India’s defence sector is growing fast. According to a recent government release through PIB, defence production reached Rs 1.3 lakh crore in FY 2023–24. Exports hit a record Rs 23,622 crore in FY 2024–25. This surge reflects how India is steadily becoming more self-reliant. Manufacturing and exports are no longer aspirations — they are happening at scale.

This rapid growth is no surprise. Everyone knows demand for defence and aerospace is rising. What’s important — and less obvious — is that most attention goes to mainstream defence names. Meanwhile, many smaller, less-visible companies remain overlooked. In this article we focus on those under-the-radar stocks that are quietly powering this transformation.

These overlooked companies often form the backbone of the industry. They build specialized components. They deliver precision engineering, avionics, subcontract parts, and niche systems. Their role may not grab headlines. But without them, bigger platforms — jets, missiles, ships — cannot be built reliably.

We are selecting just three such companies for a deeper look. These are not the large public sector giants. Instead, they are smaller, agile firms deeply embedded in aerospace and defence-supply chains. We believe these three offer the best mix of “under-appreciated” status and strong exposure to India’s defence and aerospace renaissance.

#1 Data patterns: The radar & radar specialist

Data Patterns (India) is one of the fastest-growing companies in the defence and aerospace electronics sector in India. It is among the few vertically integrated defence and aerospace electronics solutions providers catering to the indigenously developed defence products industry.

Data Patterns reported strong momentum in the first half of FY26, with revenue doubling year-on-year to Rs 407 crore and healthy growth in profits. The company executed a large strategic contract during the quarter, which pulled margins lower, but management said the project was taken at a competitive price to unlock long-term opportunities. Earnings before interest, tax, depreciation, and amortisation (EBITDA) for H1 stood at Rs 101 crore, while PAT came in at Rs 75 crore. The order book, including negotiated but unfinalised orders, stands at around Rs 1,300 crore.

The company is expanding its role from a subsystem supplier to a full systems integrator. It is now building complete radar and electronic warfare systems in-house. Several major development programs are under way, including airborne fire-control radars, EW suites for the Super Sukhoi upgrade, drone-detection systems and next-generation seekers. Management said the total addressable market for these programs could be Rs 15,000–20,000 crore.

Exports are becoming a larger focus. A transportable precision-approach radar delivered to a European customer has completed acceptance trials. The company is pursuing opportunities in Europe, South America and the U.K., supported by co-development discussions with multinational partners.

Management remains confident of meeting its full-year guidance, citing strong order visibility and rising interest in indigenous systems. It expects the shift towards larger production contracts to improve working-capital cycles over time.

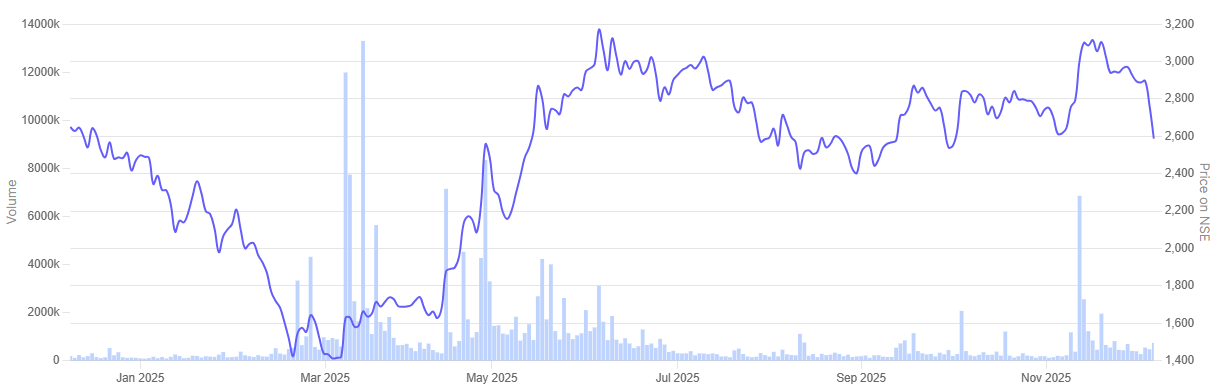

In the past one-year Data Patterns share price is down 2.3%.

Data Patterns 1 Year Share Price Chart

#2 MTAR Technologies: Critical components for clean energy & defence

MTAR Technologies develops and manufactures components and equipment for the defence, aerospace, nuclear and clean energy sectors. The company was incorporated to cater to the technical and engineering needs of the Indian government in the post embargo regime.

MTAR Technologies reported a soft second quarter but expects a sharp rebound in the second half as large orders move into execution. Q2 revenue stood at Rs 135 crore, compared with Rs 156 crore in the previous quarter, while EBITDA margins dipped due to inventory build-up and delays linked to tariff related discussions with US customers. Management said these were temporary issues and maintained full-year margin guidance of about 21%.

Order visibility remains strong. The company closed Q2 with an order book of Rs 1,296 crore. It expects to end FY26 with a record Rs 2,800-crore book after execution. A large Rs 500-crore order for Kaiga 5 and 6 reactors is expected this month, along with about Rs 300 crore from refurbishment projects. The new orders should give the nuclear division a clearer growth runway from FY27.

The clean-energy side of the business is also expanding steadily. Capacity for fuel-cell hot boxes will rise from 8,000 units to 12,000 by March, and to 20,000 by FY27. The aerospace pipeline is expanding as first-article approvals progress with global OEMs. Management expects revenue in H2 to double the first half, supported by high dispatch volumes and better operating leverage.

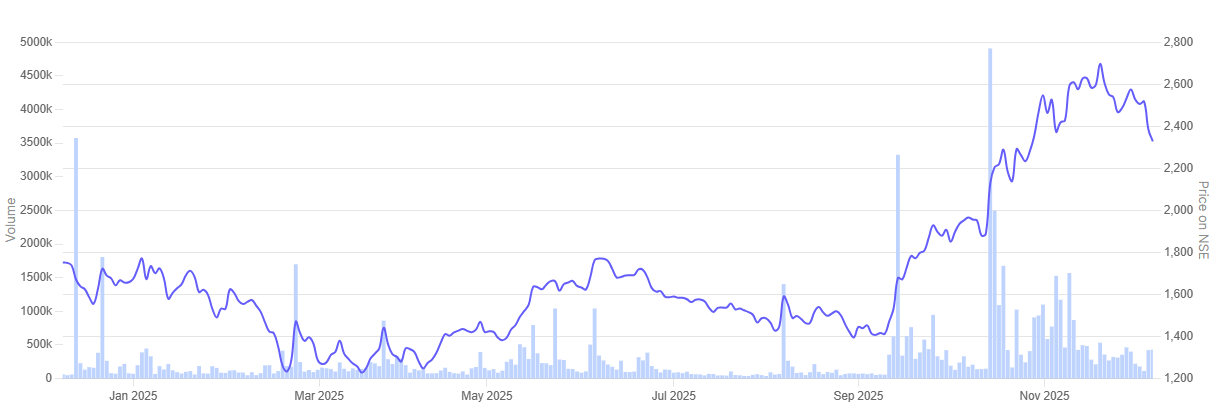

In the past one year MTAR Technologies share price rallied 32.6%.

MTAR Technologies 1 Year Share Price Chart

#3 Avantel: A small-cap play on strategic comms

Avantel is engaged in the business of designing, developing and maintaining wireless and satellite communication products, defence electronics, radar systems and development of network management software applications for its customers majorly from the aerospace and defence sectors.

Avantel reported steady operational progress in Q2 FY26, even as growth moderated after a strong FY25. Revenue for the September quarter stood at Rs 55.1 crore, similar to the June quarter, while net profit rose to Rs 6.2 crore. The company continued to invest in product development, reflected in higher employee-expense outgo driven by ESOP charges.

At its AGM, management outlined a broader expansion plan anchored in defence communication systems. Five iDEX projects are under active development, covering satphones, convoy-management systems, satellite video receivers and SATCOM-on-the-move terminals. Several of these have completed major design stages, and field trials are under way. Management said commercialisation may begin from FY27 as defence procurement cycles progress.

The company is building new capacity across antennas, satellite ground-station services and integration facilities. A very small aperture terminal (VSAT) hub is expected to become operational soon, pending final guidelines from the Department of Telecommunications. A proposed Vijayawada facility will cater to high-power military and SATCOM antennas.

Exports remain an emerging theme through geostationary satellite (GSAT) ground-station services once regulatory clearances arrive. Management expects growth to stabilise in the next two years and improve meaningfully from FY28 as multiple projects move into production.

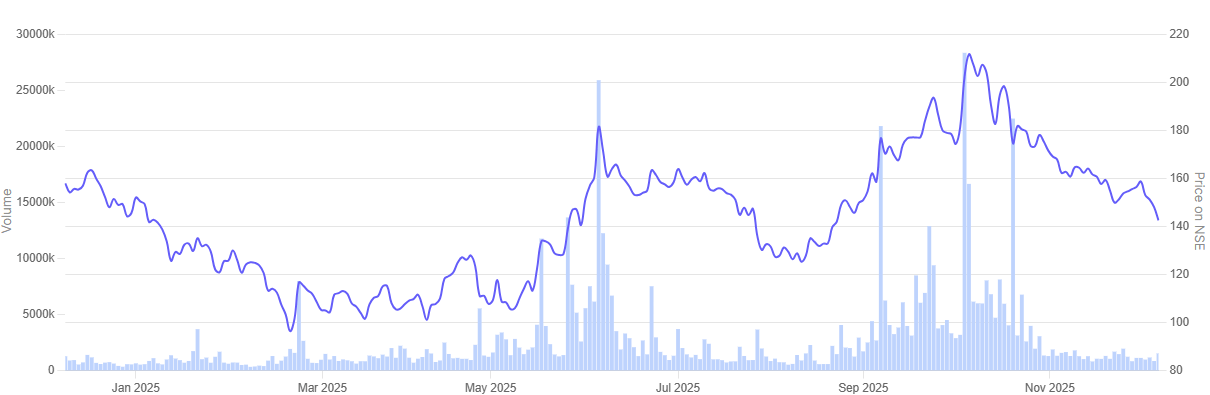

In the past one year Avantel share price is down 9.8%.

Avantel 1 Year Share Price Chart

Valuations

Let’s now turn to the valuations of the defence stocks in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Defence Stocks in India

| Sr No | Company | EV/EBITDA | Industry Median | ROCE |

| 1 | Data Patterns | 42.1 | 31.2 | 21.0% |

| 2 | MTAR Technologies | 60.6 | 31.2 | 10.5% |

| 3 | Avantel | 55.6 | 31.2 | 37.1% |

The numbers show a clear pattern. All three companies trade well above the broader industry median of 31.2 times. This reflects how defence electronics, precision engineering and satellite-communication businesses have seen a meaningful re-rating over the past few years.

Part of this premium is understandable. India’s defence expansion has accelerated. Order visibility has improved. Balance sheets today look healthier than they did a few years ago. In specialised pockets like aerospace electronics, precision engineering and satellite communication, there are only a handful of meaningful players. That scarcity, along with the value of in-house technology and the difficulty of entering these segments, often results in richer valuations.

Even so, the premium needs to be viewed with some caution. Markets tend to factor in future expansion well in advance, and in this category, the optimism around upcoming orders and margins has already moved ahead of past performance. Investors must therefore ask how much of the next leg of expansion, margins and export opportunities are already reflected in these valuations. ROCE helps differentiate quality, but it does not fully offset stretched multiples.

As always, the most rewarding opportunities arise when strong businesses trade at sensible prices. Given the long runway for defence and aerospace, investors need to judge whether current valuations leave enough room for meaningful upside.

Conclusion

India’s defence and aerospace ecosystem is changing faster than ever. The shift from imports to indigenous technology has opened doors for dozens of specialised companies that do not always sit in the spotlight. Yet their work quietly supports the larger platforms that dominate public attention. The three firms discussed here offer a window into that undercurrent. Each plays a different role, and each reflects how deep the supply chain has become.

Their growth over the past few years shows what consistent R&D, engineering strength and long project cycles can deliver. At the same time, the sector is still evolving. Order flows look steadier than before, yet the pace of actual work on the ground still depends on procurement schedules and approvals. That mix creates room for strong growth but also calls for patience and a realistic view of the uncertainties involved.

Valuations bring in an additional consideration. The companies now trade at a premium to the broader industry median, which means the market has already priced in a fair share of the optimism. Future returns will depend on how effectively they convert today’s development work into steady production revenues.

Investors should therefore treat these stocks as part of a longer arc. The opportunity is real, but so is the need for careful assessment. Investors should take time to study the company’s finances, order pipeline, cash generation and present valuations before committing any money.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.