If you get a chance to walk into an Astra Microwave campus early in the morning, you probably won’t hear the roar of heavy machinery. Instead, you’ll hear a hypnotic and almost novel silence, the kind that only happens in places where the work happening is too sensitive to make noise about.

Imagine, inside clean rooms lit by white lights, engineers sit behind glass screens, bonding tiny microwave components so tiny that they almost vanish into the edge of a circuit board.

These pieces, hidden from the naked eye, ultimately become the “eyes” and “ears” of Indian seekers, radars, satellites, and electronic warfare systems.

Yet, Astra Microwave rarely gets the credit. You hear a lot about the BrahMos, Akash, or Tejas. But very few people outside the industry recognize that Astra Microwave’s components live inside almost all of them.

In the defence sector, where large public-sector names get the praise, Astra Microwave plays an entirely distinct role, the quiet expert nobody sees, but everybody depends on.

And that’s the remarkable thing about Astra Microwave: its story is not about size or glitz. It is about accuracy, trust, and an engineering depth that grew from the inside out.

The Company That Built the Parts Nobody Else Wanted to Try

Astra Microwave wasn’t born to pursue large, visible contracts. It was born to resolve problems most companies actively dodged.

In the late 1990s and early 2000s, India faced a basic vulnerability: critical microwave subsystems, the heart of radars, satellites, and missile guidance, were almost entirely imported.

These were not regular electronic parts. They had to function under extreme temperatures, tremors, radiation, and at frequencies where even minuscule mistakes could damage performance.

Very few Indian defence firms had the persistence, capital discipline, or scientific genius to work at this level.

Astra Microwave chose to build exactly those things.

Instead of high-volume production, the founders focused on high-difficulty engineering: radio frequencies (RF), travelling wave tube amplifiers, microwave modules, antenna arrays, telemetry systems, power amplifiers, and control electronics. These were parts where a millimetre’s error could disrupt an entire defence platform.

This “solve the hardest problem first” philosophy became Astra Microwave’s moat. And slowly, the defence enterprise began relying on it.

Astra Microwave had already built something irreplaceable: credibility born of repeated success by the time India’s radar, missile, and surveillance programs began scaling up.

A Company Expanding Not by Yelling, but by Being Needed

Astra Microwave today looks larger than it once did, but the core beliefs remain unchanged.

Rather than expanding into dozens of product lines, the company continues to focus on a narrow, high-value set of microwave and RF systems where changing suppliers is both risky and expensive.

This is why it quietly finds itself embedded across programs such as the missile seekers and guidance subsystems, battlefield and surveillance radars, airborne surveillance and EW pods, SATCOM payloads and telemetry systems, and naval electronic warfare platforms

The crucial word here is embedded.

Once a microwave subsystem becomes part of a radar or missile’s architecture, it tends to remain there for years, often for the entire life cycle of the platform.

Defence systems don’t change these contractors lightly. Certification takes time. Testing is brutal. And the replacement risk is high.

When Philosophy Reflects in The Numbers

That embedded nature also explains the company’s financial character.

FY25 saw Astra Microwave cross ₹1,051 crore in annual revenue, with operating margins steadily improving as execution stabilised.

In Q2 FY26, though the company posted a revenue of ₹215 crores, the sales dropped ~6.5% YoY from the same quarter in the year before. Astra’s net profit (excluding exceptional items) was ~₹24 crores in Q2FY26, lower by ~6% YoY.

It was because defence contracts tend to be lumpy, and combined with quarterly volatility, the revenue fell. However, the strong sector demand helped the company secure new orders, aiding stability and scale.

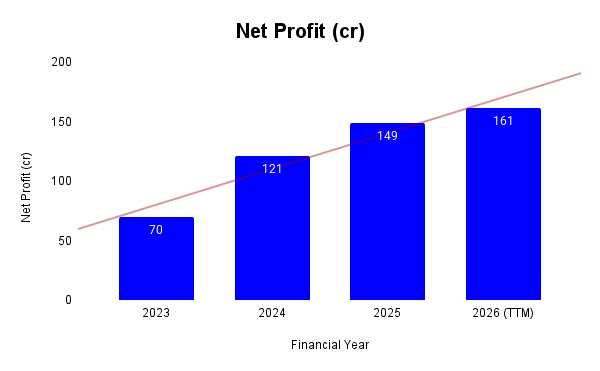

Profitability improved as the company scaled. The profit grew at a compounded rate of 58% over the last three years (FY22 to FY25), while the return on equity was 14%.

Net Profit Growth (2023 -2026(TTM))

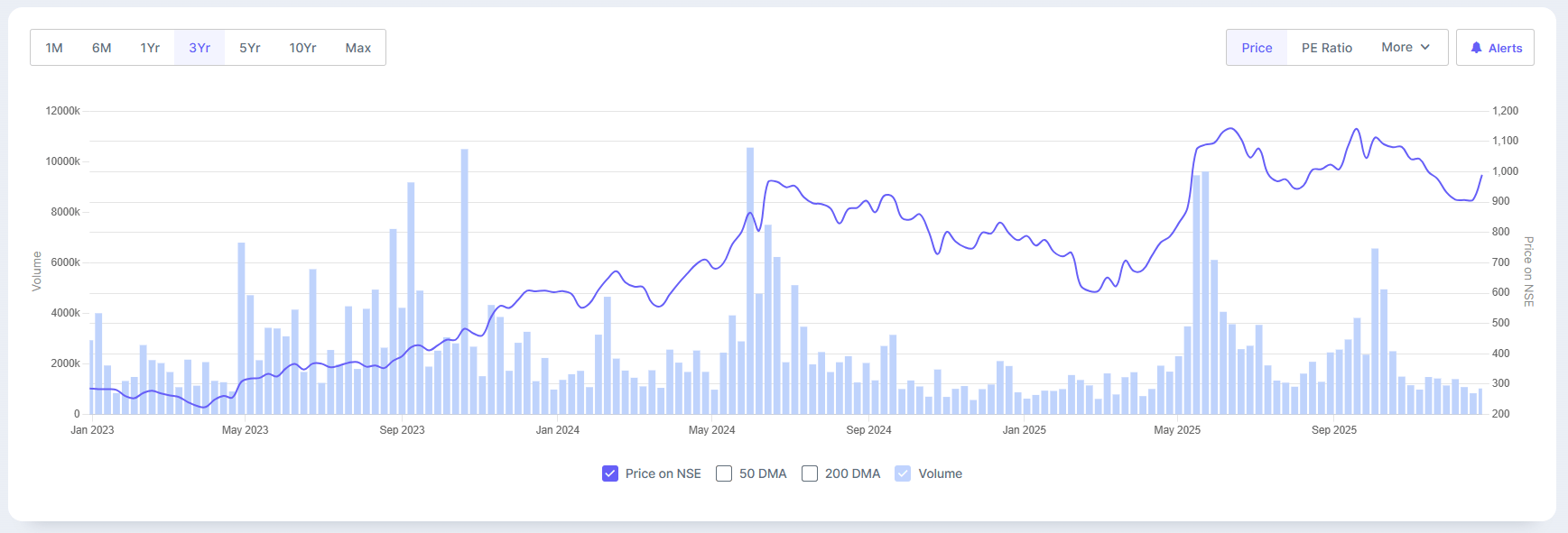

Moreover, the stock price surged 54% during the same period.

Astra Microwave 3-Year Share Price Trend

The balance sheet has stayed conservative, with limited leverage and controlled working capital. The order book of ₹1,916 crore as of 30th September offers future visibility, but more notably, it indicates continuity.

The growth is from the follow-on programs, repeat platforms, and long-life systems.

Nothing flashy. Nothing abrupt. Just engineering-led compounding.

Astra Microwave Is Better Understood as Deeptech, Not Defence

Astra is typically classified as a defence stock. But that label makes light of the real story.

Microwave engineering is not a defence competence. It is a physics capability.

That difference matters.

Because it allows Astra Microwave to move across domains without reinventing itself. The same high-frequency proficiency used in missile seekers applies to satellite payloads, secure communication systems, and space-based surveillance.

Over the last few years, the company has steadily intensified its participation in ISRO-linked programs and private space missions, selling microwave components and payload systems where failure is not an option.

This is not a sudden change. Space-grade microwave systems take years to be eligible.

Astra Microwave has that head start already.

And this is where the multiplying effect becomes visible. As India shifts from mechanical radars to active electronic scanned array (AESA) systems, from traditional missiles to smarter seekers, and from single platforms to networked warfare, the company’s significance grows inevitably.

It doesn’t need to chase scale. Astra Microwave chases complexity.

Precision Has Its Costs, And Its Risks

Living in the world of microwave engineering comes with its share of trade-offs.

First, execution is seldom linear. A minor fault in a high-frequency subsystem can slow down an entire platform. So, the company’s revenues often show up in the latter half of the year, and quarterly numbers can appear unbalanced.

Second, customer concentration is a real risk. A large stake of business still comes from Defence Research and Development Organisation (DRDO) and a limited number of defence Original Equipment Manufacturers. Even a small delay in a key program can briefly reduce margins or working capital.

Third, and most significantly, is talent dependency. Microwave engineering cannot be scaled by hiring alone. It is built over years of training and implied knowledge.

Retaining senior engineers and mentoring the next generation is not optional; it is existential.

The company does not fear competition as much as it fears losing intellectual continuity.

The Kind of Company That Rewards Patience

Astra Microwave will probably never be the loudest defence stock. It may rarely dominate headlines or surge on single-order announcements. That is not how it is built.

It compounds quietly, through embedded systems, repeat platforms, and rising technological depth. Each upgraded seeker, each new radar, each satellite payload adds another layer to its importance.

Some defence companies build what you can see.

Astra Microwave builds what makes those things work.

And in an era where warfare is increasingly determined by sensors, signal clarity, and electronic intelligence, that silent role may be one of the most valued positions in India’s defence ecosystem.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.