By Kiran Jani

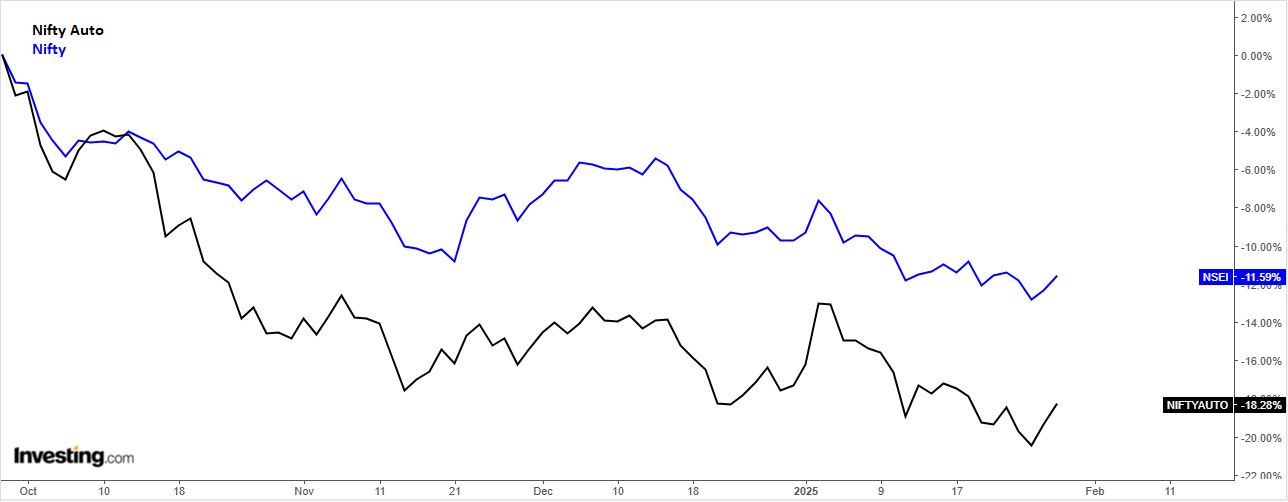

Since September 2024, the Nifty Auto Index reached an all-time high of 27,696 before undergoing a correction, hitting a low of 21,835 in January 2025—a decline of 18.20%. The Nifty 50 Index corrected 11.50% during the same period.

With the upcoming RBI policy announcement and the Federal Reserve’s decision, there is growing optimism that both central banks will implement interest rate cuts. Such a move would benefit the overall market, with the Auto and Realty sectors expected to gain the most.

Given this backdrop, Eicher Motors and Tata Motors exhibit strong technical setups, making them attractive opportunities.

Types of technical setups

There are two main types of trading setups in the stock market:

- Continuation Pattern – Forms within a trend, indicating it will continue (e.g., a bullish pattern signals an uptrend).

- Reversal Pattern – Appears at the end of a trend, signalling a trend reversal (e.g., a bearish trend turning bullish).

1. Eicher Motors:

From June 2024 to December 2025, Eicher Motors remained in a consolidation phase, delivering a modest 7% return. However, technical indicators suggest a potential breakout:

- Ascending Triangle – A bullish continuation pattern indicating trend strength.

- Volume Surge – Increasing price and volume confirm a successful breakout, signalling further upside.

- RSI in Bullish Zone – The 14-period RSI is bullish, supporting upward momentum.

Outlook

Eicher Motors broke out from its consolidation/ascending triangle pattern in early January 2025, reaching a fresh high of ₹5,385. However, it failed to sustain the breakout and pulled back into the triangle. Now, the stock is gearing up again, nearing another breakout attempt.

If ₹5,000 holds as a support, the setup indicates a potential upside in the near term.

Tata Motors

Tata Motors had a strong rallyin early2024, delivering a45% gainbefore correcting from₹1,179in August 2024. Thedaily chartnow signals arenewed bullish trend, supported by:

- Bullish Harami Pattern – A reversal pattern has formed at the stock’s bottom.

- Falling Wedge Formation – The stock is on the verge of a breakout from this bullish setup.

- RSI Strength – The 14-period RSI has shown a bullish divergence, supporting further upside.

Both stocks present strong technical setups for a potential rally.

Outlook

After correcting from ₹1,179 to ₹700 over the past six months, Tata Motors appears to have completed its correction phase and is now trading in a strong accumulation zone. Multiple short- and long-term support levels suggest a high probability of an upward move from here.

If ₹700 holds as a support, the setup indicates a potential upside in the near term.

Auto Stocks: Setting up for a promising future

Since early 2024, most central banks have been reducing interest rates, while the RBI maintained its stance throughout the year. However, with the recent CRR cut, a repo rate cut is a possibility in the upcoming policy.

A rate cut would likely positively impact the broader market, with the Auto and Real Estate sectors expected to benefit the most. From a technical perspective, Eicher Motors and Tata Motors show strong bullish setups, making them key stocks for traders and investors to watch.

Disclaimer:

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

As per SEBI guidelines, the writer and his dependents may or may not hold the stocks/commodities/cryptos/any other assets discussed here. However, clients of Jainam Broking Limited may or may not own these securities.

Kiran Jani has over 15 years of experience as a trader and technical analyst in India’s financial markets. He is a well-known face on the business channels as Market Experts and has worked with Asit C Mehta, Kotak Commodities, and Axis Securities. Presently, he is Head of the Technical and Derivative Research Desk at Jainam Broking Limited.

Disclosure: The writer and his dependents do not hold the stocks discussed here. However, clients of Jainam Broking Limited may or may not own these securities. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives and resources, and only after consulting such independent advisors if necessary.