While most of the media focuses on the big names and mostly the male ones when it comes to the super investors of India (barring exceptions like Rekha Jhunjhunwala), some women super investors are quietly causing ripples with their strategies.

One of them is Shivani Tejas Trivedi, who currently holds 12 stocks in her portfolio worth Rs 964 cr. According to Trendlyne, her portfolio grew by over 7% in the last quarter.

And of these 12 are two stocks that she recently bought into. However, what has raised questions is that both these companies are struggling when it comes to profits. So, what has caught the attention of Shivani, a super investor followed by thousands?

A Petrochemical Manufacturer Struggling with Profits

Incorporated in 1984, Tamilnadu Petroproducts Ltd manufactures and sells petrochemical products.

With a market cap of Rs 1,057 cr, the company part of the AM International group, was established as a joint venture between Southern Petrochemical Industries Corporation Limited and Tamilnadu Industrial Development Corporation.

Shivani Trivedi just bought a 2.1% stake in the company worth almost Rs 22 cr.

The company’s sales have grown at a compounded rate of a mere 8% in the last 5 years. However, in the last couple of years, it has seen a lot of fluctuations.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 1,225 | 1,145 | 1,806 | 2,150 | 1,669 | 1,827 |

The EBITDA (earnings before interest, taxes, depreciation, and amortization) declined in the same period.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 93 | 170 | 248 | 128 | 72 | 64 |

Although, the company did not record any losses, the net profits also followed the same downward path in the last 5 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | 63 | 126 | 175 | 94 | 50 | 58 |

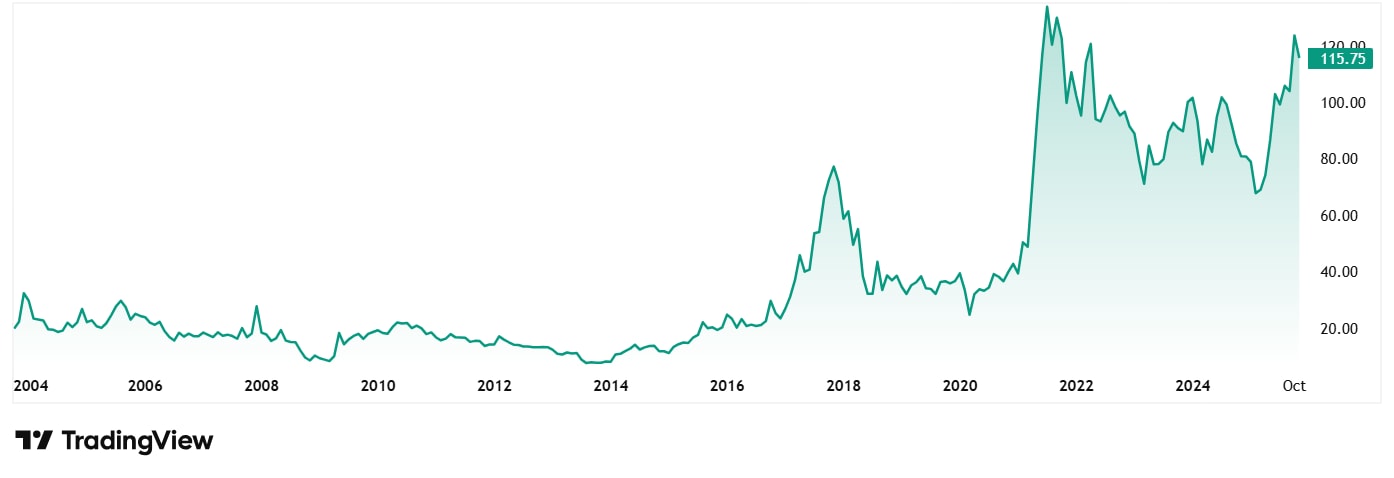

The share price of Tamil Nadu Petro Products Ltd was around Rs 38 in November 2020 and as on 7th November 2025, the price was Rs 117, which is over a 200% jump.

So, while the financials saw a downward spiral, the company’s share prices still saw over 200% jump in the last 5 years. Plus, the company has a dividend yield of 1.01%, which is higher than the industry median of 0.4%. It maintains a healthy dividend payout of 18%.

Currently, the company’s share is trading at a PE of 15x which is slightly lower than the current industry median of 20x. The 10-Year median PE for the company is 7x while the industry median for the same period is 13x.

The company’s directors note in the last annual report “This is a challenging macroeconomic climate typified by geopolitical uncertainty, high commodity prices, and lacklustre market growth. We live in a complicated and volatile world. Our plan of action is continually evolving to respond to the trends and forces driving our industry and affecting our stakeholders”.

Powering the Defence Sector of India

Incorporated in 1979, High Energy Batteries (India) Ltd manufactures batteries for Defence and commercial applications.

With a market cap of Rs 504 cr, the company manufactures high-tech batteries for defence and other applications. It boasts a strong in-house R&D foundation, enabling it to design, develop, and establish the manufacture of alkaline electrolyte-based silver-zinc, nickel-cadmium, and seawater-based silver-chloride magnesium batteries.

Shivani Trivedi bought a 1.5% stake in the company worth almost Rs 8 cr.

The company’s sales have grown at a compounded rate of just 6% in the last 5 years and seen a decline in the last 3 years.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 61 | 78 | 80 | 93 | 78 | 81 |

The EBITDA saw what we can call a roller coaster ride between FY20 and FY25.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 15 | 30 | 29 | 33 | 24 | 19 |

Coming to the net profits, the company did show some growth after FY20, which it wasn’t able to sustain for long.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | 6 | 18 | 18 | 20 | 17 | 15 |

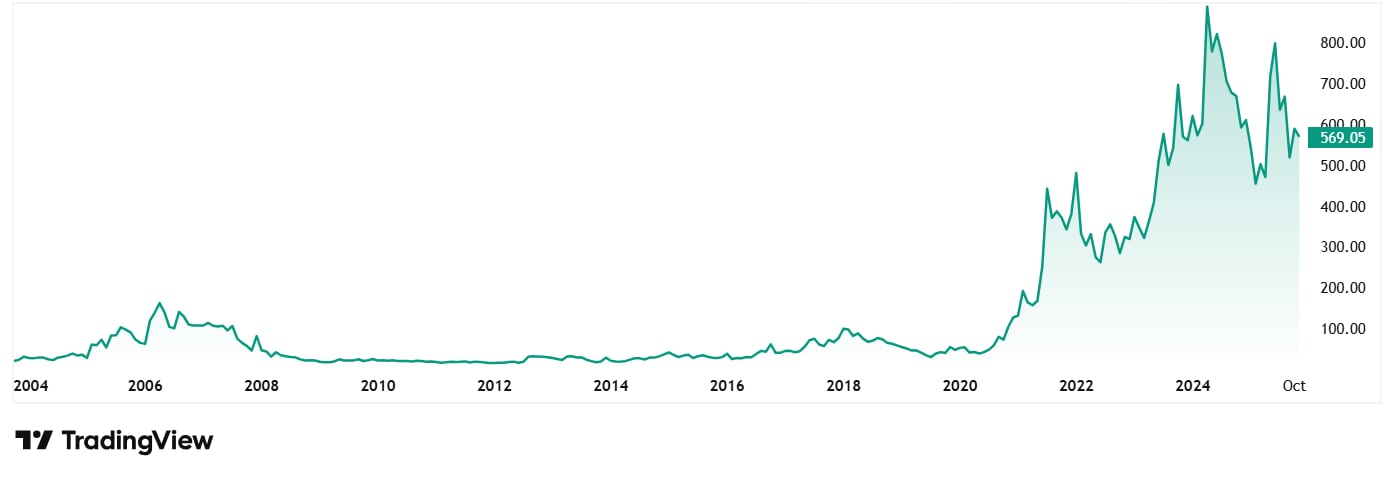

The share price of High Energy Batteries (India) Ltd was around Rs 70 in November 2020 and as on 7th November 2025, it was at Rs 563, logging a jump of over 700%. Rs 1 lac invested in the stock 5 years ago would have been over Rs 8 lacs today.

At the current price of Rs 563, the stock is available at a discount of over 30% from its all-time high price of Rs 830.

The share is trading at a PE of 38x while the current industry median is 33x. The 10-year median PE for High Energy Batteries is 22x and the industry median for the same period is 24x.

In the past 12 months, High Energy Batteries (India) Ltd has declared an equity dividend amounting to Rs 3 per share.

Does Shivani Foresee a Big Turnaround?

At the first glance, both the companies we saw today seem to be struggling with the core financials, which could turn any investor away. But probably Shivani Trivedi sees something in these companies, which has led to her fresh stakes in them.

While both the companies, Tamilnadu Petroproducts and High energy Batteries, have seen a drop in figures in the last 3 years, they have also shown promise before that. It might be the case of Trivedi seeing a possible turnaround in the future, which she plans to bank on.

However, that is something that we shall only know in time. But it would be a good idea to add these stocks to a watchlist and keep an eye on them to not miss out on any opportunity. Maybe one can ride the turnaround with Shivani Trivedi, if it happens.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, he was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.