The Nifty 50 has pushed to new highs in the last two years and the broader market has kept pace.

When investors crowd into familiar growth names, the odds of outsized returns drop. That is when bottom-up discipline matters.

Look for businesses that throw off cash, run efficiently and carry little or no debt. Prefer those still available at sensible valuations. A useful hunting ground sits inside India’s public sector.

This is where the Nifty CPSE (Central Public Sector Enterprises) Index comes into the picture.

It was created in 2009 to help the government sell stakes in state-owned companies through an ETF route. The index tracks ten large enterprises that meet clear rules on ownership, market value and dividend record. Together, they form the backbone of India’s economy across power, energy, defence and infrastructure.

Many constituents of the index have delivered steady earnings growth with strong RoE and clean balance sheets.

Here are five of the best picks from the Nifty CPSE Index that are based on strong RoE and good balance sheet strength.

#1 Bharat Electronics

First on our list is Bharat Electronics.

Bharat Electronics Ltd (BEL), a Navratna PSU, is India’s largest defence electronics manufacturer and a trusted partner to the armed forces. The company designs and builds critical systems across radar, communication, electronic warfare and avionics. These are the key pillars of the government’s self-reliance drive.

Over the last three years, revenue has grown robustly at 16% CAGR and net profit at 30% CAGR. The average return on equity over this period stands near 26%. BEL carries no long-term debt on its books.

In Q1 FY26, revenue grew 5% year-on-year while EBITDA margin expanded to 28% from 22% last year. The improvement came from better localisation, material savings and a favourable product mix.

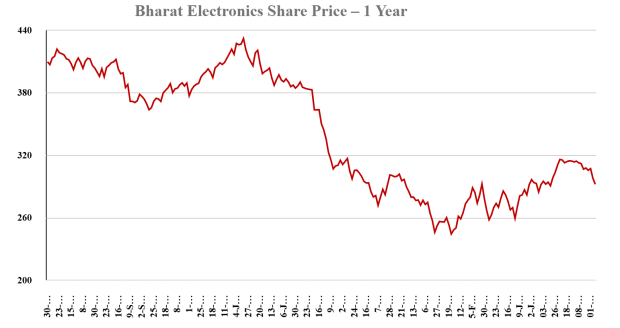

Bharat Electronics Share Price – 1 Year

The order book stood at Rs 749 billion (bn) as of July 2025, with inflows up 29% year to date. The company has guided for US$7 bn in fresh orders over the next 12 months. Following the recent border tensions, the government fast-tracked several ‘Make in India’ emergency defence procurements, prompting BEL to project a 44% rise in FY26 order inflows.

New opportunities include air defence radars, missile electronics, drone detection, and cyber systems. The company also aims to increase its share of non-defence and export revenues, with all capacity expansions funded through internal accruals.

At Rs 414, the stock trades around 55x FY27 earnings—above its five-year median of 29x. With scale, profitability and a clean balance sheet, BEL remains one of the strongest Nifty CPSE stories.

#2 Cochin Shipyard

Next on our list is Cochin Shipyard.

Cochin Shipyard is India’s largest government-owned shipbuilding firm. Once seen as a pure-play shipbuilder, it’s now actively pivoting to new engines of growth like green vessels, global repairs, exports and technical alliances.

FY25 was good for the company. Standalone revenue rose 24% YoY to Rs 45 bn, while PAT inched up 4% to Rs 8.4 bn. Margins compressed from 31% to 26%, due to provisions. However, revenue quality improved.

In fact, ship repair revenue overtook shipbuilding, hitting Rs 18.6 bn. This mix shift speaks to a more profitable operating structure and better asset utilisation.

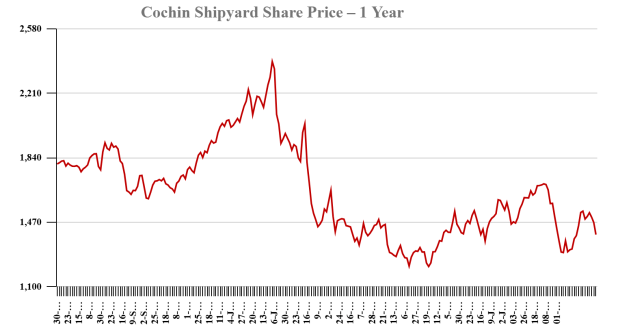

Cochin Shipyard Share Price – 1 Year

In Q1 FY26, consolidated revenue rose 38% year-on-year to Rs 10.7 bn, driven by a surge in ship repair income — up 157% to Rs 6.3 bn — while shipbuilding revenue moderated to Rs 4.4 bn. EBITDA margin came in strong at 28%, and PAT rose 7% year-on-year to Rs 1.88 bn. The order book remains robust at Rs 211 bn, providing multi-year revenue visibility. Management guided for 14–15% topline growth and around 20% EBITDA margins for FY26, with steady profitability as newer facilities scale up.

The outlook remains bright. Two large facilities including an international ship repair hub and a new dry dock, worth over Rs 21 bn are expected to come online in FY26. These could unlock higher throughput and expand margins further.

Cochin Shipyard has also been active on the global stage. It’s inked partnerships with Dubai’s Drydocks World for ship repair clusters and Korea’s HD KSOE for technical exchange. A recent order for high-powered tugs and luxury river vessels adds to its visibility.

It enjoys a strong balance sheet, zero long-term debt and pays regular dividends.

#3 NBCC (India)

Third on our list is NBCC (India).

NBCC (India) Ltd, a Navratna CPSE under the Ministry of Housing and Urban Affairs, is among India’s largest project management and construction companies. The company operates through three verticals; project management consultancy (PMC), engineering procurement and construction (EPC) and real estate development. Redevelopment projects across Delhi and other metro cities have emerged as the key growth driver.

Over the last three years, NBCC’s revenue has grown at about 16% CAGR and net profit at roughly 30% CAGR, supported by consistent execution and higher-margin PMC contracts. The company’s three-year average return on equity stands near 24%, and it remains virtually debt-free with a healthy cash position.

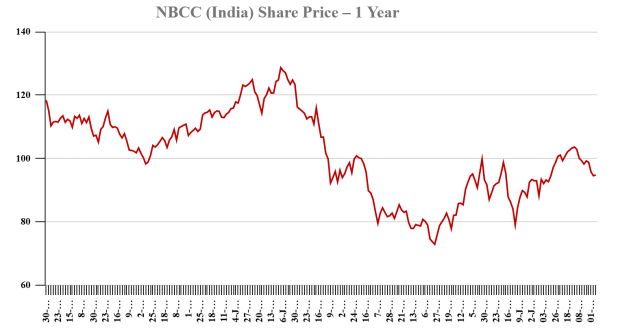

NBCC (India) Share Price – 1 Year

In Q1 FY26, consolidated revenue rose 12% year-on-year, while EBITDA margin improved to 5% from 4% a year ago. The improvement came from better operating leverage, a higher share of PMC projects, and tighter control over material and overhead costs.

NBCC’s order book stands at nearly Rs 1.2 trillion, its highest ever, offering strong long-term visibility. Major projects include the redevelopment of Sarojini Nagar, Netaji Nagar and the Amrapali housing projects. Management expects revenue of Rs 140–150 bn in FY26, rising to about Rs 250 billion by FY28, with margins improving from around 6% to 8–9%. Order inflows are guided at Rs 200–250 billion this year, supported by new awards worth about Rs 150 bn. Expansion remains self-funded through internal accruals and project advances, keeping the balance sheet healthy.

At around Rs 119, the stock trades near 50x earnings, a premium to its five-year median.

#4 NTPC

Fourth on our list is NTPC.

NTPC, a Maharatna PSU, is India’s largest power producer and a key pillar of the country’s energy security. The company generates nearly one-fourth of India’s electricity and is gradually shifting from a coal-heavy base to a diversified portfolio across solar, wind, hydro, nuclear, and green hydrogen.

Over the last three years, NTPC’s revenue has grown at about 12% CAGR and net profit at 8% CAGR, supported by new capacity addition and efficiency gains. Its three-year average return on equity stands around 12%, reflecting steady operational improvement. The balance sheet remains strong with regulated cash flows and moderate leverage.

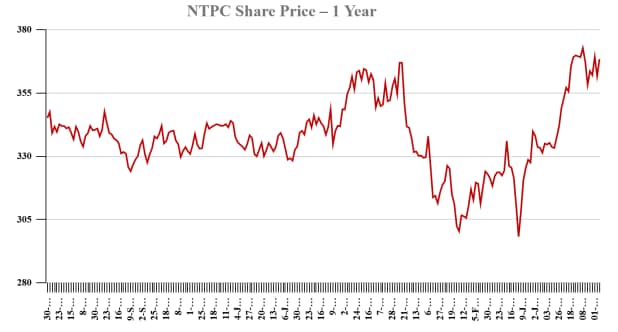

NTPC Share Price – 1 Year

In Q2 FY26, revenue growth was flat while EBITDA margin improved to 29%. Profitability stayed firm despite lower generation volumes, aided by a rise in regulated equity, higher plant load factors, and tariff clarity under the FY25–29 framework, which rewards availability and reliability.

NTPC has announced a Rs 2.7 trillion (about US$31 bn) capex plan for FY26–28 to accelerate growth in both regulated and non-fossil capacity. It aims to achieve 60 GW of renewable capacity by FY32 (from current 8GW), with 24 GW already under construction. The expansion includes pumped storage projects and 2.8GW nuclear ventures through ASHVINI and NPUNL. All projects are being funded through internal accruals and regulated borrowings.

At Rs 345, NTPC trades near 14x earnings, a premium to its long-term median. With stable returns, rising clean energy exposure, and visible execution, NTPC stands out as one of the strongest CPSE opportunities today.

Bottom of Form

#5 Coal India

Last on our list is Coal India.

Coal India, a Maharatna PSU, is the world’s largest coal producer and the backbone of India’s energy supply chain. The company meets over 80% of the country’s coal demand and has begun diversifying into renewables and critical minerals to align with long-term energy goals.

Over the last three years, revenue grew at 9% CAGR and net profit at 27% CAGR. The average ROE over three years is 49%. The balance sheet sits in net cash, effectively debt-free on a net basis.

The near-term picture looks more mixed. In Q2 FY26, revenue declined about 3% year-on-year and EBITDA margin printed near 22%, down 6% year on year. The slippage came from a prolonged monsoon that hit volumes, softer e-auction realizations and higher “other” operating costs, including a lower stripping-credit adjustment.

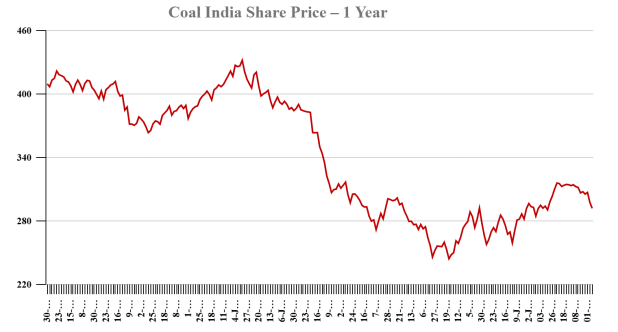

Coal India Share Price – 1 Year

Coal India has mapped out a focused expansion plan for the next few years, aiming to spend over 150-200 bn every year. It expects output to rise around 3% annually through FY28 as new MDO-based mines come onstream and washing capacity expands. The company is developing several washeries to improve fuel quality and reduce import dependence. The miner is also moving into renewables through a 500 MW solar venture and has tied up with Hindustan Copper to explore critical minerals. In parallel, it has secured graphite and vanadium blocks in Chhattisgarh to diversify its resource base. All projects are being funded through internal accruals, with debt considered only for large-scale diversification such as coal gasification.

At Rs 390, the stock trades at roughly 2.3x P/BV, a discount to its long-term median. With a 6–7% dividend yield and stable cash flows, Coal India remains a dependable income-generating PSU.

Conclusion

Even in a volatile market, the Nifty CPSE basket offers stability. These companies may not deliver flashy growth, but their steady cash flows, strong balance sheets and predictable dividends provide an anchor.

With government capex driving visibility and balance sheets largely debt-free, they remain relevant long-term plays. Valuations have rerated, but select PSU names still trade below intrinsic value. For investors, patience is key. CPSEs may not sprint, but their consistency, earnings visibility and yield make them dependable wealth builders over time.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.