Let’s agree that Bollywood has struggled in recent years, but the music industry has shown resilience. With big-ticket films underperforming at the box office, their songs have often found a second life on streaming platforms, YouTube, and social media reels. Solo music has also gained momentum in recent years.

Solo music has also stood tall even when films have faltered. For investors, this has underlined a crucial point. While the movie business can be cyclical, music libraries, once created, continue to generate revenue for decades. This resilience has put music companies in a sweet spot.

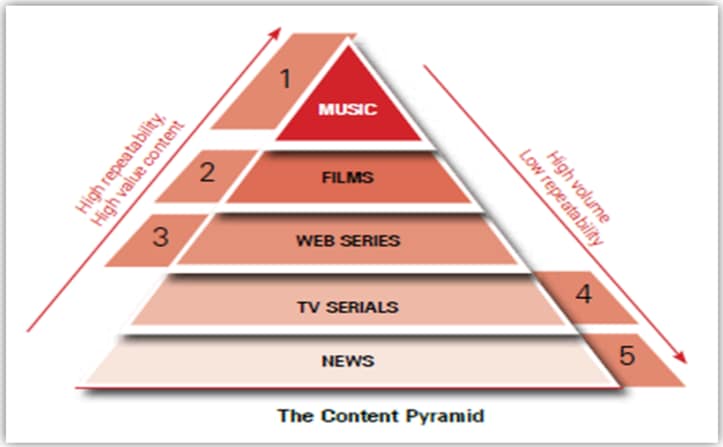

Music tops the content value pyramid

Their vast catalogues have been turned into monetisation engines, licensing content across OTT platforms, social media, and streaming services.This has also pusheddigital media, to become the dominant segment of the media and entertainment sector in 2024, accounting for 32% of industry revenue.

Among them, the music segment reached ₹53 billion (2024) and is expected to grow to ₹78 billion by 2027. Here are two legacy and leading companies that will likely lead this revolution…

#1 Saregama India: Where India’s music legacy meets the digital future

Saregama India is a part of the RP-Sanjiv Goenka Group. It positions itself as a pure-play content company, aiming to capitalize on the global content consumption boom driven by increasing digitization. It maintains a strong focus on scaling business with profitability at the core.

How Saregama built its IP empire

Saregama is India’s leading Entertainment Intellectual Property (IP) company with a strong legacy dating back to 1902. It is India’s only entertainment company with IP offerings across multiple media channels (music, films, digital series, TV serials, and short-format) and delivery platforms.

Saregama licensing partners

Saregama owns an extensive IP portfolio consisting of 175,000+ songs, 70+ films, 55+ digital series, and 10,000+ hours of television content. This catalogue spans multiple Indian languages and genres, including Hindi (54,000+ songs), Bengali (31,200+), Tamil (19,000+), & Telugu (12,800+).

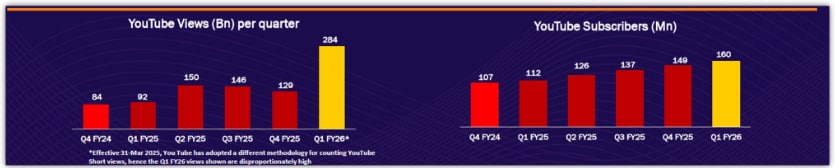

YouTube subscribers and views

The company amortises its new music cost over 10 years, and generates revenue for 60-80 years. The company maintains a significant digital presence, with its owned and controlled channels reaching over 400 million followers and subscribers across YouTube, Instagram, and Facebook. Saregama’s YouTube channels alone have a subscriber base of 160 million.

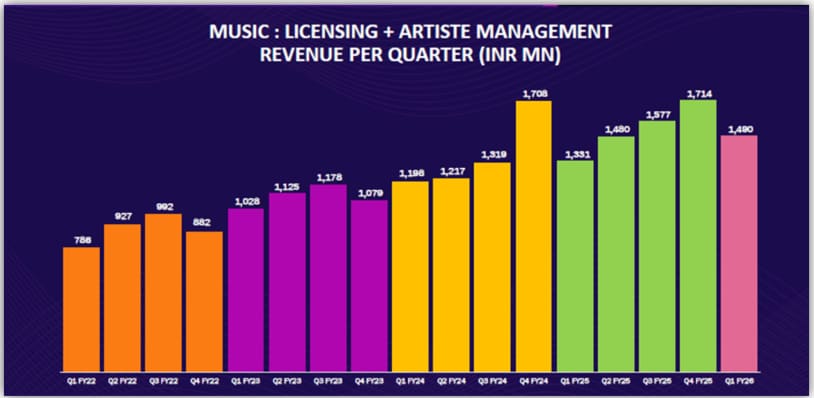

Music leads, but other segments lag

From a financial standpoint, Saregama’s revenue in Q1FY26 increased by just 1% to ₹206.8 crore. Music (licensing and artist management) revenue grew 12% to ₹149 crore, accounting for 72% of the company’s total revenue. This came despite the closure of Airtel Wynk.

Music revenue is a major revenue driver

Video segment revenue, however, declined 23% to ₹35.7 crore, due to a slight loss on the Malayalam film (Bazooka). Retail (Carvaan) revenue also fell 31% to ₹17 crore, due to a decline in volume. Its event segment revenue rose 410%, albeit from a small base, to ₹5.1, propelled by Himesh Reshammiya’s CAP-MANIA Tour 2025.

Adjusted EBITDA, however, decreased by 2% to ₹66.4 crore, and the margin declined 100 basis points (bps) to 32%. Profit after tax (PAT) also decreased 2% to ₹36.5 crore. But this is expected to improve, as Video Vertical is expected to become profitable in FY26.

The company is also focusing on improving the profitability of Carvaan via e-commerce and modern trade. Due to the cost being spread out over 10 years, the company commands a lower return ratio. RoCE stands lower at 17.2%, and RoE at 12.5%, respectively.

Betting big on digital and new content

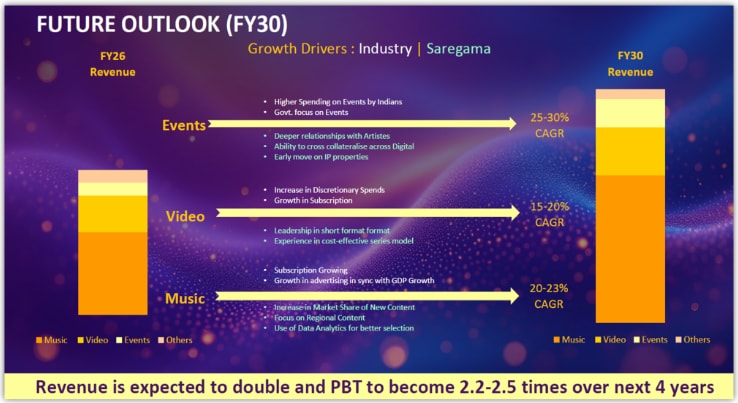

Looking ahead, the company expects revenue to double and profit before tax to grow by 2.2-2.5 times over the next four years, ending FY30. Notably, the management believes that they will be able to maintain their earnings guidance not only for the next 2-3 years but for the next 20-30 years.

Saregama’s ambitious growth outlook

For Saregama, the strategy is to unlock the value of existing IP through language remakes, new platform licensing and syndication, and monetizing existing IP through licensing to every third-party digital platform (music, video, social) and TV platform. It also aims to increase the market share of new content and focus on regional content.

NAV acquisition adds depth to Saregama’s catalogue

In line with this strategy, Saregama acquired the NAV Records catalogue, comprising over 6,500 tracks and a subscriber base of more than 24 million across popular YouTube channels. This acquisition, funded entirely through QIP money, fills a gap in the Haryanvi market, and revenue is expected to flow from Q3 onwards.

NAV records portfolio

This is expected to be supported by massive increases in digital consumption, cash reserves, professional management depth, and access to the best movie soundtracks. Saregama believes that digitisation is key, driven by about 750 million smartphones, cheap data, and anti-piracy laws.

This is expected to shift consumers towards subscription models, benefiting players like Saregama and Tips Music. In line with this, the company plans to invest ₹10 billion over the next three years for the music catalogue.

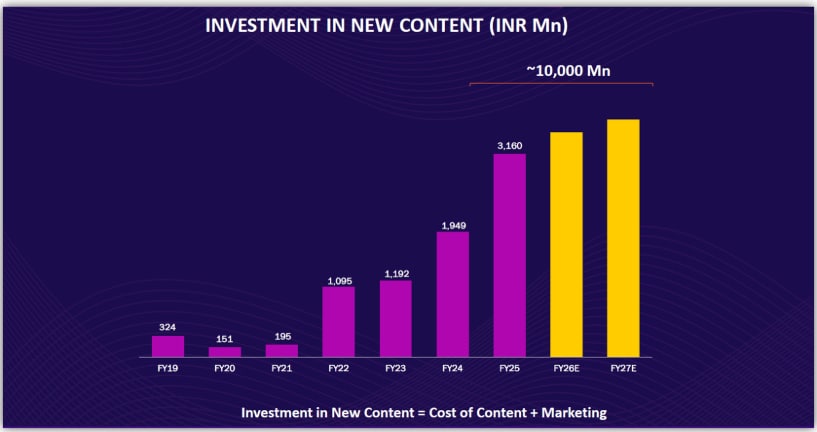

Investment in new content

Of this, ₹350 million is earmarked for spending in FY26 itself, with the remainder allocated in subsequent years. These investments pay back over 5 years. With this strategy, Saregama intends to acquire 25% to 30% of all new content released, but does not plan to increase its market share beyond the current 30%.

The company states that free Revenue is under pressure from the closure of platforms like Airtel Wynk, ByteDance Resso, and Hungama. As a result, Subscription revenue is showing healthy growth, with the potential of reaching 100 million paid subscribers in India at ₹100 per month, which is considered a “Gamechanger.”

Premium valuations backed by growth story

From a valuation perspective, Saregama trades at a price-to-earnings (P/E) multiple of 45.6x, which aligns with Tips Music (43.8x). But, it’s higher than the 10-year median of 39.8x and the industry median of 36.1x. Its premium valuation can be justified by its industry-leading position.

#2 Tips Music: Bollywood’s hit factory, now monetising the digital era

Tips Music is a demerged business from Tips Films. The company’s core business involves the creation and acquisition of audio-visual music content, as well as the digital monetization of its content library in India and overseas through licensing on various platforms.

Building a music library that scales

Tips maintains a vast and diverse music library comprising over 34,000 songs across multiple genres and more than 25 languages. The company’s annual YouTube views have increased by about 6 times, from 38.5 billion (FY21) to 228.3 billion in FY25. Its quarterly YouTube views in Q1 FY26 were 56.7 billion, which is somewhat stagnant due to the rapid rise of YouTube Shorts.

Rich music library, backed by YouTube presence

Accounting approach sets it apart

What differentiates Tips from listed players is that it incurs 100% of the content cost in the quarter of release itself. This is a relatively conservative accounting approach, where the full impact of new content is immediately reflected in the profit and loss statement.

In contrast, other players (like Saregama) capitalize content costs and amortize them over several years, which results in smoother earnings but understates the upfront cost burden.

Strong revenue growth, but profit and margin weak

From a financial perspective, the company’s revenue increased 19% year-on-year to ₹881 million. Of this, content costs alone accounted for 73.7% (₹235 million, up 85% from the previous year) of the total cost. This led to a decline in EBITDA by 4% to ₹565 million, while the margin also fell 940 bps to 64.2%, reflecting weaker operating leverage.

Tips Music’s last 10 quarters’ financial summary

PAT also increased by just 5% to ₹457 million. Lower profitability due to accounting policy is not a concern, which is why management has asked to look at it on an annual basis rather than quarterly. However, this policy also has its benefits. The company’s RoE stands at a massive 86%, supported by its asset-light balance sheet.

Chasing growth while rewarding shareholders

Looking ahead, management aims to post at least 20% revenue growth in FY26, which could increase to 30%. Additionally, it expects to grow its PAT at a minimum of 20% annually over the coming years. Like Saregama, Tips also views India as the fastest-growing market by volume and sees a significant opportunity for music monetization. The music sector is also expected to grow to ₹58.3 billion by FY27, from 44.9 billion in FY25.

Tips aims to spend 25-28% of its revenue on content costs, especially new content, which may increase slightly as quality content opportunities arise. Tips continues to prioritize rewarding shareholders, having returned ₹1.4 billion through buybacks and dividends in FY25. It has already paid ₹511.3 million in Q1FY26, in line with its policy of distributing the previous year’s PAT as dividends in the current fiscal year.

From a valuation perspective, Tips Music trades at a P/E multiple of 43.8x, which is in line with Saregama. But, it’s at a premium to the 10-year median of 32.2x and the industry median of 36.1x. Its premium valuation can also be justified by its industry-leading position.

Bottomline

Both Saregama and Tips Music are at the centre of India’s rapidly expanding digital entertainment ecosystem. Their vast music libraries, strong distribution partnerships, and scalable asset-light models position them well to capture the secular growth in streaming and subscription revenues. While Saregama offers a more diversified play across music, video, and Carvaan with steadier earnings, Tips stands out for its conservative accounting policy, asset-light balance sheet, and exceptionally high return ratios.

At current valuations, both trade at a premium to historical and industry averages, reflecting their leadership in a sector with long-term tailwinds. For investors, the choice lies between Saregama’s broad-based content monetisation strategy and Tips’ high-return, music-focused model. Either way, the ongoing shift in consumer behaviour towards digital consumption ensures that Bollywood’s music houses will remain a structural growth story for years to come.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.