This year, despite the volatility in the Indian equity market midcaps have managed to generate 5.2% absolute returns as of 5 November 2025.

Investors have been attracted to midcaps (and smallcaps) in their endeavour to build wealth. In August 2025, midcap funds reported the highest ever monthly inflows to the tune of Rs 53.31 billion (bn), and the second highest in the ensuing month, worth Rs 50.85 bn, as per the AMFI data.

This is not surprising given the long-term returns delivered by this market cap segment. The Nifty Midcap 150 – TRI has clocked a handsome 27.9% and 18.7% CAGR over the last 5 years and 10 years, respectively (as of 5 November 2025).

The period since the covid lows, particularly, has been impressive for midcaps.

As a result, the net assets under management (AUM) of midcap funds has surged from Rs 904.16 bn in September 2020 to Rs 4.34 tn in September 2025 – nearly 5x or 37% CAGR.

That said, one also needs to be mindful of the valuations. The trailing PE of the Nifty Midcap 150 index, as of 5 November 2025, is over 34. This is higher than the 5-year average of 30. Although the current trailing PE is down from 44 at the start of 2025, you still need to be careful.

Mid cap mutual funds are mandated to invest at least 65% of their total assets in midcap companies.

Midcaps are defined as companies ranking from 101st to 250th in terms of full market capitalisation. They are level below the largecaps, which are typically the top 100 companies.

When compared with largecaps or bluechips – who are well established, have wider moats, access to capital, and strong managements – midcaps may have fewer opportunities, capacity constraints, and could face challenges. They are more sensitive to economic cycles.

Considering this, if you are looking at mid cap mutual funds, you need to keep an investment horizon of at least 7-8 years, be ready to assume very high risk, and sensibly choose schemes that have rewarded investors on a risk-adjusted basis.

You simply cannot opt for any mid cap fund out there to earn good returns. A thoughtful approach needs to be followed.

In this editorial, we will take you through 3 mid cap mutual funds that have performed well on longer-period rolling returns and risk-return metrics such as standard deviation, sharpe ratio, and sortino ratio.

In short, these funds have fared optimally on a risk-adjusted basis by keeping risks in check.

#1 HDFC Mid Cap Fund

Launched in June 2007, this fund – earlier known as HDFC Mid-Cap Opportunities Fund – is the most popular scheme and the largest fund by AUM in the mid cap funds category. As per the September 2025 portfolio, the fund is managing assets of over Rs 848 bn.

It invests in stocks that have reasonable growth prospects, sound financial strength, sustainable business models, and are available at acceptable valuations.

For its portfolio construction, a bottom-up approach is followed instead of fads and short-term trends. It focuses on business fundamentals, management effectiveness, and long-term earnings expansion.

HDFC Mid Cap Fund usually holds a large portfolio of 70-80 stocks and has limited the exposure in a single stock to well within 5%.

As per the September 2025 portfolio, the fund has 73 stocks, of which 66% are midcaps, 20% smallcaps, and 8% largecaps.

The top 10 stocks comprise 32.3% and include names such as Max Financial Services (4.7%), Balkrishna Industries (3.5%), Indian Bank (3.3%), etc.

Among the various sectors, the top 3 sectors are auto & ancillaries (16.3%), banks (13.4%), and healthcare (12.6%), constituting 42.2% of the portfolio.

Currently, the fund is holding around 6% in cash & cash equivalents.

A buy-and-hold approach is followed, and the fund manager avoids unnecessary portfolio churning. In the last one year, the portfolio turnover has ranged between 14-25%, reflecting conviction.

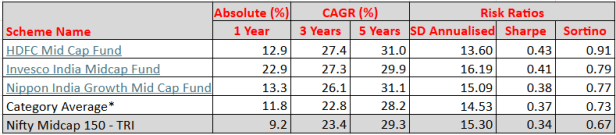

The fund’s focus on fundamentally sound stocks having healthy growth prospects has yielded attractive returns. The compounded annualised rolling returns over 3 years and 5 years are 27.4% and 31% respectively, noticeably higher than the category average and the Nifty Midcap 150 – TRI (as of 5 November 2025).

The risk registered by the fund (standard deviation of 13.6) is among the lowest in the category and is much lower than the Nifty Midcap 150 – TRI.

Thus, on a risk-adjusted basis as well, the fund stands out as superior, as reflected by its sharpe and sortino ratios of 0.43 and 0.91, respectively. It highlights that the fund’s ability to generate impressive returns while managing risks better than both its benchmark and category peers.

HDFC Mid Cap Fund has consistently shown strong performance across bullish and bearish market conditions.

#2 Invesco India Midcap Fund

This fund was launched in April 2007 and is renowned for its consistent generation of alpha and rigorous risk management style.

It has reported a sharp increase in its AUM since March 2020, and today, as of September 2025, it is managing assets of over Rs 85.18 bn.

While investing in midcaps, it looks for companies with sustainable competitive advantages, scalable business models, robust balance sheets, good governance, and clear long-term visibility. This is with an aim to make superior returns over the long term with reduced volatility.

A bottom-up approach to stock picking is followed like many of its peers with an investment philosophy of high-conviction ideas based on fundamental analysis, valuation comfort, and capital efficiency.

The fund holds a fairly diversified portfolio of 45-50 stocks. As per the September 2025 portfolio, the fund has 48 stocks, of which 64% are midcaps, 18% smallcaps, and 15% largecaps.

The top 10 stocks are 41.1% of the portfolio, and include names such as Swiggy (5.1%), AU Small Finance Bank (5.1%), L&T Finance (4.9%), etc.

The top 3 sectors are finance (21.1%), healthcare (18.3%), and retail (14%), making up for 53.4% of the portfolio, a bit concentrated than some of its peers.

The fund is almost fully invested, as cash & cash equivalents are just 0.3% of its assets.

In the last one year, the fund’s portfolio turnover ratio has ranged between 36-80%, which reflects that while the fund approaches stocks with a long-term view, at times it may churn.

That said, the fund endeavours to optimise portfolio turnover to maximise gains and minimise risks, keeping in mind the cost associated with it.

This strategy has helped Invesco India Midcap Fund to clock an appealing compounded annualised rolling returns of 27.3% and 29.9% over 3 years and 5 years respectively (as of 5 November 2025), outperforming the category average and the Nifty Midcap 150 – TRI by respectable margins.

The fund has exposed its investors to a higher risk (standard deviation of 16.19) than the category average and Nifty Midcap 150 – TRI. Nevertheless, on a risk-adjusted basis (sharpe and sortino ratios of 0.41 and 0.79, respectively), it has justified the risk quite well.

In the current bull phase, the fund has fared very well, attracting many investors. The risk-adjusted performance is driven by strong stock selection and sector positioning.

#3 Nippon India Growth Mid Cap Fund

Launched in October 1995 as Reliance Growth Fund, it is now known as Nippon India Growth Mid Cap Fund, after Nippon Life bought a 75% stake in Reliance Capital’s asset management arm in October 2019. It is the oldest scheme in the mid cap fund category.

The fund followed a multi-cap strategy, maintaining a balanced exposure across large-cap, mid-cap, and small-cap stocks until 2017. However, after the mutual fund categorisation and norms took effect, it repositioned and was recategorised as a mid-cap fund.

The fund has displayed an impeccable track record since its inception. The fund’s AUM has stupendously increased after the pandemic lows, and as per the September 2025 portfolio, it manages assets of over Rs 393 bn – the third largest in the mid cap funds subcategory.

The fund adopts a Growth at Reasonable Price (GARP) strategy to identify high-potential stocks and follows a bottom-up approach.

It avoids momentum-driven bets, instead focusing on quality stocks available at reasonable valuations and holding them with a long-term perspective.

This has helped the fund navigate various economic cycles and India’s growth story through nascent leaders in industries like industrial manufacturing, financial services, auto components, and consumer discretionary, which continue to pick up momentum in today’s economic landscape.

What distinguishes this fund is its worthy portfolio characteristics and research-driven approach.

It holds a large portfolio of 90-100 stocks. As of September 2025, it has 95 stocks, 65% are midcaps, 21% largecaps, and 10% smallcaps.

The top 10 stocks are 22.9% of the portfolio (making it well-diversified) and include names such as Fortis Healthcare (3.3%), BSE (2.6%), Cholamandalam Financial Holdings (2.6%), etc.

Among a diverse range of sectors, the top 3 are finance (15.1%), auto & ancillaries (13.3%), and healthcare (11.5%), comprising 39.9% of its portfolio.

The fund is currently holding cash & cash equivalents around 3% of its assets.

It resists churning the portfolio often, instead follows a buy-and-hold approach. The portfolio turnover has ranged between 6-19% in the last one year.

The approach followed has rewarded investors decently. The compounded annualised rolling returns over 3 years and 5 years are 26.1% and 31.1%, respectively, higher than the category average and the Nifty Midcap 150 – TRI (as of 5 November 2025).

The fund has exposed its investors to higher risk (standard deviation of 15.09) than the category average and Nifty Midcap 150 – TRI but has justified it with its risk-adjusted returns.

Both the sharpe and sortino ratios of the fund, at 0.38 and 0.77, are higher than the category average and the benchmark index.

In fact, the sortino ratio – which captures the downside risk while speaking about risk-adjusted returns – the fund is way better than Nifty Midcap 150 – TRI.

Performance of the 3 Best Mid Cap Mutual Funds

Rolling period returns are calculated using the Direct Plan-Growth option. Returns over 1 year are compounded annualised.

Standard Deviation indicates the risk, while the sharpe ratio and sortino ratios measure the Risk-Adjusted Return. They are calculated over

3 years, assuming a risk-free rate of 6% p.a.

*All mid cap funds are considered for category average purposes.

Please note that returns here are historical returns.

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-relate

Source: ACE MF

What You Should Know

Mid cap funds are placed at the higher end of the risk-return spectrum, a notch below the small cap funds. Simply put, the risk is high; they aren’t for the fainthearted. Also, not all mid cap funds have been generating alpha and outperforming the category average performance.

Besides, like any other market-cap segment, midcaps also move in cycles. While bull markets have favoured midcaps, during bear or corrective phases, the drawdowns have been deeper compared to large caps.

Hence, do not lay much emphasis on recent past returns, which may or may not repeat in the future.

In volatile times such as at present, taking the SIP route may prove beneficial as opposed to making a lump sum investment. SIPs with an inherent rupee-cost averaging feature may help mitigate risks.

Be a thoughtful investor.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary