Investing in small-cap stocks can deliver impressive growth, as these young companies are often at the start of their expansion journey.

But the flipside is their high volatility, their prices can swing widely, making them sensitive to market ups and downs.

Here are three small-cap stocks that have experienced significant declines and might be worth including in your watchlist.

This is not intended as a fundamental analysis or investment recommendation. The editorial simply highlights stocks from the smallcap category that have seen sharp drops in value.

#1 Protean eGov Technologies

First on our list is Protean eGov Technologies.

Over the past few months the stock has faced significant selling pressure. The price has tumbled from a 52-week high of Rs 2,074 to Rs 898, a decline of nearly 56%.

The primary reason is the company’s failure to secure the government’s PAN 2.0 project. This is a major managed service contract for upgrading India’s PAN ecosystem.

Protean eGov Technologies is a population-scale technology company that builds digital public infrastructure and e-governance solutions.

The company has been a key player in modernising and implementing India’s national digital infrastructures such as PAN (Permanent Account Number), TIN (Tax Information Network), Aadhaar enrolment services, National Pension System (NPS), and Atal Pension Yojana (APY).

Protean eGov Technologies holds a dominant position in the social security and welfare services segment, with a 97% market share.

Moving ahead, the company is looking to strengthen the Central KYC infrastructure of the nation under the CERSAI mandate of CKYCRR 2.0.

It’s also planning to expand the Central Agristack and support the Ayushman Bharat Digital Mission (ABDM) in digitising Maharashtra’s Aapla Dawakhana clinics.

The comoany is strategically investing in several next-generation, value-added solutions such as eSignPro, a comprehensive digital documentation suite.

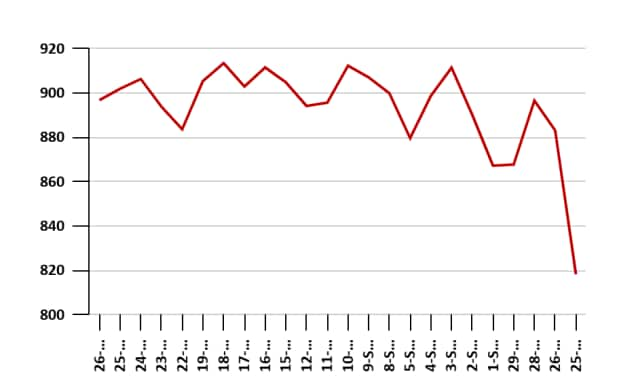

How Shares of Protean eGov Technologies Performed

In the past five days, Protean eGov Technologies have gained marginally to Rs 891 from Rs 888. In the last one month, the share price has gained about 3%. In the last one year, the shares have lost 52%.

The stock touched its 52-week high of Rs 2,074.4 on 17 December 2024 and its 52-week low of Rs 716.5 on 12 August 2025.

Protean eGov Technologies Share Price – 1 Month

#2 Raymond Realty

Second on our list of beaten down small-cap stocks is Raymond Realty.

The stock has declined significantly from its 52-week high of Rs 1,055.2 to its current level of Rs 592. Its downward trajectory began following the demerger from Raymond Ltd and its subsequent market listing in July 2025.

Raymond Ltd underwent a vertical demerger of its real estate business to create a wholly owned subsidiary called Raymond Realty. Shareholders of Raymond received one share of Raymond Realty for every share held in Raymond Ltd, maintaining a 1:1 share swap ratio.

The company has a strategic land bank of about 100 acres in Thane with a potential value of around Rs 250 billion (bn), complemented by joint development agreements (JDAs) worth roughly Rs 150 bn in prime locations across Mumbai Metropolitan Region (MMR).

Moving ahead, the company has several development projects lined up. It will continue to follow a strategy of asset-light business model through the joint-development agreement rule.

The company hopes to deliver a 20% YoY growth for booking values. According to the management, it’s on track to deliver the same for FY26.

So far, cumulatively Raymond Realty has delivered 26% return on capital employed (ROCE). As per a recent conference call, the company going forward will continue to deliver more than 20% ROCE.

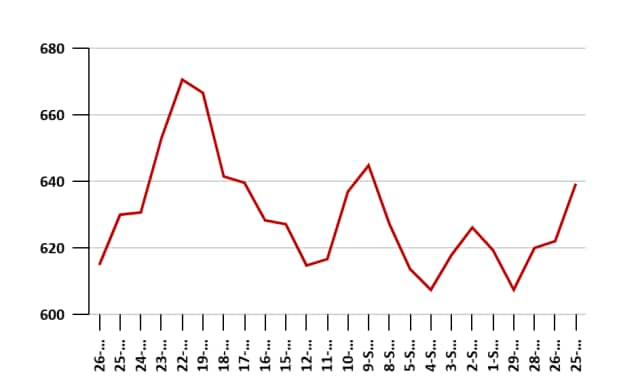

How Shares of Raymond Realty have Performed

In the past five days, Raymond Realty shares have dropped to Rs 592 from Rs 670. In the last one month, the share price has declined marginally.

The stock touched its 52-week high of Rs 1,005.2 on 1 July 2025 and its 52-week low of Rs 592 on 29 September 2025.

Raymond Realty Share Price – 1 Month

#3 Ksolves India

Third on our list is Ksolves India.

This is another small-cap stock that has been beaten down. The shares have dropped 42% from its 52-week highs of Rs 537.

Ksolves India focuses on delivering digital transformation services and developing tailored software solutions powered by cutting-edge technologies.

The company’s expertise spans big data tools like Apache Kafka, NiFi, Spark, and Cassandra, as well as data science techniques involving artificial intelligence and machine learning.

It has successfully finalised a salesforce deal with a prominent UAE-based firm renowned for its diverse portfolio, spanning retail, luxury brands, automotive, beauty, and hospitality.

Ksolves has secured a US$ 6 million (m) contract with a leading New York-based research and analytics services provider.

Further strengthening its position, the company initiated big data collaborations with one of India’s top independent full-service retail and institutional broking houses. It has also expanded its partnership with a Fortune 200 global telecom leader.

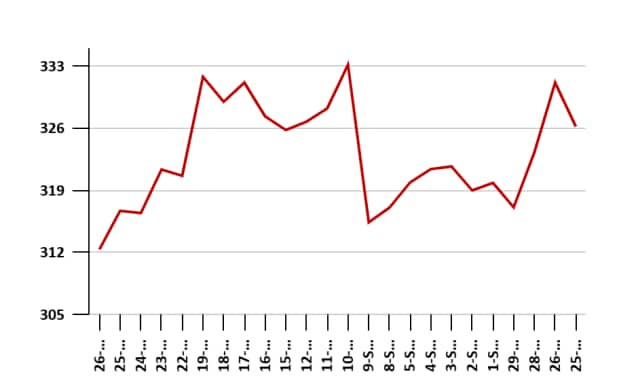

How Shares of Ksolves India have Performed

In the past five days, Ksolves India shares have dropped to Rs 313 from Rs 320. In the last one month, the share price has fallen marginally.

The stock touched its 52-week high of Rs 537 on 20 January 2025 and its 52-week low of Rs 300.1 on 19 August 2025.

Ksolves India Share Price – 1 Month

Conclusion

Small-cap stocks offer attractive growth opportunities but come with heightened risk and volatility.

These stocks are best suited for investors with a high risk tolerance and a long-term investment horizon who are willing to conduct thorough fundamental research.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.