Indian paint companies live under the same stress – Grow faster. Spend more on advertising. Drive deeper into the dealer network. Fight for mindshare during festivals and housing upcycles.

The rules are well known and often prove to be costly for the companies.

Yet, Kansai Nerolac Paints picked a different route long ago. And that choice supports almost everything investors see today: stable but discreet growth, and the quiet strength of its earnings.

This is not a story about revival or reinvention. Kansai Nerolac hasn’t changed; it has always been the same.

The real story is that it never developed into what the market wanted it to be, and that may be its biggest achievement.

The Structural Difference: Why It’s Not Just Another Consumer Stock

To understand Kansai Nerolac, you have to start where most investors don’t – inside industrial units, not homes.

While its larger peers built their domains around ornamental paints sold to homes, Kansai Nerolac secured itself deeply in industrial and auto coatings. These are not products motivated by impulse or brand recall.

They are controlled by client approvals, industry requirements, stability, and long-term relationships. Auto producers do not switch paint providers lightly.

Once a paint system is passed for a model line, it often stays for years. Volumes may vary, but the relationship is sticky.

This industrial paint niche has quietly shaped Kansai Nerolac’s financial profile. It does not rise drastically when the housing sector rises. But it also does not fall when consumer sentiment declines.

That structural difference is why Kansai behaves differently from other paint stocks, and why comparing it purely on ornamental paint growth misses the point.

The Financials: Boring, Stable, and Drama-Free

A deeper dive into Kansai Nerolac’s financials over the last few years will show you that a clear pattern emerges.

Revenue growth has been modest, but steady. From around ₹5,280 crore in March FY20, revenues dipped during the pandemic year, then recovered gradually to about ₹7,825 crore by FY25. There are no sharp jumps. No dramatic falls either.

Operating margins have hovered in a band around 10–17%. Net profit has stayed positive every single year, inching up from roughly ₹509 crore in FY20 to over ₹591 crore in FY25, excluding exceptional items. The debt has stayed negligible.

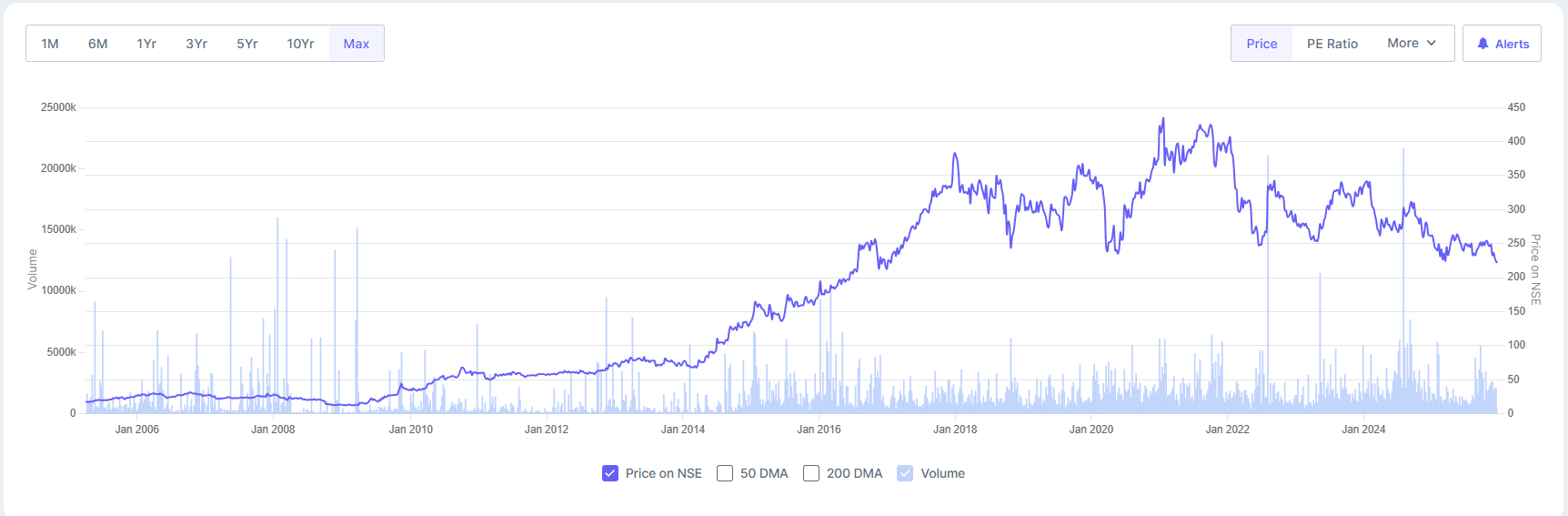

Kansai Share Price Trend (2006-2025)

Moreover, in the second quarter of 2025, the company posted sales revenues of ₹1,954 crores and a net profit of ₹133 crore excluding exceptional items.

The profits grew at a compounded annual rate of 22% over the last three years, while the return on equity is 11%. Just for comparison’s sake, in this same three-year period, Asian Paint grew profits by 8.4%, and Berger Paints by 12.4% (both compounded annual rates).

These are not the numbers of a company chasing scale at any cost. Or that of a company operating in a cutthroat marketplace. They are the numbers of a business preserving profitability while letting growth come at its own pace.

That stability is easy to discount in bull markets. It becomes far more obvious when the cycles turn.

The Valuation Gap: Why the Market Punished ‘Control’

For long stretches, Kansai Nerolac simply didn’t fit the market’s favoured narrative.

When housing demand rose, peers displayed faster ornamental paint growth. When branding wars increased, Kansai spent less.

When investors pursued premium valuations, Kansai traded at a PE multiple of ~27.5x, much lower compared to the industry median of ~39x. That was not because it was defeated, but because it refused to overspend for brand visibility and growth.

That created a widening perception of inequality. The enterprise value/ earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) ratio is low at ~17x compared to the sector median of ~23x.

To momentum investors, the stock looked still. To sector observers, it felt like the business was losing significance.

But inside the business, something else was happening: margins were being secured, connections preserved, and capital control maintained.

In an industry where aggressive growth often means write-offs later, Kansai chose control.

The Anchor: How Auto Paints Cushions the Blow

The most important steadying force in Kansai Nerolac’s business is also the least discussed: industrial coatings.

This segment cushions the company when the demand for decorative paints reduces due to rural tensions, real estate slowdowns, or irregular monsoons.

Auto and industrial clients may decrease production, but they don’t vanish suddenly. This gives Kansai an efficient income curve, one that may lack thrill but offers consistency.

It also justifies why the company’s margins don’t fluctuate wildly, even in the face of raw material instability. Technical coatings offer a better cost economy than mass-produced ornamental products, helping to avoid price wars.

The Reality Check: Don’t Call It a Comeback

It’s important to be clear: Kansai Nerolac is not “on the road to recovery” from anything.

There is no balance-sheet overhaul underway. No margin salvage mission. No strategic turnaround. The company has continued doing what it always does, offering a mixed portfolio of ornamental and industrial coatings, prioritising steadiness over speed.

Calling it a turnaround misses the reality. The real story is a mismatch in expectations. The market thought Kansai would behave like a high-growth decorative paint champ. Kansai never planned to.

The Catalyst: Why ‘Good Enough’ Might Be Great

The potential surprise is indirect, not dramatic.

Today, Kansai Nerolac is valued like a company whose best days are behind it. That belief leaves little room for appreciation if even small positives develop.

If decorative demand regularises and does not explode, the earnings increase incrementally. If automobile manufacturing remains constant, the industrial coatings volumes stay intact. If margins are solid, then cash creation persists.

In such a scenario, the stock doesn’t need to overdo it. It only needs stability. It is how mature companies silently incentivise patience: not with sharp rallies, but with measured re-rating when distrust fades.

The Risks: Competition, Cycles, and Crude Oil

Kansai Nerolac’s story works precisely because it avoids being too ambitious, but that does not make it risk-free. The risks here are not thrilling cliff-edge ones; they are slow, fundamental pressures that can silently shape results over time.

The most immediate risk is competitive intensity in decorative paints. Asian Paints and d Berger Paints, among others, continue to devote serious money to promotions, dealer incentives, and new product launches.

Kansai Nerolac’s controlled approach protects margins, but it also means the company risks gradual market-share loss in the decorative segment.

This is especially true if the competition effectively locks in sellers and contractors with incentives that Kansai elects not to match. Over time, this trend could restrict growth even if demand expands.

A second, less obvious risk lies in the automobile sector’s cyclicality. Kansai’s industrial coatings business is its stabiliser, but that strength depends on stable vehicle production.

Any prolonged slowdown in auto production, due to low consumer demand, regulatory changes, or supply-chain troubles, would affect volumes. Unlike decorative paints, industrial coatings do not have the cushion of retail demand spikes.

There is also raw material instability, a constant challenge in the paint industry. While industrial coatings offer a better cost economy than decorative paints, timing mismatches persist.

Sudden spikes in crude-linked inputs can squeeze margins for a few quarters before price revisions catch up, a reality most investors must be prepared for.

Finally, there is the risk of permanent undervaluation. Kansai Nerolac may continue to do everything right operationally and still not command premium multiples. Markets often reward visibility and anticipation over predictability.

The Verdict: A Stock for the Patient, Not the Greedy

Kansai is a business built for continued existence. It may remain mispriced longer than investors expect, especially during strong bull phases. However, these risks don’t break the story, but they define its personality. Kansai Nerolac is a stock that tests patience, not faith.

Kansai Nerolac is not a stock that demands attention. It doesn’t create urgency, and it doesn’t reward impulsive decisions. Instead, it asks a quieter question of investors: what do you actually want from a paint company?

If the answer is rapid growth, dominant branding, and frequent re-ratings, Kansai may not meet expectations. But if the answer is stable earnings, balance-sheet discipline, and a business model that lasts both good and bad cycles, Kansai Nerolac starts looking very different.

It is a company built around connections rather than retail buzz, deals rather than campaigns, and technical performance rather than advertising spend. Those choices have shaped its financials: steady, expected, and largely drama-free.

For investors who understand that not every good stock needs to be exciting, Kansai Nerolac gives something increasingly rare in cyclical sectors: a business that knows exactly what it is, and what it refuses to become.

A Stock Described by What It Refuses to Do

In a sector obsessed with growth charts and brand recall, Kansai Nerolac stands out for refusing to play the same game. It has chosen stability over conquest, margins over momentum, and relationships over market reach.

That choice has made it easy to overlook and easy to misjudge. The company is not falling behind because it is weak.

It is lagging because it is different. Its numbers tell a story of endurance rather than acceleration, and its business model is built to absorb cycles rather than ride them.

For the right kind of investor, one who values hardiness over noise, that distinction matters. Markets in time rediscover such businesses, not in moments of excitement, but in moments of reflection.

Kansai Nerolac may never lead headlines, but it continues to do something far more important: it remains standing, profitable, and relevant, long after louder stories fade.

And in the long run, that may be its silent edge.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.