India is the largest provider of generic drugs globally and is known for its affordable vaccines and high-quality medicines. The Indian pharmaceutical industry is currently ranked third in pharmaceutical production by volume and 14th in terms of value. The industry has grown at a CAGR of 9.5% over the past decade and contributes around 1.72% to India’s GDP.

The sector is valued at Rs 4,71,295 cr (US$ 55bn) in 2025 and is projected to reach Rs 10,28,280-11,13,970 cr (US$ 120-130 billion) by 2030. No wonder the sector drives about 4% of India’s FDI inflows. Not to forget it also gets attention of investors back home.

And at such times, 2 lesser-known underdog pharma companies are slowly but steadily showing signs of sustainable growth. They are also recording solid capital efficiency and are not shying away from giving back to its investors in the form of dividends. Let us dig into these two stocks.

Jenburkt Pharmaceuticals Ltd

Incorporated in 1985, Jenburkt Pharmaceuticals Ltd manufactures and markets branded Pharmaceuticals and health care products. It promotes 85 brands across 1 Lac+ doctors regularly. The company has 1,000+ stockists and its reach extends to 4 Lac+ pharmacies across the globe.

With a market cap of Rs 536 cr, the company caters to large government, semi-government institutions, missionary hospitals, public sector enterprises, etc.

The company has a current ROCE (Return on Capital Employed) of 27%, which is almost double of the current industry median which is 15%. In simple words, Jenburkt Pharma makes a profit of Rs 27 on every Rs 100 it uses as capital for business, while its peers average about Rs 15.

The company has also successfully reduced debt and is currently almost debt free, keeping it free from any huge interest payments.

Another feather in its hat is that it has successfully reduced its cash conversion cycle from 117 days in FY20 to 59 days in FY25. Which in simple words means that in FY20 it took the company almost four months from the day it spent cash (on raw materials, etc.) to the day it got that cash back (from customer payments). It has now reduced to less than 2 months.

Club this with the high ROCE and near zero debt, it just makes it easier for the company to use money efficiently and not look for funds outside in times of need. It allows the company to be able to use the profits to buyback shares, pay dividends or invest it back in for growing the business.

No wonder the company has a dividend yield of 1.48%, which is much higher than the industry median of 0.12%.

Looking at the core financials. the sales of the company, its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and Net profits have shown a slow but upward growth in the last 5 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Rs Cr | 119 | 109 | 124 | 137 | 142 | 152 |

| EBITDA/Rs Cr | 20 | 20 | 27 | 30 | 33 | 40 |

| Profits/Rs Cr | 15 | 16 | 22 | 25 | 26 | 32 |

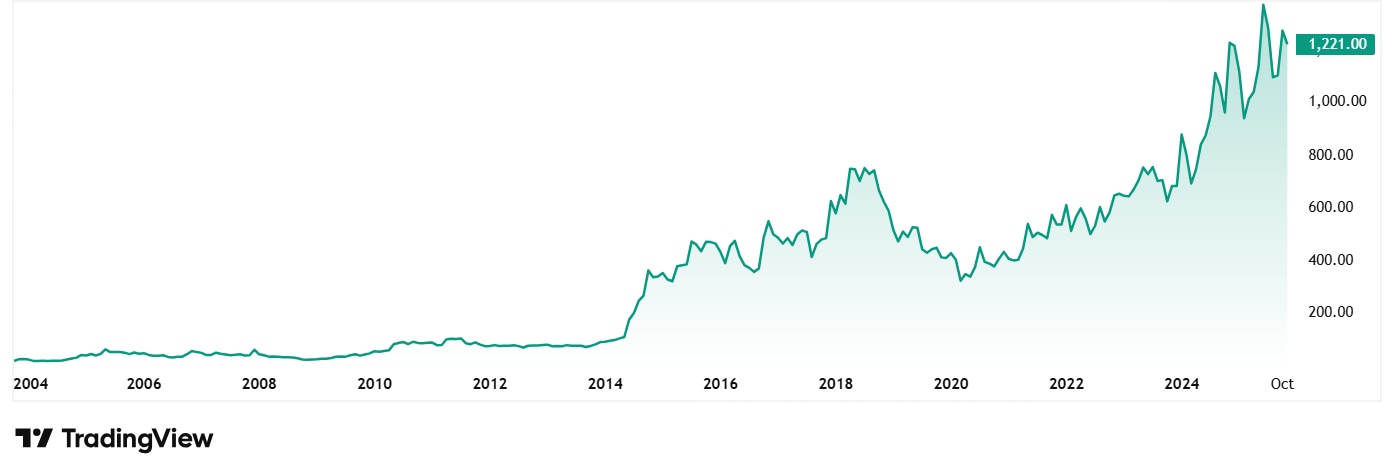

The share price of Jenburkt Pharmaceuticals Ltd was around Rs 425 in November 2020 and as on 6th November 2025, it is at Rs 1,215, which is a jump of 185%. Rs 1 lac invested in the company 5 years ago would have been Rs 2.9 Lacs today.

The stock is trading at a PE of 16x which is less than half or much lower than the current industry median of 33x. The 10-Year median PE for Jenburkt is 14x and the industry median for the same period is again 27x.

According to the company’s last annual report, investments in precision medicine, AI, and domestic API production are key to moving up the value chain. Management said: “The path forward requires a delicate balance of navigating short-term challenges while investing in long-term strategic capabilities.”

Jagsonpal Pharmaceuticals Ltd

Incorporated in 1978, Jagsonpal Pharmaceuticals Ltd manufactures and trades pharmaceutical products and active pharmaceutical ingredients.

With a market cap of Rs 1,448 cr the company provides essential medicines for women-specific healthcare needs, through Gynaecology and Orthopaedics as its focus segments. It is also present in major therapeutic sub-segments like antibiotics, allergy management, immunity and cell protection, OTC products, dermatology and paediatrics segment.

Ace investor Mukul Agarwal holds a 1.74% stake in the company.

The company has a current ROCE of 23%, which is higher than the current industry median of 15%. Jagsonpal too has reduced debt and is currently almost debt free, free from any huge interest payments.

Looking at the cash conversion cycle, the company has improved from 164 days in FY20 to just 39 days in FY25, making cash available much faster to them.

The company has a dividend yield of 1.14%, which is higher than the industry median of 0.12%.

Here is how the upwards trajectory of the company’s core financials looks:

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Rs Cr | 159 | 188 | 218 | 237 | 209 | 269 |

| EBITDA/Rs Cr | 9 | 19 | 26 | 34 | 23 | 51 |

| Profits/Rs Cr | 8 | 17 | 19 | 27 | 22 | 55 |

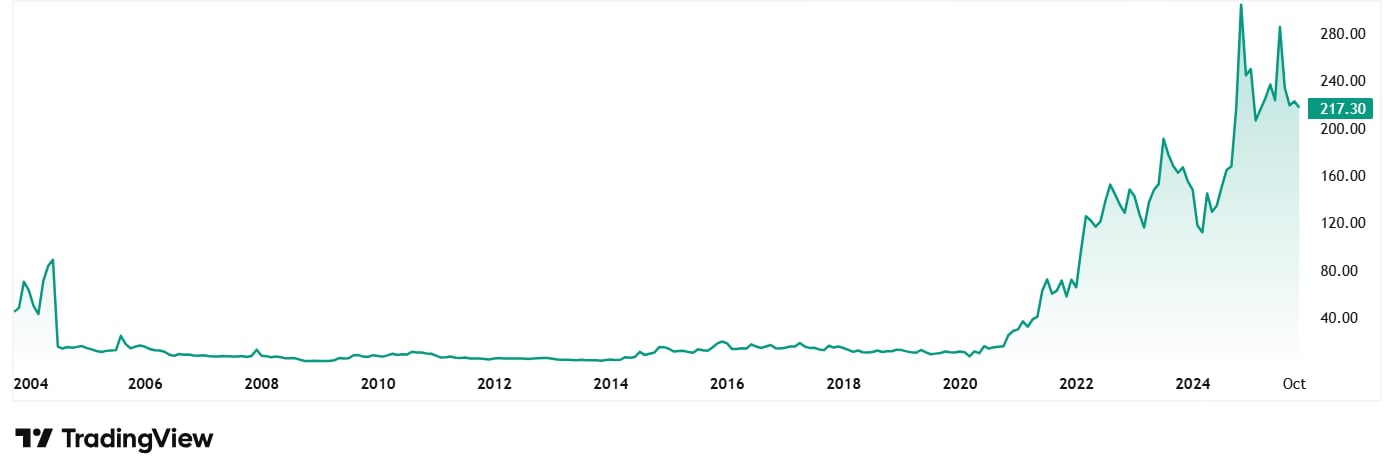

The adjusted share price of Jagsonpal Pharmaceuticals Ltd was around Rs 16 in November 2020 and as on 6th November 2025, it is at Rs 217, which is a jump of over 1,250%. Rs 1 lac invested in the stock 5 years ago would have been close to Rs 13.5 lacs today.

The company’s stock is trading at a PE of 33x, which is the same as the current industry median. The 10-Year median PE for the company is 32x, while the industry median for the same period is 27x.

The company has announced two major leadership changes in its November 2025 investor presentation. Amrut Medhekar is appointed as Chief Operating Officer effective September 4, 2025. He has over 30 years in pharma, is the ex-CEO of Akums Drugs.

Nirav Vora was appointed as Chief Financial Officer effective October 7, 2025. He has over 18 years of experience in finance. He is a Chartered Accountant and has had earlier roles at PwC, EY, KPMG, and SFA Sporting Services.

Could These Cure an Ailing Portfolio?

The India Pharma sector is on the cusp of big growth. In the Union Budget 2025-26,

Rs. 1,400 cr (US$ 163 million) was provided to support three mega bulk drug parks across states, the total pharma industry budget allocation was raised to Rs. 5,268 cr (US$ 614 mn) and medical device parks promotion budget was raised to Rs. 1,460 cr (US$ 170 mn).

With the government initiatives and solid growth projections, the sector is attracting big investments. However, most of it goes to the well-known big names. But stocks like Jenburkt and Jagsonpal are slowly building their growth story. With upward moving strong financials and willingness to give back to investors, they are showing signs of being the next big thing.

Do note that both these companies are small caps, and hence one must exercise extra caution. Small caps, in general, are considered to be more risky as compared to their larger peers. Among other reasons, this is also due to the relatively limited information and research coverage on such stocks.

Now, how these two stocks will do in the near and long-term future will be interesting to watch. For now, it would be a safe bet to add them to a watchlist and watch them closely, to ensure any opportunity is not missed.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.