IRCTC, Ircon International, Indian Railway Finance Corporation, Rail Vikas Nigam, among other railways stocks gained as Union Finance Minister announced to manufacture 400 new generation Vande Bharat train in next three years. Indian Railway Catering and Tourism Corporation share price surged 3.7 per cent to Rs 900 apiece, IRCON International gained nearly 2% to Rs 46.40 apiece, Indian Railway Finance Corporation stock was up over 1% to Rs 23.60 apiece, and Rail Vikas Nigam scrip added nearly 4% to Rs 37.35 apiece.

Analysts said that with the government laying emphasis on expansion of railway infrastructure in terms of 400 additional Vande Bharat trains and cargo terminals, presumably railway stocks have posted initial gains. “Technically, 905,46.5 & 37.4 remain massive resistance for IRCTC, IRCON, and Rail Vikas Nigam. Buying should be done only on sustained closing above these levels,” AR Ramachandran, Co-founder & Trainer, Tips2Trades, told Financial Express Online.

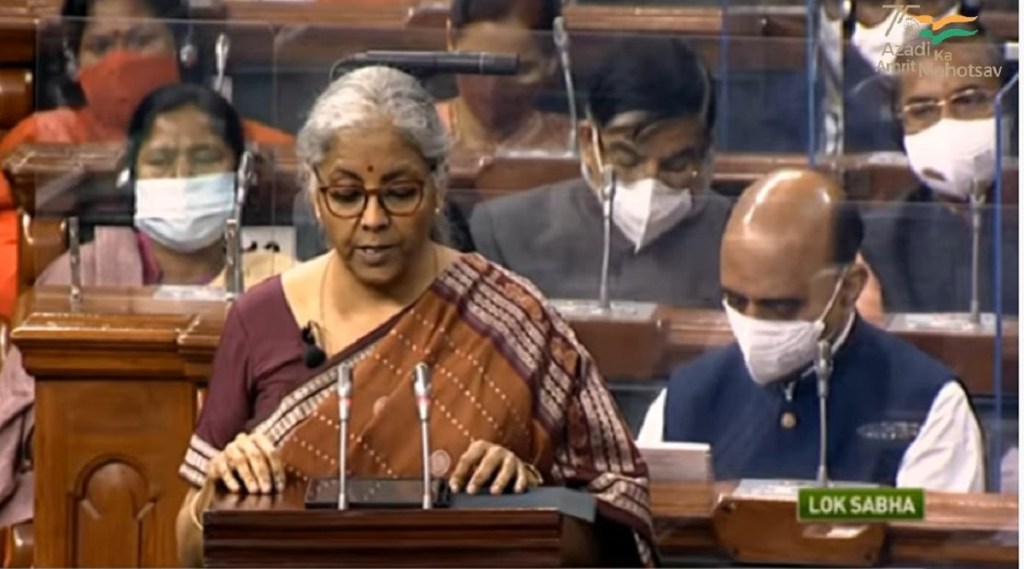

Analysts at ICICI direct said that this step will be positive for players supplying steel and stainless steel for coach body. FM Sitharam also said Union Budget 2022 has steps to boost transport and logistics, and 2000 km of network will be brought under a new scheme called KAVACH. Also, 100 new cargo terminals will be built over the next few years under PM Gati Shakti. Yash Gupta, Equity Analyst, Angel One, said cargo terminals announcement is positive for the logistics sector and will benefit companies like VRL logistics and GATI.

FM Sitharaman also announced that Railways will develop efficient logistics for small farmers and enterprises. “One station, one product to help supply chain of local products,” FM said. “The impact on railway sector will be quite positive as the sector privatisation may also be seen in the near future to some extent which will open the doors of innovation in the mundane sector policies. Increased operations in this sector will also be a key factor in pushing the growth element. IRCTC and Rail Vikas Nigam may be seen acting as a sector leader for the upcoming FY,” analysts at CapitalVia Global Research, said