– By Chinmay Joshi

At the start of the decade when the world was enduring the horrid consequences of the Covid-19 pandemic, economies world-over suffered another massive shock in the form of rising price levels especially after the beginning of Russia-Ukraine war in February 2022. In order to deal with the persistence of inflationary pressures, central banks across the world resorted to monetary tightening which further caused the negative repercussions especially for the economic growth. As per the World Economic Outlook (WEO), July 2023, IMF, the global growth is expected to decline to 3.0 per cent in 2023 and 2024 from an estimated 3.5 per cent in 2022 indicating a fragile growth outlook.

In the Indian context, as per the estimates of Gross Domestic Product (GDP) released by the National Statistical Office (NSO), MOSPI, GoI, on August 31, 2023, the Indian economy registered a growth rate of 7.8 per cent on demand as well as supply side in Q1 of the financial year 2023-24. The growth rate of GDP was lesser than the Reserve Bank of India (RBI) estimates of 8.0 per cent given in its latest monetary policy committee (MPC) meeting concluded on August 10, 2023. The Private Final Consumption Expenditure (PFCE) and Gross Fixed Capital Formation (GFCF) registered a modest growth of 6 per cent and 8 per cent on Y-o-Y basis respectively as compared to the lacklustre performance of other components. This implies that the economic growth from the demand side was led by the consumption demand and investment activity in Q1 of FY 2023-24. On the supply side, the increase in growth was visible among the agriculture and financial, real estate and professional services sectors which registered a growth rate of 3.5 per cent and 12.2 per cent respectively on Y-o-Y basis. However, the contraction of exports and increasing imports along with the dwindling growth in the industrial sector which mainly comprised of manufacturing and construction sectors will be a cause of worry for policymakers going ahead especially when the employment generation in India is subdued. A dismal performance of many sectors along with the weaker growth prospects in the ensuing period may necessitate and prompt the MPC-RBI to continue adopt a status quo in its upcoming monetary policy resolutions.

The recently concluded forty-fourth meeting of the MPC-RBI on August 10, 2023, also decided to keep the policy repo rate (PRR) unchanged at 6.50 per cent along with maintaining the ‘withdrawal of accommodation’ stance. Through this monetary policy decision, the MPC-RBI tried to remain focused on supporting the goal of achieving economic growth as well as remaining vigilant on achieving price stability by withdrawing the excess liquidity from the economy. However, in the past couple of months, the headline inflation i.e., Consumer Price Index – Combined (CPI-C) has again gradually started to exhibit an increasing trend registering a print of 7.44 per cent in July 2023, breaching the upper tolerance band of flexible inflation targeting (FIT) framework i.e., 6 per cent.

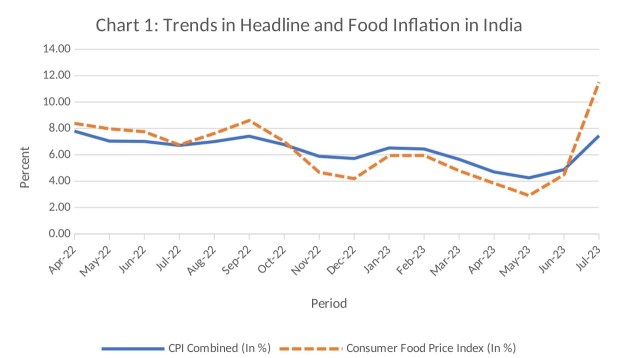

The recent rise in the headline inflation was predominantly led by the rise in the food prices. In this context, it is important to note that during the festival period in India, there is a tendency of food prices to rise rapidly causing overall price level to increase. This is also visible in the same period a year ago where food inflation was one of the major contributors behind the rise in headline inflation. During that period, the food inflation registered a higher print than the headline inflation (Chart 1). This year too, at the outset of the festival season, the food inflation has started showing an upward trend causing the elevation of headline inflation. It has been observed that the CPI-C surged to 7.44 per cent in July 2023 whereas the food inflation recorded a growth rate of 11.51 per cent on Y-o-Y basis. Moreover, the possibility of deficient rainfall characterised by uneven spatial and temporal distribution will prove detrimental to the food inflation in India.

Another risk to the headline inflation is evident in terms of rising international Brent crude oil prices. The crude oil prices have again started to trade northwards especially after the past few reductions in the oil output by the OPEC+ countries. The oil prices are further expected to increase due to the possibility of another round of output cuts by Saudi Arabia and Russia to boost their oil dependent economies. The demand and supply mismatch caused by lowering of output in the past few months will lead to erosion of oil inventories resulting into the escalation of oil demand. The rise in oil prices will have negative consequences for the Indian economy through imported inflation as India is heavily dependent on the import of international crude oil for its energy requirements.

Furthermore, the adverse impact of the El Niño effect, continued disruptions in the global supply chain largely due to the deteriorating geopolitical conflicts, and the negative impact on household inflation expectations due to rising food prices domestically together will aggravate the inflation situation going ahead. Similarly, the unveiling of populist measures ahead of upcoming assembly elections at the end of the year has the capacity to generate more aggregate demand in the economy thereby adversely impacting inflation.

Keeping this in mind, while dealing with the menace of increasing inflation arising from various sources, the MPC-RBI should be adequately restrictive in adopting upcoming monetary policy resolutions so that the headline inflation is maintained within the mandated target of 4 per cent (+/-2 per cent) under the FIT framework. In this regard, it is worthwhile to note that in the aftermath of Russia-Ukraine war when inflationary pressures began to rise in India, in order to rein in the elevated price levels, the MPC-RBI resorted to increase the PRR cumulatively by 250 bps since May 2022 before adopting a pause in April 2023. The positive impact of this cumulative increase in the PRR was evident in the form of gradual reduction in the headline inflation where CPI-C in India reduced from 7.79 per cent in April 2022 to 4.31 per cent in May 2023. Also, central banks of some of the major advanced economies such as the US, UK and Euro Area have been quite successful in gradually reducing the inflation by maintaining consistency in the adoption of monetary policy tightening. Going ahead, the attainment of price stability as mandated under the FIT framework over a longer period of time is imperative for RBI while supporting economic growth amidst the challenging and uncertain economic circumstances.

(Chinmay Joshi is the Research Associate – Finance and Economics at Bhavan’s SPJIMR, Mumbai.)

(Disclaimer: Views expressed are personal and do not reflect the official position or policy of Financial Express Online. Reproducing this content without permission is prohibited.)