The Sensex on Wednesday closed above the 41,000-mark for the first time as investor sentiment improved owing to easing of trade rift between the US and China. Foreign portfolio investors (FPIs) remained net buyers of Indian equities for the sixth consecutive day, having bought shares worth $3.2 billion so far in November — their highest monthly purchase in the last eight months. On Wednesday, FPIs bought shares worth $6 million, according to provisional data on the bourses.

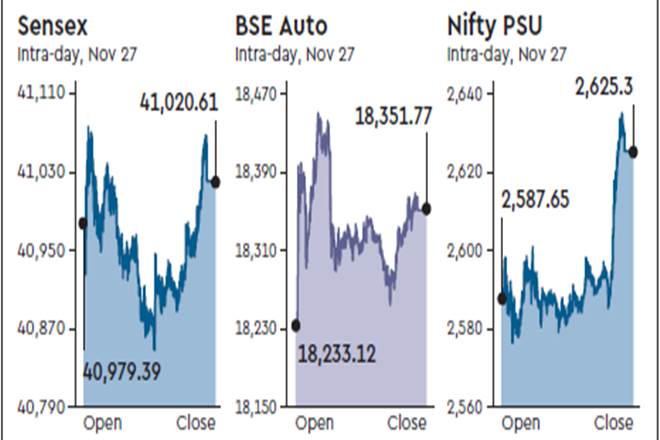

While the Sensex gained 199.31 points or 0.49% to end the session at 41,020.61 points, the broader Nifty50 ended the session at 12,100.70, up 63 points. Even as the benchmark Sensex continued to hit new highs, gains did not percolate to all stocks as the rally was predominantly driven by a handful of stocks. Since September 20, the Sensex rallied nearly 14%, with stocks such as RIL, HDFC Bank, ICICI Bank, HDFC and Axis Bank among them contributing about 70% of the gains.

Chandresh Nigam, MD & CEO, Axis Asset Management Company, observes: “What is doing well and has potential to keep doing well are reflected in their stock prices. This is a market where winner takes it all. Great businesses are edging out by everybody else and they are getting much higher multiples. Bigger ones are becoming much bigger because of technology, money and execution and these are the ones which driving the market.” Good companies will continue to do very well even in this economy, he added.

The Sensex now trades at an exalted valuation of 19.6 times of its 12-month forward earnings, compared to 11.63 for Kospi and 10.68 for Shanghai Composite. AK Prabhakar, head of research at IDBI Capital Market Services, is of the view that “it is more of global liquidity, we need to be with it. The bullish sentiment may continue for some more time.”

Shares of Yes Bank rallied the most on Sensex on Wednesday. The stock advanced 7.65% after the private lender said its board will meet on Friday to consider fund-raising options. Yes bank was followed by State Bank of India and Maruti Suzuki with gains of 2.4% each. In fact, the stock of country’s largest car maker has surged over 33% from its July low of Rs 5,472.15.

The positive sentiment rubbed off on most sectoral indices on Wednesday. Of the 19 sectoral indices compiled by the BSE, all barring five ended the day in green, with BSE Auto, BSE Basic Materials and BSE Oil & Gas gaining over 1% each.