Dolly Khanna, is an ace investor also called the “Queen of Small Caps”. She is highly followed and is known for having an eye for spotting future multibaggers. With her highly disciplined and thoroughly researched approach, along with a focus on long-term value, she has carved a name for herself in the markets.

Currently her portfolio holds 15 stocks worth almost Rs 530 cr. She has been investing in the stock markets since 1996. Her portfolio is managed by her husband Rajiv Khanna. And her portfolio typically leans towards more traditional stocks in manufacturing, textile, chemicals, and sugar stocks.

But what has caught investors’ attention is her latest stake addition in two stocks which she has been holding for some time now. Here is everything about these stocks.

A Strong Foundation Building India – Prakash Industries Ltd

Prakash Industries Limited, originally established as Prakash Pipes and Industries Limited on July 31, 1980, is engaged in the business of manufacturing and sale of Steel Products and generation of Power.

With a market cap of Rs 2,847 cr, the company has seen a steady holding by Dolly Khanna since September 2023 (as per data available on Trendlyne.com). As on the quarter ending June 2025 Dolly held a stake of 2.3% in Prakash Industries, which she raised to 2.9% as per filings for the quarter ending September 2025.

The sales for Prakash Industries have grown at a compound rate of a mere 6% from Rs 2,974 cr in FY 20 to Rs 4,014 cr in FY25.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) has climbed from Rs 350 cr in FY20 to Rs 520 cr in FY25. That is a compounded growth of 8%.

Coming to the net profits, the company saw a compounded growth of 25% from Rs 118 cr in FY20 to Rs 355 cr in FY25.

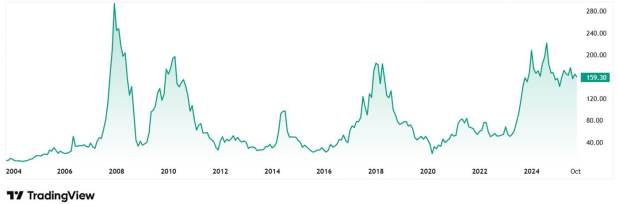

The share price of Prakash Industries Ltd was around Rs 45 in October 2025 and as on 14th October 2025, it was Rs 159. That is a jump of over 250% inn 5 years.

The company’s share is trading at a current PE of 8x while the industry median is 22x. The 10-year median for Prakash Industries is again 8x while the industry median for the same period is 13x.

Apart from Dolly Khanna, another Warren Buffett of India, Mukul Agarwal also holds another 1.7% stake in the company.

The company has completed and made operational the Bhaskarpara coal mine for a rated capacity of 10 lakh TPA. The supplies of coal from this mine will provide stability to the company’s Integrated Steel operations, resulting in significant cost reductions.

A Turnaround Story Ridden by Losses – Coffee Day Enterprises Ltd

Incorporated in 1996, Coffee Day Enterprises Ltd is in the business of Coffee and related business, Integrated multimodal logistics, Financial services, Leasing of commercial office space, Hospitality services and Investment and other corporate functions.

With a market cap of Rs 887 cr, the company is also engaged in the trading of coffee beans. The company through its subsidiaries, associates and joint venture companies, is engaged in business in multiple sectors such as Coffee-retail and exports, Leasing of commercial office space, Hospitality and Information Technology (IT) / Information Technology Enabled Services (ITeS).

Dolly Khanna bought a 1.6% stake in the company worth Rs 13 cr as per the filings for the quarter ending June 2025. And as per the filings for the quarter ending September, she increased holding to 2.2% making the overall holding worth Rs 20cr.

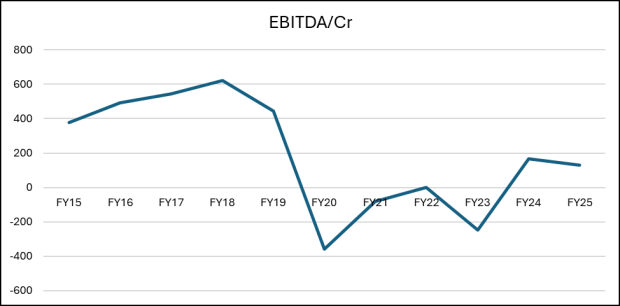

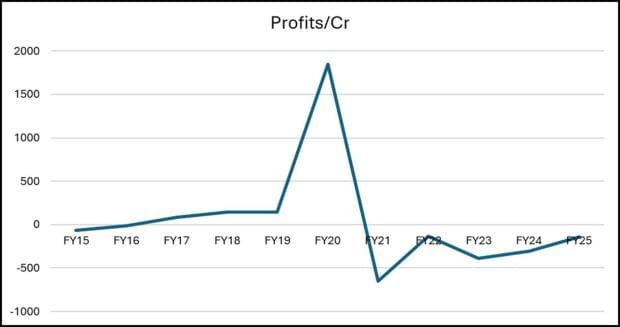

Coffee Day Enterprises must be looked at differently when it comes to financials.

The sales, EBITDA and Net Profits of the company saw a huge drop after the sudden death of its founder Siddhartha Hegde in 2019, which his wife turned around after she took over.

Sales Performance (FY15–FY25)

EBITDA Performance (FY15–FY25)

Profits Logged In (FY15–FY25)

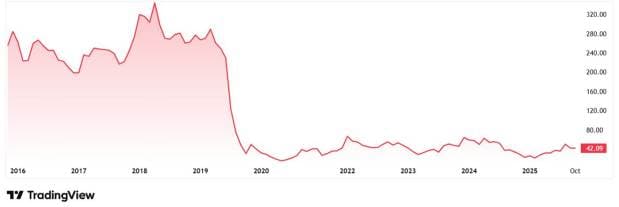

The share price of Coffee Day Enterprises Ltd was around Rs 265 in November 2015 which fell to Rs 16 post Hegde’s demise. However, it has shown some promise post Malavika, Siddhartha’s wife taking the reins in her hands.

The company’s share is trading at a negative PE due to a string of losses while the while the industry median is 333x. The 10-Year median PE for the company is however 59x and the industry median for the same period is 95x.

In January 2023, SEBI had imposed a total penalty of INR 26 crore on Coffee Day Enterprises Limited (CDEL) for violations related to the transfer of funds by its subsidiaries to Mysore Amalgamated Coffee Estates Limited (MACEL). SEBI directed Coffee Day Enterprises to recover the entire dues from MACEL and its related entities along with interest and to appoint an independent law firm for this purpose.

In all, Coffee Day Enterprises Ltd is facing severe financial distress marked by continuous debt defaults, a significant portion of its assets being highly questionable receivables from related parties, and auditors expressing a fundamental uncertainty about its ability to continue operations. The recurring nature and the long-standing period of these audit qualifications (six times on several issues) indicate deeply embedded governance and financial control issues.

Follow The Small Cap Queen’s Big Bets?

Dolly Khanna has repeatedly proved that the risk associated with small caps is nothing but a myth to her. She has demonstrated that with the right strategy and research, even this category could be a goldmine.

So, when she picks two stocks and adds more of their shares to her portfolio, it deserves the attention of investors across the board. While Prakash Industries shows a lot of promise, Coffee Day enterprises comes with more risks than gains.

But given that Dolly Khanna is known to laugh her way to the bank with most of her picks, it would be interesting to see how these 2 stocks do in the short and long term. It would be smart to add them to a watchlist and watch them closely.

Note: We have relied on data from http://www.Screener.in and http://www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.