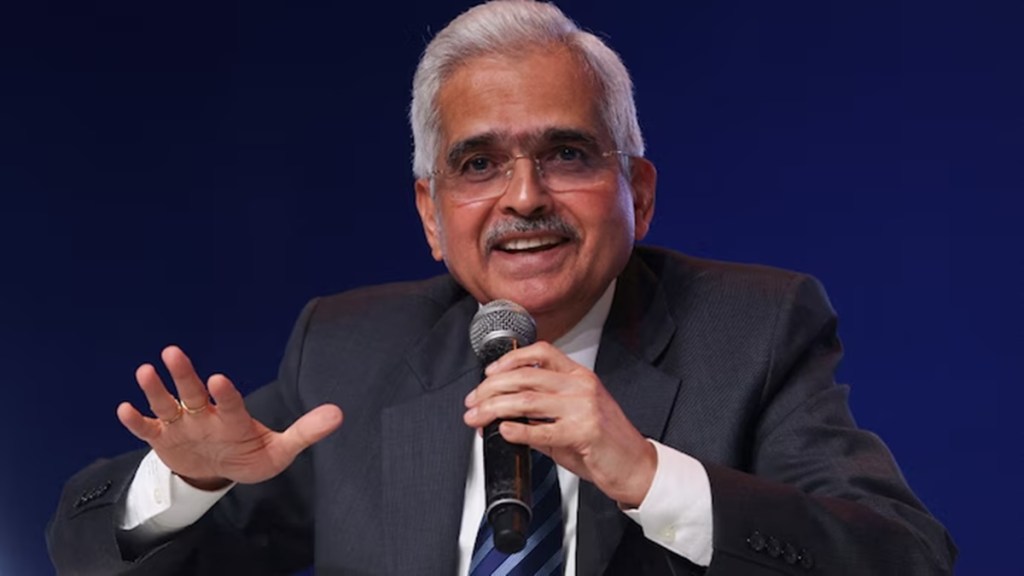

Shaktikanta Das, former Reserve Bank of India (RBI) governor, spoke about the importance of having definite timelines while providing liquidity.

Speaking at the SOUL Conclave in Delhi on Saturday, Das said, “Liquidity is like a Chakravyuh — very easy to get in, very difficult to pull it out.”

He said timing of the liquidity withdrawal is also important, adding that during his tenure at the RBI, especially during the Covid period, the central bank had injected ample amount of liquidity in the system to ensure smooth functioning of the economy.

In addition, liquidity was provided for definite timelines, such as six months, one year, or even three years, so that stakeholders knew when there will be a withdrawal and were able to manage their affairs accordingly.

“And if there was need for liquidity to stay in the system for a longer period, we always had the option to extend it,” he added.

He emphasised that while liquidity is the wheel of financing, if allowed to persist, it leads to inflation, asset price bubble and other kinds of adverse reactions — much like what happened after banks went for big liquidity infusion during the 2008 financial crisis.

He also mentioned that during his tenure, the RBI had cut the cash reserve ratio (CRR) in December 2024, which had released `1.16 lakh crore in the system, along with a slew of other measures, as the central bank foresaw a liquidity crisis in February and March.

Das also spoke about thinking out of the box when faced with difficult situations, citing the resolution plan of YES Bank. “The earlier solution was to merge the weak bank with a bigger bank. But that would have pulled down the big bank too, and it would have taken years to come out of it,” he explained.

RBI came up with the resolution plan for YES Bank in which the big banks, led by the State Bank of India, took an equity stake in the bank and today, YES Bank is back on the rails.

Faced with several headwinds like Covid, war in Ukraine and other conflicts, RBI focused on the financial system. “We have completely recast the regulatory architecture of the banks, non-banking finance companies, cooperative banks, and for digital lenders,” he said.

Das also added that the future of the financial system lies in digital currency (CBDC) which was launched by four-five banks globally, including RBI.

Answering a question on the financial inclusion, he said the ULI, or Unified Lending Interface, can provide loans within just ten minutes for even the smallest of needs, such as purchasing two cows.