India is both the world’s largest producer and consumer of milk, contributing approximately 24% to global milk production. A growing global population, urbanization, and changing dietary habits, which prioritize dairy as a primary source of nutrition, are some of the key reasons for this growth. According to Dodla Dairy’s annual report, the organized dairy sector is projected to grow at a compound annual growth rate of 6.9% to reach $41.8 billion by 2030.

The Indian dairy sector is also benefiting from various government policies focused on rural development and farmer empowerment. The National Dairy Development Program, the Rashtriya Gokul Mission, and the extension of the Kisan Credit Card facility to dairy farmers are key policies driving the sector’s growth. Similarly, here are three major players in the dairy sector that you should keep an eye on.

#1 Dodla Dairy: Growing across borders, capturing new markets

Dodla Dairy is an integrated dairy company that manages the entire dairy value chain, from procurement and processing to distribution. Founded in 1995, the company, which began in a town in Andhra Pradesh, has now expanded to 13 Indian states, as well as Kenya, Uganda, and Singapore. Its integrated business model enhances traceability, quality control, and cost competitiveness.

A growing dairy network across borders

Dodla operates 16 advanced processing plants across India, Kenya, and Uganda. Its combined installed capacity is over 24 LLPD (Lakh Liters Per Day). To support procurement, the Company maintains 190 chilling centers and 7,800+ village-level collection centers in India. It procures raw milk directly from over 130,000 farmers across about 8,800 villages.

Margin pressure despite record revenue

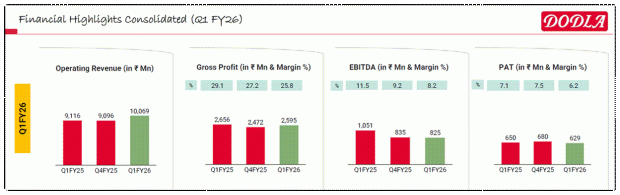

From a financial perspective, Dodla’s revenue grew 10.5% year-over-year to reach its highest quarterly revenue of ₹10 billion in Q1F26. Milk procurement volume (up 6.2%), average milk sales volume (up 4.9%), and sales of value-added products (up 12%) were key drivers of growth. Value-added product (VAP) sales account for 36.2% of sales, up from 35.4% in the corresponding quarter.

Dodla Dairy Financial Performance

However, gross profit (GP) and EBITDA (earnings before interest, taxes, depreciation, and amortization) declined 2.3% and 21.5%, respectively. This was due to a shortened summer season due to unseasonal rains, an increase in purchasing prices by 9.5%, the liquidation of some inventory, and increased expenses.

EBITDA margin fell 320 basis points (bps) to 8.2%, leading to a 3.3% decline in profit after tax (PAT) to ₹629 million. Margins are expected to bounce back in Q2FY26 as the full impact of lower procurement prices will be reflected. In FY26, Management estimates overall top-line growth to be between 10% to 15%, while absolute growth (at an EBITDA or PAT level) is expected to be between 15% to 20%.

Expansion, acquisitions, and value-added push

Looking ahead, the company is expanding to establish a greenfield facility in Maharashtra with an investment of ₹2.8 billion. The plant aims to diversify procurement risks, strengthen its B2B presence in Western India, and access new markets. This plant, with a handling capacity of 10 LLPD, is expected to be operational by the end of FY27.

The company has also acquired HR Food Processing for about ₹2.7 billion. HR operates under a premium brand with a strong foothold (10% share) in Bihar and Jharkhand. The acquisition aligns with the company’s aim to diversify geographic reach. The acquisition is also financially beneficial as HR reported revenues of Rs 2.8 billion in FY2025 with a GP margin of 24.7%.

Also, Dodla is strategically expanding its high-margin value-added products (VAP) segment. VAP’s contribution to total sales increased from 0% in 1995 to 35% by 2025. Now, it plans to focus on expanding into emerging themes such as probiotic yogurt, ready-to-drink buttermilk, spiced milk, and high-yield cheese.

#2 Heritage Foods: Pan-India network, powering value-added growth

Heritage Foods is a leading Indian dairy company based in Andhra Pradesh. Heritage’s Vision 2030 goal is to become India’s most admired dairy nutrition company. This vision is supported by its mission: to delight every home with fresh and healthy products and empower farmers.

Building a Pan-India dairy network

Heritage operates across 17 states in India, serving over 10 million consumers daily, offering a wide range of products with over 400 total SKUs. The dairy vertical is the flagship business unit, accounting for 99.9% of the company’s total revenue. The product portfolio includes milk, curd, paneer, ghee, fresh cream, UHT milk, lassi, milkshakes, flavored milk, and buttermilk.

Heritage operates on an integrated, farmer-to-consumer model. The distribution network is extensive, covering 7,400+ distributors and 205,000 retail outlets. The company’s processing capacity spans 18 state-of-the-art processing plants with a total capacity of 28.3 LLPD. It procures milk from 300,000 farmers across 9 states.

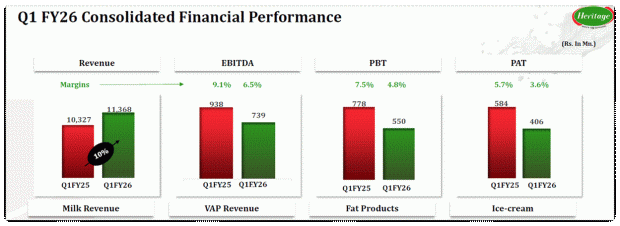

Growth sustains but margins under pressure

From a financial standpoint, revenue increased by 10% year-on-year to ₹11.3 billion, marking the third consecutive quarter of double-digit growth. Higher milk sales and pricing strength were the key growth drivers. However, margins fell to 6.5% impacted by unseasonal rains, leading to a 30.5% decline in PAT to ₹406 million.

Heritage Financial Performance

Value-Added push and the next growth frontier

Heritage is increasingly focused on VAP to improve profitability and leverage industry growth. Curd is the largest VAP in the portfolio, contributing about 70% of VAP revenues. In Q1FY26, VAP revenue rose 7.4% to ₹4.5 billion, contributing 36.1% to the total revenue. Looking ahead, the company aims for strong double-digit growth, aiming to achieve 15-16% revenue growth.

Margins are also expected to normalize in the coming quarters as volume-led operating leverage kicks in. It is also setting up a greenfield ice cream project at Shamirpet, which is slated to commence operations toward the end of FY26. The company identifies the ice cream sector as having explosive growth potential in India.

#3 Hatsun Agro: Market leader driving premium dairy growth

Hatsun Agro is India’s largest public dairy company. Hatsun operates in a single segment: milk and milk products. It emphasizes vertical integration, covering milk sourcing, cattle care, production, and distribution across India. Hatsun procures milk from over 500,000 farmers daily.

Hatsun offers a diverse portfolio of dairy and related products, including Arokya, Hatsun, and Arun Ice Creams. The company’s distribution network operates through over 4000 Hatsun outlets. These outlets are present across numerous states and Union Territories, including Tamil Nadu, Puducherry, Karnataka, Telangana, and Andhra Pradesh.

Hatsun’s revenue in Q1FY26 increased by 6.7% year-on-year to ₹25.3 billion, while margins increased by 100 bps to 15%. PAT, on the other hand, increased by 13% to about ₹1.5 billion.

Expanding beyond Tamil Nadu

The company has been diversifying geographically over the past five years, with revenue from Tamil Nadu declining from approximately 67% five years ago to 55% in FY25. Its market position in Tamil Nadu remains strong, but it’s also gradually expanding into other states, including Andhra Pradesh, Telangana, Karnataka, and Maharashtra.

In line with this, Hatsun acquired Milk Mantra Dairy for ₹2.3 billion, bringing the popular brand Milky Moo into its portfolio. The acquisition strengthens Hatsun’s presence in eastern markets (Odisha) and in value-added dairy offerings like milk, curd, paneer, lassi, and buttermilk. This is expected to lead to increased revenue in FY26.

Valuation check: Is the growth already priced in?

In terms of valuation, market leader Hatsun Agro has a price-earnings multiple of 66.6x, which is lower than its 10-year median of 90.8x but higher than the industry (28.9x). Dodla and Heritage are trading in line with both their median and sector multiples.

Valuation Comparison (X)

| Company | P/E | 10-year Median |

| Dodla Dairy | 31.1 | 31.5 (3-year) |

| Hatsun Agro | 66.6 | 90.8 |

| Heritage Foods | 25.9 | 24.8 |

| Industry | 28.9 | NA |

This suggests that while Hatsun continues to command a premium for its scale and brand strength, much of its growth appears to be priced in. In contrast, Dodla and Heritage offer relatively balanced valuations, supported by improving margins and expanding value-added portfolios. For investors, the near-term focus may be on execution and margin recovery.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.