October and November witnessed strong double-digit SSSG (same-store sales growth) for most retailers while December was relatively soft. Ex DMART, we expect margins of other companies to see some expansion. EOSS (end of season sale) has started a week early in Q3 which will aid sales but can hamper margins.

Aditya Birla Fashion and Retail Ltd: Overall topline growth is expected to be 15% y-o-y. Though base of margin is catching up, we still expect close to 114bps y-o-y expansion in Ebitda margins.

ALSO READ: Modi govt’s election handouts threaten FM Jaitley’s fiscal math

Avenue Supermarts: We expect 40% y-o-y revenue growth for D-Mart while Ebitda and PAT growth will be lower at 21.9% y-o-y and 23.1% y-o-y respectively.

Future Lifestyle Fashions Ltd: We expect topline growth of 27% y-o-y while Ebitda and PAT growth is expected to be 29% and 22.5%, respectively.

Future Retail: We expect revenue, Ebitda and PAT growth of 16% y-o-y, 31.7% and 15.3%, respectively.

Shoppers Stop: We expect revenue, Ebitda and PAT growth of 12% y-o-y, 18.3% and 23.9%, respectively.

Trent: Topline growth is expected to be strong at 21% y-o-y. Ebitda and PAT growth is expected to be 26.9% y-o-y and 24.5% y-o-y, respectively.

V-Mart: We expect revenue, Ebitda and PAT growth of 21% y-o-y, 23.5% and 30.7%, respectively.

ALSO READ: Infosys Q3 results 2019: Firm announces dividend of Rs 4, share buyback of up to Rs 8,260 crore

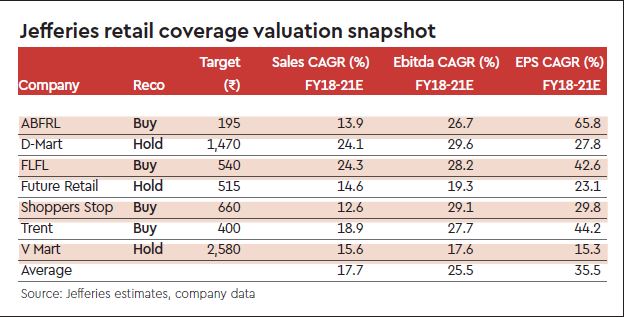

Buys: We continue to prefer apparel retailers to grocery. Though grocery and value apparel segments are best positioned, valuations are factoring in all positives. Within the strong execution bucket, TRENT is the only Buy, as we have a Hold on DMART and VMART, given unfavorable risk-reward. We have a Buy on ABFRL, and a Buy on FLFL and SHOP. Amid rising complexity, we maintain a Hold on FRETAIL.