The issuance of new credit cards fell in February, with over 5.49 lakh new credit cards being issued during the month, implying a 47% year-on-year (y-o-y) decline and 21.57% month-on-month. The total credit card base stood at 61.6 million at the end of the month, down 8% y-o-y. ICICI Bank continued to lead in fresh issuances, accounting for over 36% of new cards, showed data released by the Reserve Bank of India (RBI).

Interestingly, ICICI Bank held a 70% share in new credit cards issued in December 2020 — the same month when the RBI barred market leader HDFC Bank from issuing fresh cards as penalty for repeated digital outages. Thereafter, ICICI Bank’s share fell to 38% in January 2021. In February 2021, ICICI Bank was trailed by SBI Card (18.1%) and Axis Bank (18%) in new issuances. In FY21, ICICI Bank gained the highest incremental market share of 32.4%, followed by SBI Card at 30.6%, Motilal Oswal Financial Services (MOFSL) said in a report on Tuesday.

Credit card spends declined 4% y-o-y to Rs 60,400 crore in February. In the 11 months to February, total spends declined 18.4% y-o-y to Rs 5.6 lakh crore. Among large players, ICICI Bank reported a 10% y-o-y growth in monthly card spends, while HDFC Bank and SBI Card reported a marginal decline, MOFSL said.

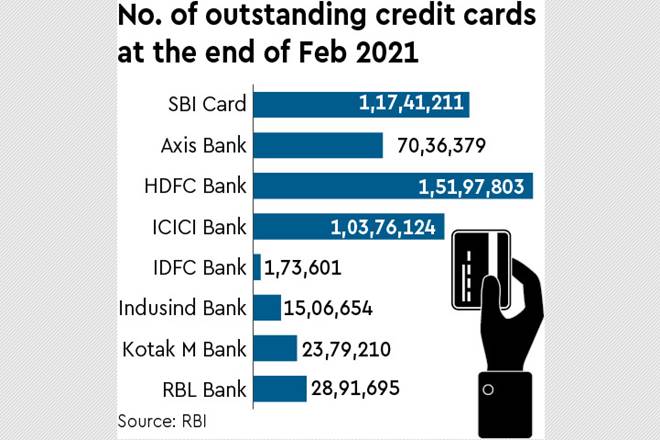

SBI Card and ICICI Bank saw an 80-110 basis point (bps) increase in market share in outstanding cards to 19% and 16.8%, respectively, in February 2021 from 18.3% and 15.8%, respectively, in FY20. RBL Bank and IndusInd Bank have largely maintained their market share, while other mCIcajor players — HDFC Bank, Axis Bank, Citi, Kotak Mahindra Bank, American Express and Standard Chartered Bank —have lost market share, the report said.

“While the surge in Covid-19 cases and ensuing lockdown in various states could slow down the recovery momentum, SBICARD would continue to gain market share, led by its diverse acquisition channels,” analysts at MOFSL said.