Penny stocks are not the go-to category for most investors as many of them often lack the transparency and corporate governance standards that larger, established companies adhere to. Obviously, this makes it difficult to assess a company’s financial health, future prospects, and management quality in a more accurate way.

But when they hit the sweet spot and clear the holy trinity test of having high ROCE (Return on Capital Employed), High Dividend Yield and Near ZERO debts, it says a lot about how the company is running the business. And when such stocks are backed by one of the Warren Buffetts of India like Radhakishan Damani, it deserves attention.

Here are 2 such penny stocks that have passed the test and one of them is backed by Damani.

#1 Advani Hotels: The Rs 55 gem in Damani’s portfolio

Incorporated in 1987, Advani Hotels and Resorts India Ltd is in the business of hoteliering.

With a market cap of Rs 509 cr, the company owns and operates the Caravela Beach Resort, Goa; an independent, 201-key, 5-Star Deluxe golf resort on the Arabian Sea, designed by the world-famous architects WATG.

The company passes the Holy trinity test with flying numbers with near zero debt, making it free from any high interest payments that eat into profits. This also makes it free to utilise the profits in paying back its investors, which it is doing by means of dividends. Currently, the company is delivering a dividend yield of 3.4% in a flat market when compared to peers.

Add to that that the current Return on Capital Employed (ROCE) of the company is an enviable 45% while the industry median is just 12%. Which means for every Rs 100 the company uses as capital, it makes a profit of Rs 45 on it, while its peers average around just Rs 12.

What makes it even more attention worthy is its hidden gem status in Radhakishan Damani’s portfolio. He has held a stake in the company since December 2015 (He might have bought it earlier, but this is the oldest data available on Trendlyne), and currently holds a 4.2% stake worth Rs 21 cr.

Let’s look at the financials of the company to try and find out what has kept an investor like Damani hooked for so long.

The company’s sales have grown from Rs 70 cr in FY20 to Rs 107 cr in FY25, logging in a compound growth rate of 9% in the last 5 years. And for H1Fy26, the company has recorded sales of Rs 35 cr.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Advani Hotels grew from Rs 17 cr in FY20 to Rs 35 cr in FY25, recording a 16% CAGR. For H1FY26, EBITDA of Rs 1.75 cr has been logged.

Looking at the net profits, the figures have grown from Rs 11 cr in FY20 to Rs 26 cr in FY25, logging in a compound growth of around 20%. And for H1FY26, the profits of Rs 1.4 cr have been recorded.

The drop in EBITDA and profits in the current year could be attributed to the cyclicality of the Goa micro market.

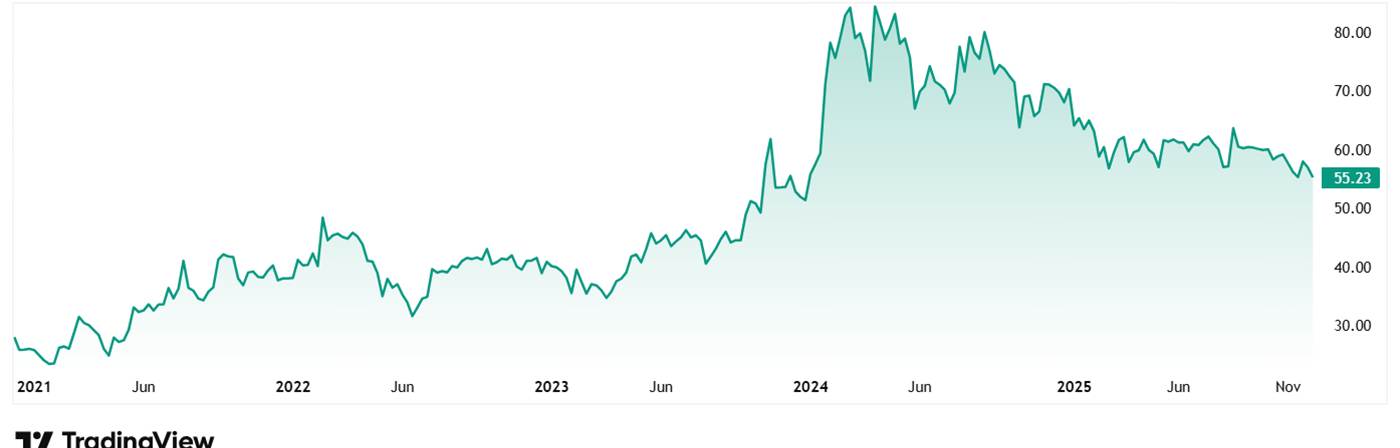

The share prices for Advani Hotels & Resorts India Ltd were around Rs 28 in December 2020, and as on 9th December 2025, it was Rs 55.

At the current price of Rs 55, the stock is trading at a discount of 40% from all its all-time high price of Rs 92.

As for valuations, the company’s share is trading at a PE of 21x, and the current industry median is 37x. The 10-year median PE for Advani Hotels & Resorts is however 27x and the industry median for the same period is 36x.

In the past 12 months, Advani Hotels has declared an equity dividend amounting to Rs 1.90 per share.

In the annual report for FY25, Chairman & Managing Director, Sunder Advani said, “We will continue our policy of not requiring debt financing for planned improvements, maintaining our strong balance sheet. Our commitment to rewarding shareholders remains steadfast – we are recognised as one of the highest dividend-paying companies as a proportion of net profits. Our healthy dividend payout ratio of 95.9% reflects our confidence in sustainable cash generation and our commitment to sharing success with our investors.”

#2 Bhansali Engineering: A debt-free cash machine with 4.5% yield

Incorporated in 1984 as Bhansali Steels Limited,the company changed its name to Bhansali Engineering Polymers Ltd in 1986 and is currently engaged in manufacturing and sale of ABS Resins, AES Resins, ASA resins, SAN resins and their alloys with other plastics in the Indian market.

With a market cap of Rs 2,198 cr, the company also checks all the boxes when it comes to the holy trinity test. Near Zero debt, a ROCE of 25% while peers average 14% and a dividend yield of an envy worthy 4.5% as the industry peers’ average hovers around 0.3%.

The sales of the company have grown at a compounded rate of 5% from Rs 1,104 cr in FY20 to Rs 1,398 cr in FY25. For H1FY26, the sales logged were Rs 633 cr.

As for the EBITDA, the company saw a compounded growth of 20% from Rs 86 cr in FY20 to Rs 215 cr in FY25. And for H1FY26, the EBITDA was Rs 102 cr.

The net profits of the company grew at a compound rate of 22% between Rs 67 cr in FY20 and Rs 180 cr in FY25. For H1FY26, profits of Rs 86 cr were already logged.

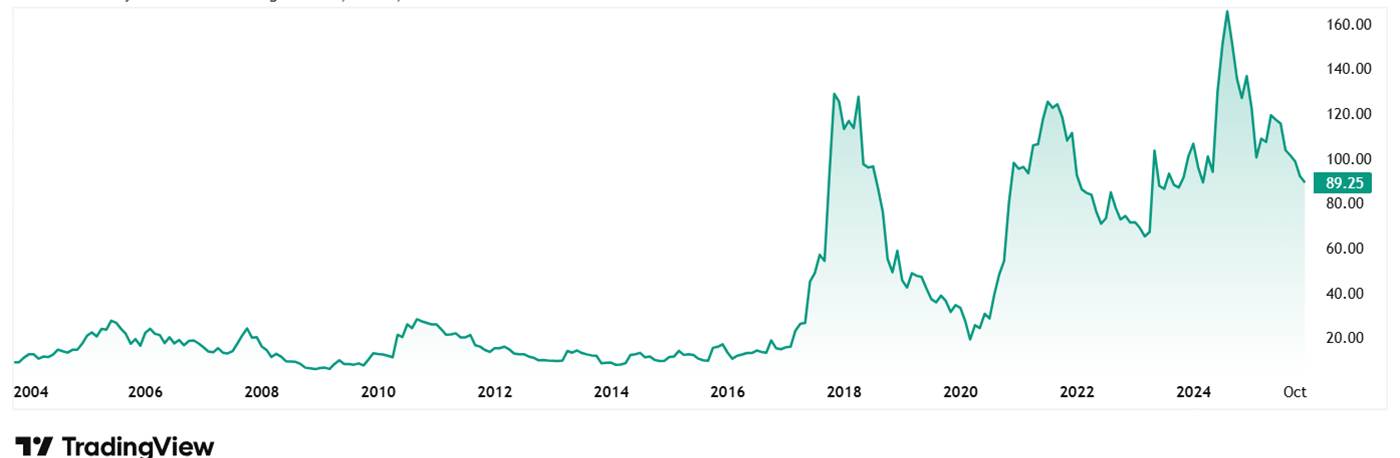

The share price of Bhansali Engineering Polymers Ltd in December 2020 was around Rs 87 and as on 9th December 2025 is Rs 88.

However, at the current price of Rs 88, the stock is trading at a discount of 50% from its all-time high of Rs 177.

The company’s share is trading at a PE of 13x while the industry median is 29x. The 10-Year median PE of the company is 15x and the industry median for the same period is 29x.

The company is focusing on expanding its presence in the ABS segment with a capacity expansion program. It plans to intensify its efforts to optimize its share of the ABS market segment, especially from the automotive industry.

Get in opportunity or landmines?

The two stocks we saw today, Advani Hotels and Bhansali Engineering Polymers, both are currently trading under Rs 100. However, it must be noted that both are currently trading at a discount of over 40%, raising questions if this is a good opportunity to get in.

Both stocks have proven their mettle with enviable ROCE, Debt Management and Dividend Yields. And given that one of them has been a less known holding in Damani’s portfolio, they both are attracting attention and rightly so.

Having said that one needs to keep in mind the cyclicality of the hotel sector, and exposure to volatile crude prices could impact Advani Hotels and Bhansali Engineering respectively.

What remains to be seen is if these penny stocks have it in them to not only sustain these numbers but also keep growing. For one to know that it is necessary that these stocks be closely followed. You can consider adding them to a watchlist and keeping an eye on them.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.