Porinju Veliyath is a super investor in the Indian stock market. As the founder of Equity Intelligence India, he has built a reputation as an astute stock picker who is not afraid to take risks. He is famous for swimming against the time, while ignoring the market noise that scares most investors. This clubbed with deep research has helped him find many future multibaggers over the years.

Thanks to his track record, investors pay attention when he makes a move. It turns heads when an expert like him sticks with stocks that otherwise scream danger to the average investor. When Porinju holds onto companies with flashing red warning signs, it sparks curiosity. One wonders what he sees that the rest of us are missing.

Right now, his two biggest holdings by holding value, have given rise to a similar conversation. They are trading at a discount of over 45% and 75%, respectively. Plus, the financials for one and valuation for the other seem to be huge red flags. Let’s take a closer look at these stocks.

#1 Aurum Proptech: The ‘Dividends Disguised as Losses’ Story

Incorporated in 1996, Aurum PropTech Ltd is in the business of software development and other services for the real estate.

With a market cap of Rs 1,260 cr, the company integrates tech expertise in real estate, and builds and operates PropTech products, services, and platforms catering to the B2B, B2C, B2B2C, and D2C Real Estate Value Chains.

Porinju Veliyath, has held a stake in the company since the filing for the quarter ending December 2021. He currently holds 2% stake in the company under his portfolio and another 3.7% under his holding company, Equity Intelligence India Private Limited. A total of 5.7% stake worth Rs 79 cr.

Let us now look at the financials of the company that are raising a lot of questions and rightly so.

Sales of the company have seen a compounded growth of 92% in the last 5 years as it went from Rs 10 cr in FY20 to Rs 264 cr in FY25. And for H1FY26, sales of Rs 151 cr have been recorded.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) is where the company has shown a turnaround in the last couple of years. It grew from losses of Rs 1 cr in FY20 to profits of Rs 47 cr in FY25. For H1FY26, the EBITDA logged is Rs 35 cr.

Coming to the net profit, this is where things go downhill. After what can be possibly called an anomaly in FY21, the company has been struggling to return to profits.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Cr | 90 | 2,413 | -13 | -40 | -66 | -41 |

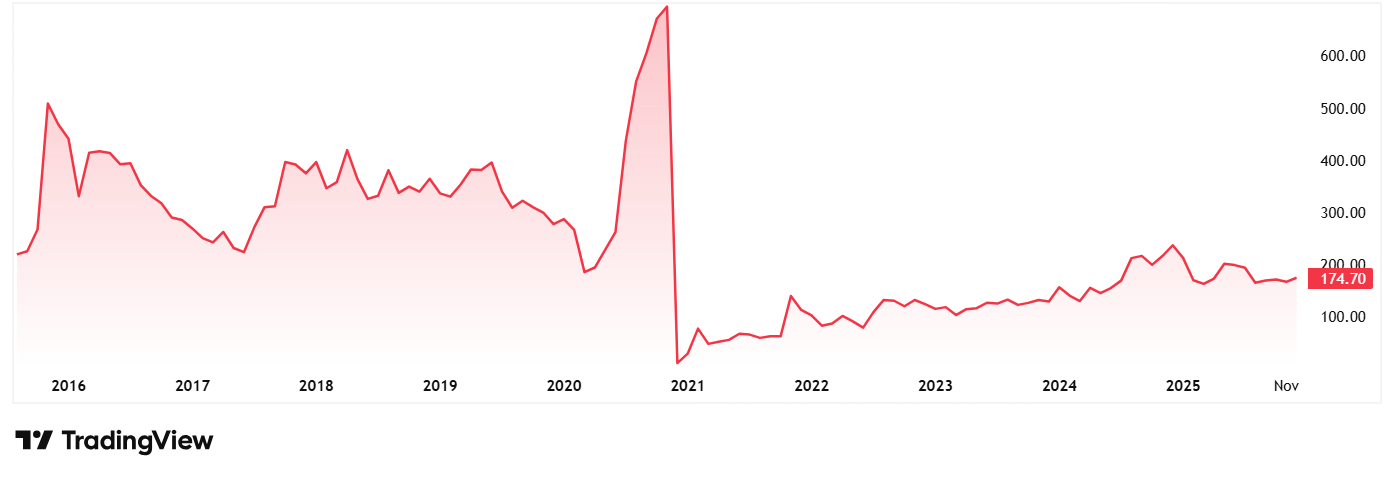

The share price of Aurum Proptech Ltd was around Rs 718 in December 2020, which has fallen to its current price of Rs 175 as on 12th December 2025.

The huge drop in Aurum Proptech’s (formerly Majesco) share price in December 2020 was a technical adjustment, and not a crash. After selling its US arm, the company distributed the proceeds via a record interim dividend of Rs 974 per share. The stock price simply corrected downward by the dividend amount on the ex-date, effectively transferring value to shareholders’ bank accounts rather than wiping it out.

At the current price of Rs 175, the stock is trading at a discount of almost 77% from its all-time high price of Rs 741 (pre business split price). On an adjusted basis, and including the dividend payoff, it could be said that this stock has been a winner over the long term.

The company’s shares are currently trading at a negative PE due to consistent losses, while the current industry median is 32x.

Ashish Deora, Founder and CEO of the company, said in the October 2025 investor presentation, “Rental vertical has delivered Rs. 200 crores ARR. We believe that our distribution vertical with the addition of PropTiger will also soon deliver Rs. 200 crores ARR. Across our verticals, we are targeting to deliver Rs. 500 crores ARR in next few quarters.”

So, even as Veliyath is in the money on this deal, the “current” company is loss making. Perhaps Veliyath sees potential in the business as well.

#2 RPSG Ventures: A Luxury Bet Trading at 400x PE

Incorporated in 2017, RPSG Ventures Limited (RVL), formerly known CESC Ventures Limited, (CVL) owns and operates a diversified portfolio of businesses including information technology (IT) services, business process management (BPM), fast moving consumer goods (FMCG), Ayurveda formulations, real estate, sports and restaurants.

With a market cap of Rs 2,499 cr, the company is a part of the RP-Sanjiv Goenka Group (RP-SG Group), which has business interests in power, carbon black, IT-enabled services, consumer & retail, media & entertainment, sports, etc.

Veliyath has held a stake in the company since the filing for the quarter ending March 2020 as per trendlyne, under EQ India Fund, a fund with his company Equity Intelligence India Private Limited. Currently he holds 1.4% stake worth Rs 34 cr.

One of Veliyath’s fellow super investor, Ashish Dhawan also holds a 3.7% stake in the company.

Looking at the financials, the company sales have seen a compounded growth of 16% in the last 5 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 4,608 | 5,599 | 6,670 | 7,166 | 7,951 | 9,608 |

The EBITDA has seen steady growth as well…

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 405 | 704 | 889 | 806 | 1,257 | 1,386 |

The net profits is an area which has seen some ups and downs.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Cr | 76 | 58 | 339 | -59 | 197 | 164 |

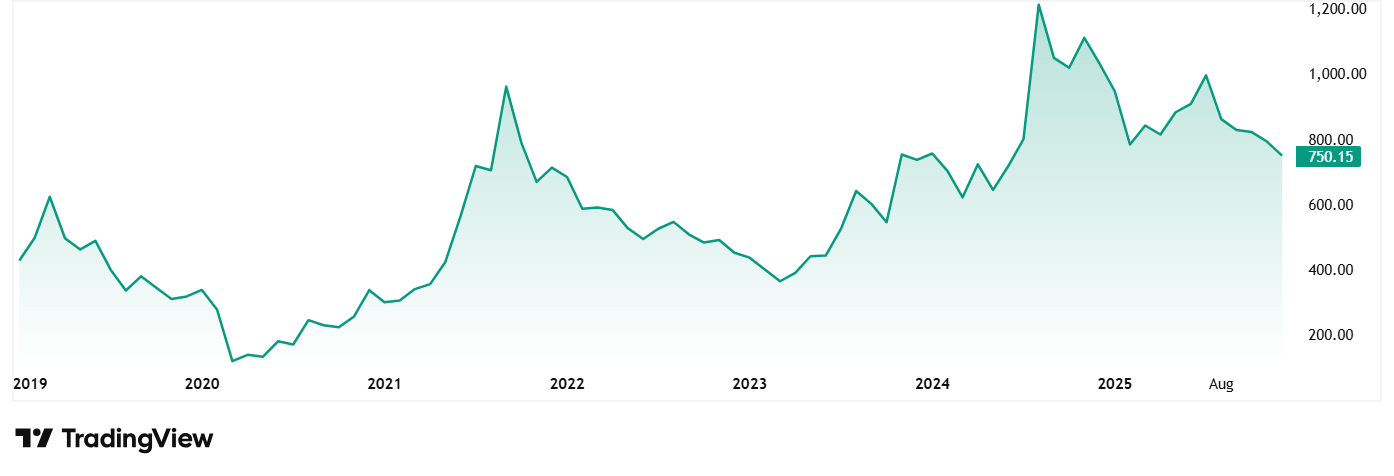

The share price of RPSG Ventures Ltd jumped from around Rs 270 in December 2020 to its current price of Rs 755 as on 12th December 2025. That is a jump of 180%.

At the current price of Rs 755, the company’s share is trading at a discount of about 45% from its all-time high price of Rs 1,360.

The company’s share is trading at a PE of 397x, which is much higher than the current industry median of 26x. This is because in the most recent reported quarter (Q2 FY 2025-26), the company reported a consolidated net loss of about Rs 52 Cr. This decline in trailing twelve months profits has resulted in the higher valuation multiple.

The company has recently in November 2025 acquired 40% stake (50,740 shares) in FSP Design Private Limited (Falguni Shane Peacock brand) at an enterprise value of Rs 455.17 cr (cash consideration, closing within 24 hours). Option for additional 10% within 18-24 months. The company says that this investment marks its foray into the luxury couture segment, representing a significant milestone in its vision to build a diverse portfolio in the luxury fashion and lifestyle space. FSP’s FY25 revenue: Rs 91.75 cr (up from Rs 77 cr in FY24).

Is Porinju Veliyath Banking on a Big Turnaround?

The two stocks that we saw today are the biggest holdings in Porinju Veliyath’s current portfolio, which means they have the trust of this Warren Buffett of India backing them. However, both have quite different stories to tell. Aurum Proptech is struggling to get back to profitability, while RPSG has logged in some good growth in sales and profits, but is probably highly overvalued at close to a 400x PE.

Will these stocks be a big turnaround story that will be another feather in Veliyath’s hat or will these turn out to be big mistakes. We can only know with time. But one can add these stocks to a watchlist and watch them closely, to not miss any red flag or opportunity that might just show up.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.