Finding good investment opportunities can be tough, especially with all the market noise, constant data flow, and expert opinions.

That’s where Motilal Oswal Chairman Raamdeo Agrawal’s ‘25-25-25’ rule offers a simple filter. According to this framework, investors should look for companies with three characteristics: 25% return on capital employed (RoCE), 25% profit growth, and a price-to-earnings (P/E) ratio of 25 or less.

This helps filter for efficient companies, growing, and reasonably valued. Accordingly, we have selected two stocks that meet all three criteria of the 25-25-25 framework, based on their recent financial performance and current valuations.

Let’s take a look..

#1 CMS Info Systems

CMS Info operates across two segments: cash management & managed services.

The cash management segment includes ATM cash management, retail cash management, and cash-in-transit services. CMS is a leading player in all these segments, commanding a 42% market share. As of 9MFY25, it manages around 1,46,000 business points.

The managed services segment covers banking automation, brown-label ATMs, software solutions and remote monitoring technology solutions.

Over the years, the company has built strong relationships with its clients, which help drive incremental business and support revenue growth. Its clients include reputable players such as SBI, HDFC Bank, Axis Bank, ICICI Bank, Citibank, among others.

As of 9MFY25, the cash management segment leads, accounting for 61% of its total revenue, while the remaining 39% comes from managed services. The company has eight accounts, each with recurring annual revenue of ₹1 billion.

CMS revenue has grown at a compound annual growth rate (CAGR) of 20% over the last three years to ₹22.7 billion in FY24. This growth was led by the managed services business, which grew at a 29% CAGR to ₹8.9 billion. In contrast, the cash management segment revenue grew at a 17% CAGR to ₹14.8 billion.

The company boasts a strong margin, which has improved five percentage points during the period to 28.3% in FY24. With strong revenue growth and margins, CMS’s net profit increased at a 30% CAGR to ₹3.5 billion during the period.

CMS has consistently followed a disciplined approach to capital allocation. It has consistently delivered strong RoCE, averaging 25% between FY21-24, with RoCE reaching 27.4% in FY24.

CMS has also demonstrated healthy cash flow conversion with an operating cash flow (OCF) to EBITDA ratio of over 61% during FY21-24. EBITDA stands for earnings before interest, tax, depreciation, and amortisation. It generated cash flow of ₹4.4 billion with an OCF-to-EBITDA ratio of 69% in FY24.

CMS trades at a price-to-equity (P/E) multiple of 20.7x, about a 10% premium to the 10-year median multiple of 19x. With 25% profit growth, 25% RoCE, and P/E below 25, CMS perfectly fits into Ramdeo Agrawal’s 25-25-25 framework.

The company’s stock price has increased by 96% since its debut on Dalal Street in December 2021.

However, the growth momentum slowed somewhat in 9MFY25 due to delays in order execution. Revenue rose by 10% from last year to ₹18 billion, with margins remaining stable at 26%. As a result, net profit grew just 7% to ₹2.7 billion. CMS aims to achieve a revenue of ₹25-27 billion in FY25.

The company has maintained a healthy order book of ₹17 billion in its managed services segment as of Q3FY25, with new orders of about ₹7 billion in 9MFY25. These orders are relatively long-term contracts, spanning 4-7 years, providing revenue visibility in the near to medium term.

CMS expects to receive new orders, supported by expected growth in ATM penetration in semi-urban and rural areas, as well as increased outsourcing of ATMS by banks. Also, its managed services are expected to see steady growth, supported by healthy orders for remote monitoring and software implementation.

Additionally, the default of AGS Transact, the second largest company in the sector, and the subsequent downgrade in its credit rating are expected to create additional opportunities for major companies like CMS.

#2 Sharda Motors

Sharda Motors, incorporated in 1986, is the largest manufacturer of emission control systems for automotive companies in India. It has a market share of around 30% for emission control systems in passenger vehicles in India.

Its current product profile includes exhaust and suspension systems for passenger cars, utility vehicles, commercial vehicles, medium- and heavy-duty commercial vehicles, and vans. The company has a 10% market share in the suspension business.

The company serves a diverse customer base across various vehicle segments, with 53% of its revenue coming from passenger vehicles, 42% from commercial vehicles, and the rest from other segments.

The company’s financials have grown massively over the last three years. Revenue has grown at a CAGR of 17% to ₹28 billion during FY21-24. However, its EBITDA rose at a faster pace, with a 41% CAGR, to ₹3.6 billion, leading to a 5.4 percentage point improvement in margin to 12.8% in FY24.

This strong operating performance translated into robust bottom-line growth, as net profit increased at a massive 65% CAGR to ₹3 billion. The growth was driven by the implementation of BS-VI real driving emissions norms, improved operational efficiency, cost optimisation, and a shift towards higher-margin products, which led to better realisations.

Backed by strong profitability, Sharda Motors’ RoCE jumped from 24% in FY21 to 39% in FY24, with an average RoCE of 33.8% during the period. It trades at a P/E of 14.4x, in line with its 10-year median P/E.

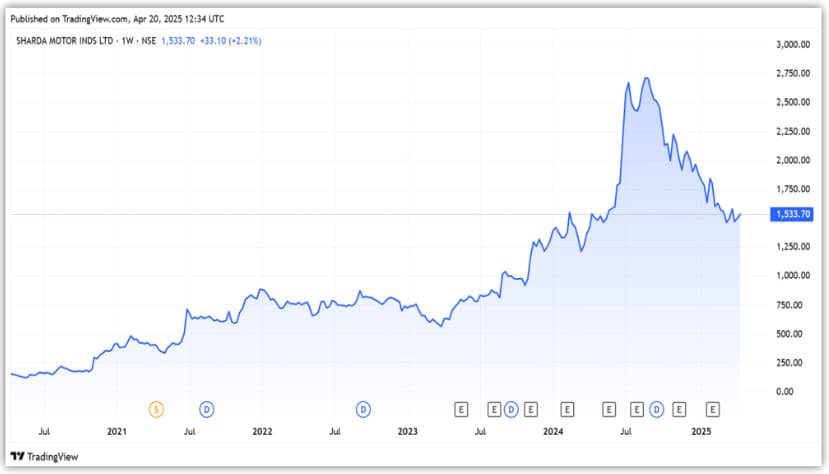

With 65% net profit growth, average RoCE of 33.8%, and P/E below 25x, the company aligns well with Ramdeo Agrawal’s 25-25-25 framework. Undoubtedly, its share price has multiplied by 9.5 times in the last 5 years.

However, the growth momentum slowed down in 9MFY25 due to the slowdown in the automobile sector. Its revenue remained stable at ₹20.8 billion. Despite that, EBITDA rose 13% to ₹2.9 billion due to cost efficiency, leading to a margin improvement of 1.75 percentage points. As a result, its profit grew 19% to ₹2.3 billion.

Sharda Motors Share Price

Looking ahead, the company aims to pursue sustainable growth by leveraging global and domestic market opportunities.

Sharda plans to foray into new businesses related to emission systems and products for tractors and construction equipment – segments that are expected to adopt stricter emission norms in the coming years. In addition, it aims to capitalise on export opportunities driven by the China +1 shift.

To this end, it plans to expand its international presence in the commercial vehicle, off-highway, tractor, and genset markets in Europe and the United States. It estimates the export market opportunity for its current product portfolio at $2.2 billion.

Furthermore, the company is looking to strengthen its suspension business as stricter emission regulations and the shift to electrification drive the need for lighter vehicles.

It aims to deepen partnerships, diversify the product portfolio and form joint ventures to increase content per vehicle.

Conclusion

Both CMS Info Systems and Sharda Motors align well with the 25-25-25 framework, as they combine strong earnings growth, efficient capital utilisation, and reasonable valuations. Such stocks often outperform the broader market.

While CMS benefits from its leadership in cash logistics and growing managed services, Sharda Motors is riding the structural shift in emission norms and export demand.

Investors seeking fundamentally strong mid-cap opportunities may find these businesses worth tracking, especially if they continue to deliver consistent performance.

Disclaimer

Note: We have relied on data from http://www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.