Ratan Tata’s one-year death anniversary had thrown the spotlight on the Tata group of companies last week. And this week, we are staring at a much-awaited demerger at Tata Motors. The split of its commercial and passenger vehicle businesses is to go effective on 14th October.

This is supposed to unlock value for shareholders. But thanks to headwinds ranging from global economic uncertainties and supply-chain issues to questions on leadership and intense competition amid an electric vehicle (EV) transition, the Tata Motors stock has continued to remain sluggish.

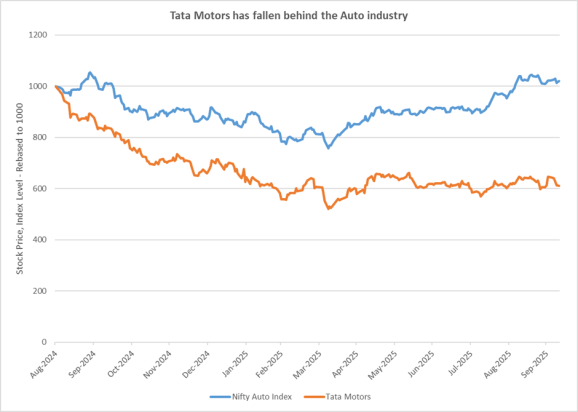

While India is the world’s 3rd largest car market, a manufacturing hub for exports, and an expanding electric vehicle (EV) ecosystem , Tata Motors has fallen behind. Nifty Auto Index has appreciated by 25% so far, this fiscal. But Tata Motors has remained flat. This is more worrying against the context that Tata Motors had already corrected by 40% off its peak in August 2024. Are all the negatives finally priced in, or is there more pain to come?

Behind Tata Motor’s recent correction

In September last year, Tata Motors DVR shares were converted into ordinary shares, with 7 ordinary shares issued for every 10 DVR shares held. The difference was accounted for, as deemed dividend. The resulting tax-implications were covered by selling shares, which triggered a correction off its peak in August 2024.

That said, a one-time sale of shares would not have resulted in a sustained negative sentiment, had it not been for risks simmering beneath the surface. Jaguar Land Rover (JLR) models including Range Rover, Range Rover Sport, and Defender drive more than 70% of the company’s consolidated sales. But concerns around JLR have compounded over time. The firm’s EV ambitions have been stalled, even as the demerger and a new acquisition raise hopes and concerns alike.

JLR’s troubles

Whole of last month, a cyberattack had resulted in halted production at the company’s UK-based JLR factories. Production resumed only on 8th October, and in a phased manner. Given that new vehicle registration plates in UK are introduced in September, JLR lost out on one of the busiest months for sales in the region. Estimates place the impact at a whopping 5 million Pounds a day.

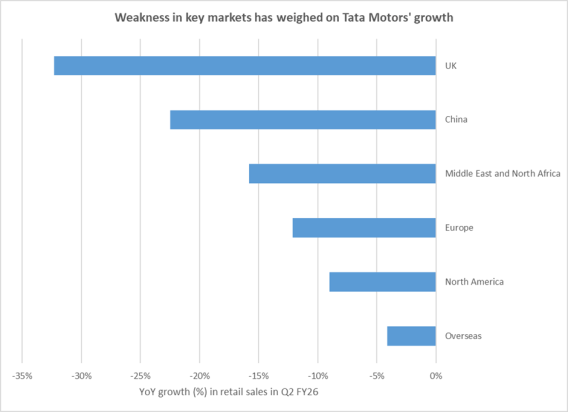

But even otherwise, the production of legacy JLR models was being wound down to make way for the new launches. Global demand has been slowing, and new launches have been delayed. With most of the company’s manufacturing based in Europe and China, the US tariffs had also impacted export volumes.

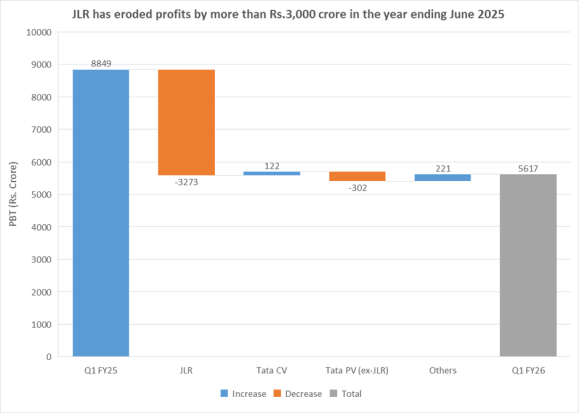

Result? In the year ending June 2025, all JLR models except Defender, saw a degrowth in sales. The quarter ending September was yet another disappointment, with 24% and 17% year-on-year declines in wholesale and retail volumes respectively.

EV pains

The company has been trying to pivot towards EVs through its JV with Chery Jaguar Land Rover (CJLR), China. But even Tesla has been struggling against intense competition in China’s EV space. Sales of domestically produced vehicles at CJLR have been affected as well. Only some of it has been offset by an increase in sales of imported vehicles, even as EVs continue to be margin-dilutive.

The company had initially hoped to manufacture EVs in India as well, with reports claiming plans for a $1 billion factory in Tamil Nadu. That has been scrapped as well, citing difficulties in balancing local sourcing norms with quality. This has contributed to the delay in launching the premium Avinya EV, which is now slated for FY27. Meanwhile, new launches from JSW MG Motor and Mahindra & Mahindra have been catching buyers’ attention, and Tata’s share in the domestic EV market has shrunk from 67% in Q1 FY25 to 37% in Q1 FY26.

To be sure, all EV players have had to rework their expansion plans amid headwinds. Governments have extended timelines to meet emission norms and EV sales. Customer-preferences have been shifting towards hybrids. To make matters worse, intense competition from China has resulted in a weaker-than-expected ramp up in demand for EVs.

Two sides of the demerger

The commercial vehicle segment of Tata Motors is being split off into Tata Motors Commercial Vehicles (TMLCV), leaving behind only the passenger vehicle business in Tata Motors which will be renamed as Tata Motors Passenger Vehicles (TMPVL). Shareholder as of 14th October, will receive 1 share of TMLCV for every share of Tata Motors.

Early next month, we will have both, TMPVL and TMLCV listed on the exchanges. While values of investor portfolios will remain unchanged on the record-date, the fortunes of the passenger and commercial vehicle units will diverge over time as investors price in the perceived values of these businesses.

That said, JLR and Indian passenger vehicles will continue to be clubbed under the same entity – TMPVL. It is important to note that JLR faces a unique set of challenges including fading appeal even among enthusiasts, and attempts at rebranding and electrification amid intense competition. This could leave the company’s passenger vehicle segment (including non-JLR EV) starving for strategic attention. The reorganization efforts had also resulted in a string of management exits, underlining the doubts around stability and competence of new leadership.

Cracks cut deeper amid industry headwinds

Tata Motor’s key markets, UK, rest of Europe, and China have been struggling under slow economic growth. This has affected demand, volumes, and operating leverage for the company. Meanwhile, stricter emission norms in Europe and supply-chain issues have weighed on margins. Domestically, low urban demand, specifically in the low-end sub-Rs 10lakh segment, has been sluggish.

EV expansion is margin-dilutive as well, until demand stabilizes. 84% of JLR’s powertrain is now electrified, and 40% of domestic passenger vehicles sold by the company are now, CNG and EV. Stiff competition, particularly in China, has been weighing on market-share, growth, and profitability as well. Which EV makers sustain in the race against China’s cost-effective EVs, will have to be seen.

Coming to tariffs, sales to US make for 25% of Tata Motor’s revenues. The company had paused exports to the US in April amid tariffs, thus affecting overall growth. Of course, UK and EU’s trade deals with the US signed since then, have locked in tariffs at relatively lower 10% and 15% respectively, thus alleviating concerns significantly. But amid these industry headwinds, questions around stability of leadership, and other company-specific concerns have kept investors cautious.

CV silver linings

Tata Motors has been doing relatively better in India’s commercial vehicle (CV) market, where it had gained ground from 35.6% to 36.1% in the quarter ending June 2025. While lower volumes due to early onset of monsoons had weighed on operating leverage, better realizations and material cost-savings had supported margins. It is targeting a 40% market-share within the next couple of years. Normalization of monsoons and continued recovery in rural and infrastructure-led demand are expected to support near-term fortunes, even as fleet-utilization, freight rates, and transporter profitability will shed light on demand going forward.

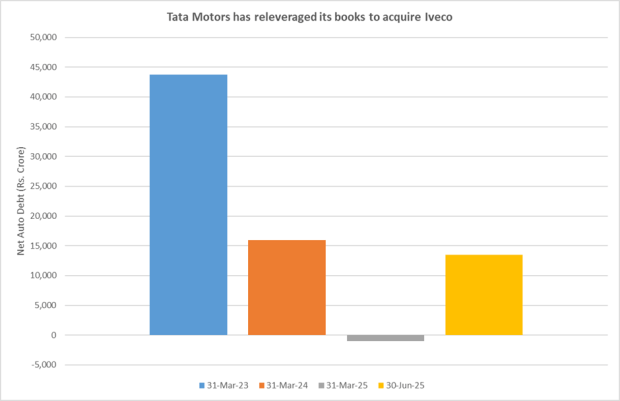

To cement its position in Europe’s CV market, it has acquired Italy-based Iveco’s business of trucks and buses for $4.5 billion. This will triple Tata Motor’s CV revenues to 22 billion Euros, half of which will come from Europe. The consequent diversification away from JLR struggles could prove to be exactly what the doctor ordered for the company. R&D synergies in electrification and powertrain technologies could also give the company a long-term leg up.

But considering that the auto maker’s last major acquisition (JLR from Ford Motors) is still weighing on the business, the Iveco acquisition raises concerns as well. The company has availed a bridge loan to fund the acquisition, which has piled on debt to the books. Of course, it hopes to replace the bridge loan with long-term debt and $1 billion raised through equities over the next few months. Investors will need to keep a watchful eye on how the debt-profile evolves.

Domestic prospects offer hope

While September played spoilsport for JLR, it brought good news for sales in India. The festive season was turbo charged with the announcement of GST rate-cuts across the board. GST 2.0 breathed fresh life into small cars in particular. Tata Motors slashed the prices of many of its models in response, with Altroz, Harrier, Safari, and Nexon now available up to Rs 1.55 lakh cheaper.

The lower prices, as well as new EV and SUV launches, bode well for domestic sales. Hatch models, Tiago and Altroz have seen healthy demand, and Harrier.ev was received positively as well. The company logged sales of 60,097 passenger vehicles last month, a 47.4% jump from the year-ago period. This pulled Tata Motors up several notches, making it the second largest car maker by sales.

As for the domestic EV space, the management has highlighted how demand in the nascent industry spikes to 2-3 times the steady-state demand on the back of new launches. The company’s electric vehicle sales had doubled year-on-year to 9,191 units in September. Management is hopeful that as range-anxiety moderates with expanding charging infrastructure, demand would stabilize in the next couple of years. The company is gunning to reclaim 50% of the Indian EV space’s steady-state market-share. It plans to back this up by doubling its domestic charging infrastructure to 400,000 charging points, including 500 fast “mega charging” stations.

Stress bottomed out?

As legacy JLR models are wound down and replaced with rebranded and EV models, the management is hopeful of delivering on the FY26 EBIT guidance of 5-7% as well as containing its free cash outflows. They have reassured investors that the company is on track to achieve long-term EBIT of 10%. While the demerger will allow sharper focus on CV, whether ex-JLR PVs are able to keep up, will have to be seen. How debt-to-equity evolves post Iveco acquisition, will also need to be monitored.

EV margins are expected to stabilize over the next few years, even as new launches and rebranding efforts drive demand in the interim. While the timelines for a demand-recovery in Europe are anybody’s guess, China’s persistent fiscal stimulus may bear fruit sooner. With UK and EU trade deals locked down, exports to the US can also be expected to stabilize. Domestic demand should be supported by monetary easing, government capex, sustained rural demand, and an anticipated recovery in urban demand post GST 2.0.

The 40% correction off its peak and improvement in financials since then, has brought the stock down to palatable valuations. It trades at less than 12 times its trailing 12-month earnings, and at par with the target-price assigned by brokerages. Upgrades hereon, will be driven by the absence of more bad news, as well as the fundamental and macroeconomic triggers covered in this article.

Note: We have relied on data from http://www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ananya Roy is the founder of Credibull Capital, a SEBI-registered investment adviser. An alumnus of NIT, IIM, and a CFA charter-holder, she pens her views on the economy and stock markets.

Disclosure: The writer and her dependents hold some of the stocks discussed in this article. Clients of Credibull Capital may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.