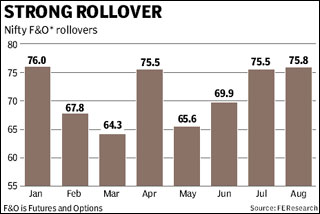

The markets witnessed healthy rollovers in the derivatives segment from the near-month June 2010 contracts to July 2010 contracts on Thursday, the day of expiry of June contracts. Rollover in both Nifty and Mini Nifty was around 70% and was high both in terms of percentage and absolute open interest. ?The Mini Nifty futures have witnessed a significantly higher rollover compared to the previous months, that too on the shorter side. It shows that small investors, who largely trade on the futures contract of Mini Nifty, are bearish on the market,? said Siddarth Bhamre, derivatives head at Angel Broking.

Some of the stocks that witnessed healthy rollovers include SAIL (82%), SBI (75%), DLF (85%), Maruti Suzuki (78%), Bharti Airtel (86%), ACC (82%), JP Associates (87%), Suzlon (88%) and Tata Power (89%). Among the exceptions were Union Bank of India (59%), Opto Circuits (69%) and Gail (62%). Chemicals and fertilisers, cement, power and mid-cap telecom were among the sectors that saw higher than average rollover.

?Chemical and fertilisers rollovers were strong on expectations of higher demand from farmers during the monsoon,? said Alex Mathews, research head, Geojit BNP Paribas.

According to a report by Angel Broking, FIIs have covered their short positions in index when Nifty started bouncing from 4,800 levels and have formed fresh long positions above 5,100.

On the other hand, domestic participants have been skeptical on the market and were short. Huge short positions were created in Nifty Futures, and banking and IT indices on Thursday. They closed marginally at a discount to the spot as investors had taken hedged positions rather than naked positions. ?Investors shorted index futures, expecting to make money if the market opened lower,? said Mathews.

On the other hand, domestic participants have been skeptical on the market and were short. Huge short positions were created in Nifty Futures, and banking and IT indices on Thursday. They closed marginally at a discount to the spot as investors had taken hedged positions rather than naked positions. ?Investors shorted index futures, expecting to make money if the market opened lower,? said Mathews.