There is something almost profound about the way Zen Technologies began its journey. While most defence companies in India were busy building metal and machinery, Zen chose a very different path: it decided to teach soldiers about the battleground instead of fighting it.

In the early days, such warfare training didn’t sound like a big idea. Simulation? Virtual training? Computer-based drills? It felt more like a sci-fi experiment inside a modest Hyderabad facility. But over the years, the world changed.

Armies everywhere began to realise that the most expensive mistake is the one you never make on a real battlefield. And suddenly, Zen’s quirky niche didn’t feel so bizarre.

What’s even more surprising is how long it took for people to notice Zen’s story. For years, the company silently built weapon simulants, firing-range guides, and basic defensive systems.

It didn’t get front-page coverage. It didn’t supply headline orders. It just kept manufacturing devices that helped soldiers become a little better every day.

The real inflection came when the Indian Army formally began shifting from physical-only training drills to simulation-led battle readiness as well.

And Zen Technologies was among the few defence businesses that had already spent over a decade planning for that moment.

Why Training Looked Peripheral, Until It Became Central

If you go back just five or six years, Zen appeared to be a weak defence supplier. Revenues moved in fits and starts. Orders were uneven. Defence procurement cycles stretched endlessly.

For years, Zen looked like a company that would never scale. Then, around FY21–FY22, the environment in India changed.

The Army began openly discussing simulation-based training exercises. Unified firing ranges became part of its modernisation plans.

Training doctrines started including virtual layers, not just live drills. That’s when Zen suddenly found itself at the centre of a shift it had quietly predicted years earlier.

The financials captured this turn. From being a ₹150–200 crore revenue company for years, Zen crossed ₹440 crore in FY24, and with a significantly stronger execution pipeline, accelerated to ₹974 crore in FY25.

Margins expanded as simulation products scaled, and the order book, once random, began to display visibility for several years ahead.

Zen’s order book at the end of September stood at ~₹675 crore, excluding orders already executed.This growth was driven not by one mega order but by many simulations, training ranges, and emerging technology commissions.

For the first time, the company could plan for hiring, R&D, and capital allocation. This wasn’t luck; it was leverage.

It was the late reward for lasting long enough in a sector that drains most small players.

When Simulation Turned into Combat Intelligence

The most misunderstood part of Zen’s story is that it is no longer just a teaching company.

Over the last few years, Zen has expanded into expertise that increasingly describes advanced warfare: anti-drone systems, autonomous risk discovery, combat zone analytics, and combined combat readiness platforms.

What started as a simulation for soldier training has evolved into a broader idea, a combat-readiness system.

A unit using Zen tech today may not only train on a simulator. It can also test live-fire precision, analyse defensive responses digitally, and deploy anti-drone systems for border protection.

Zen’s anti-drone solutions, in particular, gained visibility as drone intimidation became real rather than imaginary, not only at borders, but around tactical installations.

Financially, this growth changed the quality of Zen’s business. Gross margins improved as proprietary software programs and systems replaced low-margin hardware work.

By FY25, Zen’s balance sheet finally matched its ambition, cleaner, robust, and elastic enough to support long-term R&D. Its debt continued to be minimal.

For a company that once struggled for stability, this shift changed everything.

When the Financials Started Matching the Purpose

For most of its life, Zen’s numbers trailed its intention. The products were promising, but the financials didn’t always reflect it. That difference finally closed over the last two years.

By FY25, Zen reported revenue of about ₹974 crores, a sharp jump from its ~ ₹219 crores two years earlier. Profitability climbed alongside revenue growth.

Q2FY26 saw a revenue of ₹174 crores with a net profit of ₹61 crores excluding exceptional items. The operating margins increased significantly as software-heavy simulation systems and integrated solutions began contributing more than plain hardware. The margins hovered between 33-42%.

The balance sheet remained unusually clean for a defence technology company. Zen continues to operate with a debt-to-equity of 0.01.

According to Screener, the return on capital employed (ROCE) was ~37%. The average return on equity was about 26% over three years, while the profit grew at a compounded rate of 411% during the same period.

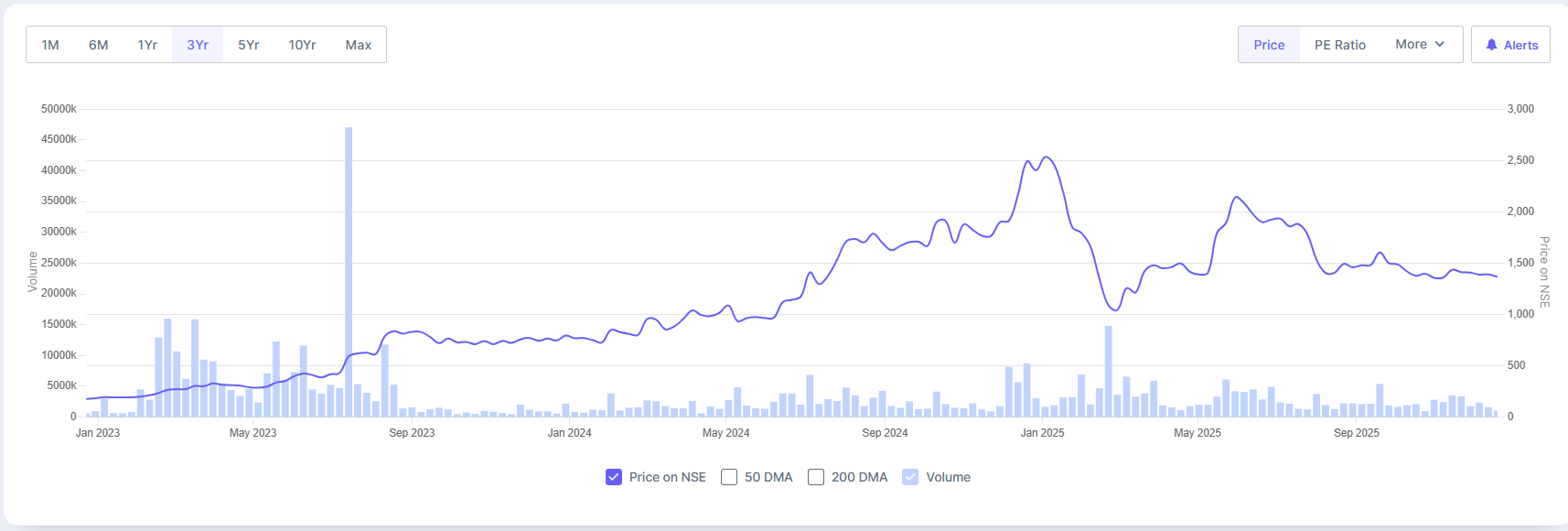

Zen Technologies 3-Year Share Price Trend (2023-2025)

And the stock price rose at a CAGR of 90% over three years. This significant rise showed that expansion was no longer coming at the cost of returns.

The valuation metrics also reflect this shift in assessment. Zen now trades at a P/E of ~49x, still lower than the industry median of ~58x. The price-to-book is near 7x.

These are not public-sector-style valuation numbers; they are more tech-style valuations, because the market now believes Zen is an expandable defence tech platform instead of a project-based contractor.

These numbers may not imply perfection. But they do hint at maturity.

Why the Business Changed Before the Market Did

Zen’s rerating wasn’t sudden, and it wasn’t speculative.

The first driver was revenue quality. Zen moved away from fragmented, low-value orders to integrated solutions.

Simulators with analysis, training systems linked with live-firing ranges, and anti-drone platforms, sold as part of wider security structures. That change increased income and visibility without the need for a significant increase in volumes.

Next was operating leverage. Once Zen’s primary simulation platforms were built, repeat, and additional orders needed far less incremental cost.

Software, digital transfers, and repetitive deployments grew faster than physical infrastructure, allowing profits to grow sooner than revenue.

Another factor for growth was significance. Defence goals changed. Training realism, skill, and drone threats moved from minor concerns to core military planning issues.

Zen didn’t have to turn aggressively; it simply benefited from being early.

Put together, these forces changed how investors read the business.

Zen stopped being seen as a niche training supplier and started being recognized as part of India’s digital defence backbone.

That is what the market responded to; not hype, not headlines, but structure.

A Company Growing into What It Was Always Building Toward

Zen Technologies today sits at an unusual intersection. It isn’t a conventional defence firm, yet it shapes how defence forces learn and train.

And, it isn’t a pure software firm, yet its future hangs heavily on code, virtual reality logic, and data-driven analysis.

It sells to the armed forces, but the real product it offers is confidence. A confidence that mistakes can be made in regulated conditions, not in real warfare.

The next phase of Zen’s journey will depend on how much more India spends on digital defence infrastructure.

The signals are clear.

Simulation-based training is no longer optional. Drone threats are no longer imaginary. Moreover, export interest is growing as developing nations look for reasonably priced training and counter-drone solutions.

Zen may still look small next to conventional defence giants, but it runs inside a trend that is no longer changeable.

Preparing for a Future That No Longer Feels Optional

Zen Technology’s story is not about unexpected success. It is about preparation.

While others chased platforms, Zen raced after readiness. While others in the sector built weapons, Zen built learning systems.

And while the world debated the future of warfare, Zen silently built tools for it.

Today, as defence becomes more digital, autonomous, and simulation-driven, Zen’s early bets are finally making sense.

For investors, the lesson is subtle but powerful.

Zen isn’t trying to become a mammoth. It’s trying to become essential. And companies that achieve that manage to stay relevant long after the initial interest fades.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.