Future Retail (FRL) has received 49 expressions of interest (EoIs) from prospective resolution applicants (PRAs), including Reliance Industries (RIL), Adani Group and Jindal Power, to acquire its assets through the ongoing insolvency process.

On Monday, FRL shares hit the upper circuit and closed up 4.88% at Rs 2.58 on BSE.

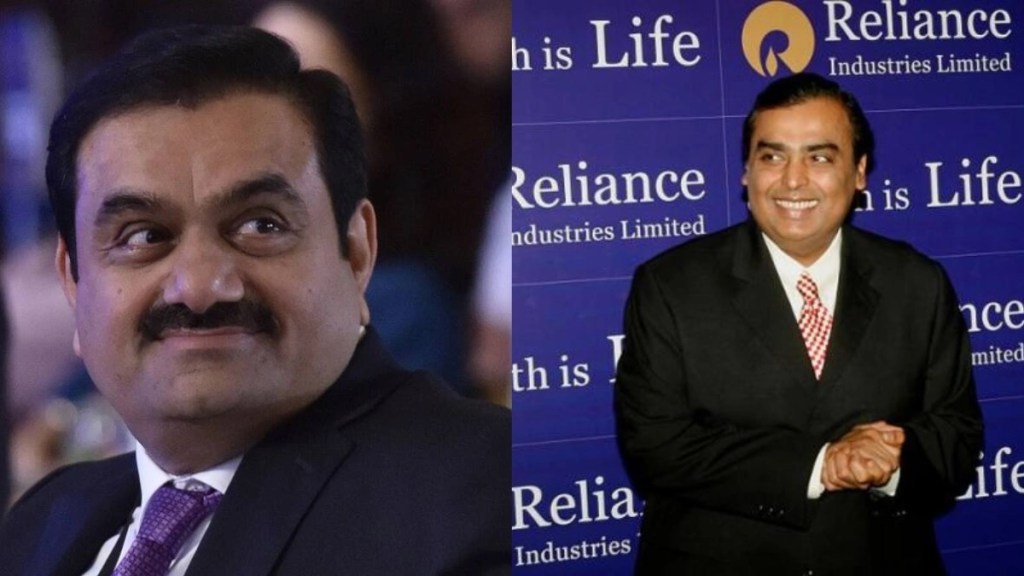

RIL and Adani Group have expressed interest in bidding again — the Mukesh Ambani company through Reliance Retail Ventures (the holding company of all its retail businesses) and Adani Group via April Moon Retail (a joint venture between Adani Airports and Flemingo Group).

FRL had invited fresh EoIs after the first round did not draw enough participants.

UK-based travel retailer WH Smith Travel, JC Flowers Asset Reconstruction, Burgundy Hospitality, IDFS Services, Pinnacle Air and a number of scrap dealers and waste recyclers have also expressed interest, according to a provisional list released by the resolution professional.

Future Retail, which was admitted for insolvency proceedings after the company failed to meet its loan obligations, has been undergoing bankruptcy proceedings since July last year. Lenders had claimed dues worth Rs 21,555 crore, of which Rs 19,183 crore have been admitted.

On March 23, FRL lenders invited EoIs offering applicants to bid for the firm “as a going concern or individual cluster or a combination of clusters of its assets”. This is the second time the resolution professional invited EoIs.

The deadline to submit resolution plans under the first round was February 20, following which the second round was called on March 23. The last date of submission for the second round was April 7. The final list of PRAs will be released on April 13, and the deadline to submit resolution plans is May 15.

Also Read: Future Retail boss Kishore Biyani withdraws resignation

Future Group founder Kishore Biyani, who stepped down as the executive chairman and director of FRL on January 23, withdrew his resignation in March following objections from the resolution professional.

In August 2020, RIL sealed a deal to acquire the retail business of Future Group for Rs 24,713 crore, to fortify its retail play in India. However, lenders rejected the takeover of 19 Future Group companies — including FRL, Future Enterprises, Future Consumer, Future Lifestyle Fashions and Future Supply Chain — after US e-commerce giant Amazon opposed the deal.

Amazon had in 2019 acquired a 49% stake in Future Coupons, the promoter entity of FRL, for about Rs 1,500 crore, and alleged a violation of certain terms of the deal.

In August last year, the Securities and Exchange Board of India ordered a forensic audit of the accounts of FRL for the FY20, FY21 and FY22.