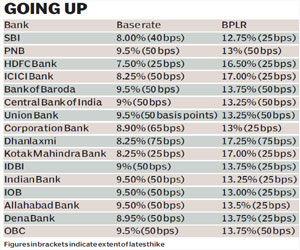

A clutch of banks upped lending and deposit rates on Thursday as it became evident that money was going to become dearer. While Bank of Baroda, among the country?s biggest lenders hiked the base rate by 50 basis points to 9.5%, it also increased the Benchmark Prime Lending Rate (BPLR) by 50 basis points to 13.75%. Union Bank raised base rate by 50 basis points to 9.5 % while Andhra Bank has increased the base rate from 9% to 9.5%. Said MV Nair, CMD Union Bank, ? Continuous hikes in rates could have a dampening effect on credit offtake. Retail credit could also see some slowdown as rates are bound to increase. However, as long as manufacturers and companies are willing to bear the interest cost and the rate hikes do not impact their profitability, credit offtake will not be impacted.?

Meanwhile, HDFC Bank hiked auto loan rates by 50 basis points on Thursday. Borrowers will now have to pay a rate in the range of 12% to 14% depending on the quantum and tenure.

Meanwhile, HDFC Bank hiked auto loan rates by 50 basis points on Thursday. Borrowers will now have to pay a rate in the range of 12% to 14% depending on the quantum and tenure.

On the deposits front, Kotak Mahindra Bank has decided to pay its customers more for their deposits. Said Dipak Gupta ED, KMB, ?We needed to up deposit rates to attract savings. We haven?t hiked loan rates yet but we believe ultimately they will have to go up.?

Earlier in the week, home loan major HDFC had made loans costlier by 25 basis points, for both its existing and new borrowers. That apart, lenders including Bank of India, Oriental Bank of Commerce, Indian Overseas Bank and Dena Bank all hiked lending rates. This round of rate hikes, the first after the Reserve Bank of India (RBI) increased key policy rates, by 25 basis points each, during the monetary policy review on January 25, 2011, was kicked off by Punjab National Bank, Allahabad Bank and United Bank, which increased both their base rates and BPLR.

Nupur Mitra, ED, IOB said, ?The demand for credit is unlikely to be impacted by higher rates and we will be taking a call on whether to hike the BPLR, which is currently at 13.5%. However, our margins are likely to suffer as a result and could drop to 3% from 3.27%.?

When the base rate was first introduced in July last year, most banks had announced a rate of around 8% but they have now moved up to 9.5%. Bankers believe demand for credit should remain strong. Said KR Kamath, CMD, PNB, ? We believe that credit offtake will not be impacted by the increase in the loan rates.?