With the early onset of the summer season and the India Meteorological Department forecasting above-average summer temperatures and increased heat waves, the AC industry is rejoicing. The segment is expected to deliver volume-led growth in Q4FY25 on the back of rising temperature coupled with aggressive channel restocking. The demand for cooling products is also expected to lead to record sales this year. The Indian room air-conditioner industry is projected to grow by 20-25 per cent in FY15, reaching sales volumes of 12-12.5 million units, stated a report by ICRA. This growth, it added, is attributed to factors such as rising temperatures, increasing household demand, urbanization, higher disposable incomes, and favorable consumer financing options.

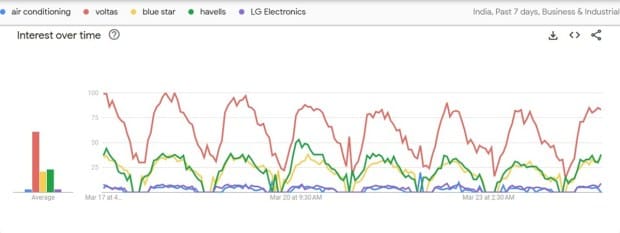

With this, AC companies have been most searched recently and here is a list of 4 such firms that were searched most on Google as per the latest data on Google Trends:

Voltas: Voltas is a Tata group company and it operates in three core business segments, including Unitary Products (UPBG), which markets room air conditioners, air and water coolers and other commercial refrigeration products. The company has a market share of around 20.5 per cent in the air conditioning segment. Earlier in January, Voltas had released its fiscal third quarter results with profit at Rs 130.76 crore in comparison to a net loss of Rs 27.60 crore in the October-December period a year ago. It posted Q3 revenue at Rs 3,164.16 crore, up 17.9 per cent as against Rs 2,683.61 crore in the year-ago period. Going forward, the company expects strong demand and positive consumer sentiment, in a more decisive summer, to support the volume growth. To capitalize on increasing demand, Voltas has undertaken several initiatives and scheduled seasonal product launches across different categories to strengthen its market share.

Blue Star: Blue Star has been operating for 80 years in India. The company operates in three business verticals: commercial air conditioning systems that contribute to 56 per cent of its total revenue, followed by unitary products contributing to 41 per cent of revenue and the balance comes from professional electronics services. In January, Blue Star had posted Q3FY25 profit at Rs 132.5 crore, reporting a growth of 31.85 per cent in comparison to Rs 100.5 crore recorded during the corresponding period of previous year. The company’s revenue from operations increased 25.3 per cent YoY to Rs 2,807.4 crore. Going forward, Blue Star said that it expected air conditioner sales to grow by 25-30 per cent this summer, despite last year’s high base when its market grew by over 57 per cent.

Havells: Consumer electrical goods maker Havells India Ltd is also expected to report growth in sales and demand this summer season. In January, it had released its fiscal third quarter earnings report with profit at Rs 278 crore, up 3 per cent on-year. In the corresponding quarter of the previous fiscal, Havells India posted a net profit of Rs 287 crore. The company’s revenue from operations increased 10.8 per cent to Rs 4,889 crore against Rs 4,414 crore in the corresponding period of the preceding fiscal. Earlier this month on March 19, shares of Havells India rose after the government exempted key components from mandatory BIS certification, easing supply concerns ahead of an expected harsh summer.

LG Electronics India: LG Electronics India had reported a 7.5 per cent increase in revenue, reaching Rs 21,352 crore, up from Rs 19,854 crore in the previous fiscal year. Its net profit rose by 12.3 per cent to Rs 1,511 crore. While refrigerators accounted for 27 per cent of sales, washing machines 21 per cent, air conditioners and televisions each contributed 20 per cent. Earlier in December, LG Electronics India had announced its plans to set up a new plant in Andhra Pradesh to boost its manufacturing capacity in the country. Besides, it is increasing the sourcing of raw materials from the local market, which is helping it meet consumer demands and lower its inventory and related costs, LG had said in its DRHP filed with SEBI. In December 2024, LG Electronics India had filed for an IPO, with the parent company planning to sell 101.8 million shares valued at approximately Rs 15,237 crore.