full story

Benchmark indices Nifty and Sensex opened with gains on Thursday but slipped in red soon after the opening bell. S&P BSE Sensex was trading 129 points down at 58,529 while NSE Nifty 50 was above 17,450. Midcap and smallcap indices outperformed. India VIX was 1% lower while Bank Nifty was 0.5% in red. Amid tepid market momentum, 199 scrips on the BSE traded at 52-week high values while 10 stocks were down at 52-week lows.

Read full story

Shriram Properties Limited IPO is receiving very good response from retail investors, as of now the retail portion of IPO has been subscribed 6.07 times and overall IPO got fully subscribed. We expect Qualified Institutional Buyer (QIB) and Non-Institutional Investors (NII) to pick up on the 3rd day of the IPO i.e. 10th December 2021. We have s subscribed rating on Shriram Properties Limited IPO. Based on H1FY2022 numbers, the IPO is priced at a Price to Book value of 2.28 times at the upper price band of the IPO, which is in line with the listed peer group. Hence, we are assigning a “SUBSCRIBE” recommendation to the Shriram Properties Limited IPO.

~ Yash Gupta, Equity Research Analyst, Angel One

Sensex and Nifty were up from their lows and seen trimming losses, but still in the red. Sensex was above 58,500 while Nifty 50 was holding above 17,400.

The market has closed on a strong note yesterday and hence, we may see further extension of this as well; but we still do not have the conviction of it moving beyond the higher boundary of 17700 in this leg. Let’s see how things shape up going ahead and if any such complete shift of sentiments has to happen, the banking space once again becomes the deciding factor. For the coming session, 17300 followed by 17200 are to be seen as immediate supports. Although individual stocks are providing excellent opportunity on the long side, now it’s time to apply some brakes on the aggressive approach and should ideally look to book timely profits in existing positions. Next couple of sessions would really be interesting to watch, because all key indices are now trading around the crucial levels," said Sameet Chavan (Chief Analyst-Technical and Derivatives, Angel One.

While Nifty and Sensex were down the smallcap and midcap indices on NSE were up with gains. Nifty smallcap 50 was up 0.70% while the midcap 50 index gained 0.24%. The Smallcap 100 index was up nearly 1%.

We have a status quo RBI policy, yet again. The MPC in the latest monetary policy meeting kept all rates unchanged and pledged to maintain its accommodative policy stance for as long as necessary. MPC also increased the quantum of existing VRRR (variable rate reverse repo) operations to Rs7.5 lakh crore by December end in a continuing effort to nudge the overnight rates higher towards repo rate. As per MPC, the economic recovery, even though gaining traction, is not conclusively durable and warrants further policy support. As a result, its ‘overarching priority’ for now is to broaden the growth impulses. The MPC regarded the uncertainty around the new Covid variant and the headwinds from faster normalization of monetary policy in advanced economies as the key risks to the domestic outlook.

Read full story

Headline indices trimmed gains and began trading flat on Thursday morning. India VIX cut losses to regain 17 levels.

Sensex and Nifty slipped from opening highs but were still trading in the green. Sensex was just shy of 58,800 while Nifty was below 17,500.

Domestic benchmark indices started the weekly futures & options expiry session with gains. Bank Nifty was up in green. India VIX was 4% in red.

Petrol and Diesel Rate Today in Delhi, Bangalore, Chennai, Mumbai, Lucknow: Petrol, diesel prices remained static on Thursday (9 December) across various cities in the country. Currently, petrol rate in Delhi is Rs 95.41 per litre while diesel in the national capital is retailing at Rs 86.67 per litre. In Mumbai, petrol and diesel are retailing at Rs 109.98 per litre and Rs 94.14 per litre, respectively. Bharat Petroleum Corporation Ltd (BPCL), Indian Oil Corporation Ltd (IOCL) and Hindustan Petroleum Corporation Ltd (HPCL) revise the fuel prices daily in line with benchmark international price and foreign exchange rates.

Read full story

Nifty reclaimed 17500 on Thursday morning during the pre-open session as the benchmark indices moved higher.

After showing sharp upside bounce from the lows on Tuesday, the strong upside momentum continued in the market on Wednesday and the Nifty closed the day with hefty gains of 293 points. Another long bull candle was formed on the daily chart with gap up opening. The upmove of the last two sessions has erased the negative sentiment created by last Friday and this Monday. This is positive indication for the short term.

Read full story

Sensex gains in pre-open session, breached 58,800 while Nifty 50 was in red, just holding above 17,400.

The Nifty index opened gap up on Wednesday and moved in the positive territory throughout the session. Buying interest aided the bulls and the index headed towards 17500 zones during the day. It formed a Bullish Marubozu sort of candle on a daily scale and closed with gains of around 300 points.

Read full story

Sensex and Nifty have rallied for two consecutive sessions now as bulls attempt to recoup losses. Nifty 50 is now at a crucial resistance zone, according to technical analysts. “Nifty has reached a good hurdle zone of 17500, if it manages to sustain above-said levels or if it gives any decisive close above the same then we may see more upside in the coming session towards 18k mark,” said Rohit Singre, Senior Technical Analyst at LKP Securities. On the fundamental side, Dalal Street could look towards global peers for cues. “Given the high volatility in the market, we would remain cautiously optimistic on the markets,” said Ajit Mishra, VP - Research, Religare Broking.

Read full story

NSE Nifty 50 and Bank Nifty index look to continue the momentum today after bulls pushed Indian share markets higher on Wednesday. S&P BSE Sensex zoomed 1,016 points or 1.76% to close at 58,649 on Wednesday, while the NSE Nifty 50 added 1.71% to settle at 17,469. Bank Nifty index jumped 1.82%, regaining 37,200 levels. All the sectors contributed to the up move. "The banking space could continue to lead the momentum as the Bank Nifty index has seen good interest from its 200 DMA support. Nifty could continue this momentum towards its hourly 200 EMA which is placed around 17550. Traders with long positions can look to book profits around 17550-17600 and wait for further signs," said Ruchit Jain, Trading Strategist, 5paisa.com

Read full story

NSE Nifty 50 and Bank Nifty index look to continue the momentum today after bulls pushed Indian share markets higher on Wednesday. S&P BSE Sensex zoomed 1,016 points or 1.76% to close at 58,649 on Wednesday, while the NSE Nifty 50 added 1.71% to settle at 17,469. Bank Nifty index jumped 1.82%, regaining 37,200 levels. All the sectors contributed to the up move. "The banking space could continue to lead the momentum as the Bank Nifty index has seen good interest from its 200 DMA support. Nifty could continue this momentum towards its hourly 200 EMA which is placed around 17550. Traders with long positions can look to book profits around 17550-17600 and wait for further signs," said Ruchit Jain, Trading Strategist, 5paisa.com

Read full story

"Positive global cues shall keep Nifty bulls rosy, with key support levels seen at 17296-17057 and resistance at 17607-18001. All the three U.S indices have essentially reclaimed levels reached before Black Friday, when news of Omicron first rocked markets. The positive theme surrounds positive development concerning the COVID omicron strain. The market focus will now shift to the release of the US consumer inflation figures on Friday. The data will influence the Fed's decision to taper its stimulus at a faster pace and set the stage for an eventual interest rate hike in 2022," said Prashant Tapse, Vice President (Research), Mehta Equities.

The initial public offer of Rategain Travel Technologies Ltd received 75 per cent subscription on the second day of the offering on Wednesday, with the retail investors’ portion getting subscribed 3.98 times. The sale, which opened on Tuesday, attracted bids for 1,29,32,815 shares as against 1,73,51,146 shares on offer. This translates to 75 per cent subscription, according to latest data available with the BSE.

Read full story

Digital mapping company MapmyIndia, which powers Apple maps, on Wednesday said it has mobilised Rs 312 crore from anchor investors ahead of its initial share sale that opens for public subscription on Thursday.

Read full story