It’s a common perception among Indian investors that small-cap stocks are currently expensive.

However, the PE of the Nifty Smallcap 250 index and MSCI India Small Cap reveals a different picture.

The trailing PE of the Nifty Smallcap 250 index – which represents the 251st company and beyond on a full market capitalisation basis – is currently at 28.5, below the 1-year and 5-year average of 31.8 and 28.9, respectively (as of 13 November 2025).

Over a long period, the PE of this index seems average or reasonable.

Even the MSCI India Small Cap Index PE is around 35, lower than previous levels. The 12-month forward PE of the MSCI India Small Cap Index is around 26.

In comparison, the froth in midcaps is yet to settle, given that the trailing PE of the Nifty Midcap 150 index is at 33.6, higher than the 1-year and 5-year averages of 34.4 and 30.5, respectively (as of 13 November 2025).

MSCI India Mid Cap Index trailing PE is about 53, while its 12-month forward PE is nearly 33. Although lower than the previous levels, it’s not very comforting.

At such a time, Samco Mutual Fund – a relatively new fund house founded by Jimeet Modi, which received its license from the capital market regulator in July 2021 – has come up with a new fund, the Samco Small Cap Fund.

The fund house believes that at this juncture, small-cap stocks have the potential to grow and create wealth.

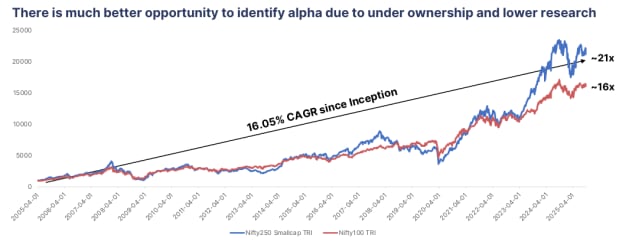

Nifty Smallcap 205 Index – Since Inception

Past returns are no indication of future returns. The index returns do not indicate returns of the scheme.

Source: Samco Mutual Fund’s Presentation

Since smallcaps are certainly more volatile than largecap, holding them for the long term (7-8 years or more) is necessary to mitigate the risk.

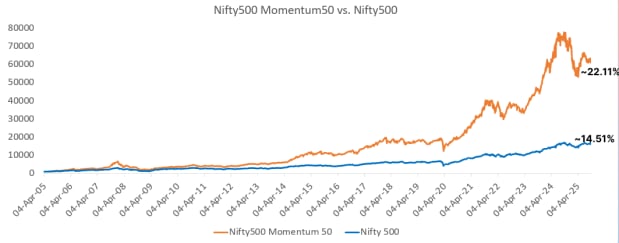

The fund house will be banking on the momentum strategy when investing in smallcaps.

Momentum as a Factor has Outperformed the Broader Index in the Last 20 Years

Past returns are no indication of future returns. The index returns do not indicate returns of the scheme.

Source: Samco Mutual Fund’s Presentation

Momentum strategy involves investing in rising stocks which are showing strong momentum. Such stocks exhibit positive price momentum.

It’s based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly.

The momentum strategy is based on buy high, sell higher or alternatively, cut your losses and let your winners run.

Samco Small Cap Fund: India’s First Momentum-based Small Cap Fund

It’s an open-ended scheme investing predominantly in smallcap companies, i.e. 251st and beyond on a full market capitalisation basis.

It has the mandate to invest 65-100% of its total assets in equity & equity-related instruments of smallcap companies.

Up to 35% of the total assets may be invested in companies other than smallcap ones and in international stocks.

For hedging and portfolio rebalancing, the fund may also invest up to 80% of its net assets in equity derivatives. For non-hedging purposes, investment in derivatives will be restricted to up to 50% of its net assets.

It may also invest up to 10% of its net assets in units of REITs and InvITs.

For defensive consideration and liquidity purposes, the fund may invest in up to 35% of its net assets in debt & money market instruments (including securitised debt up to 20%).

It may also indulge in securities lending and borrowing up to 35% of its net assets.

However, the fund shall not invest in:

- Overseas mutual funds

- Short selling of debt securities

- Debt instruments with special features (AT1 and AT2 Bonds)

- Credit Default Swap (CDS) transactions

- Debt derivatives

- Commodity derivatives

What is the Investment Objective?

Given the asset allocation, the investment objective is to generate long-term capital appreciation from a diversified portfolio predominantly consisting of equity and equity-related instruments of smallcap companies.

There is no assurance that the investment objective of the scheme will be achieved.

What is the Investment Strategy?

The fund will be actively managed to achieve its objective. The portfolio will be built on a momentum-based investment strategy that seeks to harness the power of market trends and corporate performance metrics.

At its core, the fund employs Samco’s proprietary C.A.R.E. system with an aim to deliver superior risk-adjusted returns by systematically identifying and allocating capital to smallcap stocks with strong momentum indicators.

The C.A.R.E. system integrates four key dimensions of momentum:

- Cross-sectional momentum (which serves as a guide to stock selection)

- Absolute momentum (to enhance portfolio resilience)

- Revenue momentum (to identify growth drivers)

- Earnings momentum (to capitalise on profit acceleration)

These parameters ensure that the portfolio remains optimised by focusing on small-cap stocks from the companies ranked beyond 250+ by market capitalisation, as defined by the AMFI, that exhibit robust momentum traits.

The investment universe of the fund shall primarily be focused on the universe of companies from the market cap rank 251st to 750th. This will also allow the fund to build exposure to small caps beyond the Nifty 500 universe.

By integrating the C.A.R.E. system of investing, the fund aims to achieve a balanced and forward-looking investment strategy.

This multi-dimensional system ensures the portfolio is potentially well-positioned to capture opportunities in market upswings while safeguarding capital during downturns.

The focus on small-cap stocks with robust fundamentals and momentum traits is at the core of the SAMCO Small Cap Fund. The use of equity derivatives actively, within the limits as stated earlier, will be for hedging, non-hedging, and portfolio rebalancing purposes.

How Will the Fund Benchmark its Performance?

The performance of the fund will be benchmarked to the performance of the Nifty Smallcap 250 – Total Return Index (TRI).

This index is designed to capture the movement of the smallcap segment of the market. Companies forming part of the Nifty 500 index but excluding those which are in the Nifty 100 and Nifty Midcap 150, are part of the Nifty Smallcap 250.

Who Will Manage the Fund?

Samco Small Cap Fund will be co-managed by Umeshkumar Mehta, Nirali Bhansali, and Dhawal Dhanani.

Mehta has over 25 years of experience in the Indian capital markets and believes in data data-driven approach to investments.

He used to lead the Samco group’s research team, and currently is the Director, CIO, and Fund Manager. He is a commerce graduate (B.Com) and a Chartered Accountant (CA), co-managing several other schemes at the fund house.

Bhansali has over 10 years of work experience with more than 7 years spanning capital markets and investment research.

She has over 10 years of work experience, with more than 7 years spanning capital markets and investment research. She is an engineering graduate (B.E.) and an MBA, co-managing other schemes at the fund house.

Dhanani started as an equity research analyst at Samco Securities Ltd. He has around 6 years of work experience, with more than 4 years spanning capital markets and investment research.

He is a commerce graduate (B.Com) and a Chartered Accountant (CA), co-managing many other schemes at the fund house.

Subscription Details

Samco Small Cap Fund is available for subscription from 14 November 2025 to 28 November 2025 during the NFO period. Units will be offered at Rs 10 each during this period. Thereafter, the scheme opens for subscription on 11 December 2025.

The minimum application or investment amount is Rs 5,000 and any amount thereafter. For the Systematic Investment Plans (SIPs), the minimum instalment amount is Rs 500 (with a minimum of 12 instalments) as per the scheme information document.

The scheme has a direct plan as well as a regular plan, with only the growth option thereunder.

What About the Risk and Investor Suitability?

Samco Small Cap Fund is classified as very high risk on the risk-o-meter.

And indeed, small-cap funds are placed at the higher end of the risk-return spectrum of diversified equity funds. Simply put, they carry a very high risk.

The fund is suitable for investors who have the stomach for very high risk and have an investment horizon of at least 7-8 years while seeking long-term capital growth by predominantly investing in smallcap companies.

How Will Capital Gains be Taxed?

As a resident individual, if your holding period is less than or equal to 12 months, called Short Term Capital Gain (STCG), and it will be taxed at 20%.

For the units that are sold after 12 months, classified as Long Term Capital Gains (LTCG), it will be taxed at 12.5% without indexation benefit if the LTCG is more than Rs 1.25 lakh in the financial year.

Should You Consider Samco Small Cap Fund?

This fund pursues a momentum strategy while investing in smallcaps.

Given that, it’s possible that its portfolio turnover ratio may be high, although it endeavours to optimise portfolio turnover to maximise gains and minimise risks. It isn’t for the fainthearted.

The momentum investing strategy has attracted investors due to its ability to generate high returns in a bullish market, but in market meltdowns or bear phases, momentum may reverse, and drawdowns could be significant.

So, the wealth creation journey will not be without challenges. In other words, a small-cap fund pursuing the momentum strategy could be negatively impacted during market downturns.

Momentum investing, by and large, thrives on stable, up trending markets, not when investor sentiments turn sour.

Keep in mind, Samco Mutual Fund is yet to complete a 3-year track record of managing equity funds.

Hence, adopt caution and consider reaching out to a SEBI-registered investment adviser.

Be a thoughtful investor.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary