Most of the television, print and digital media is usually busy harping about the big bluechips and how they make hundreds and crores of rupees backed by huge capex and manpower. But amidst all this noise, some strong smaller companies are never seen on these platforms.

Two such companies that have proved their solid capital efficiency and managed to get almost debt free have caught the attention of smart investors. These companies work in stealth mode and hence few know about them. With solid ROCE (Return on Capital Employed) and freedom from hefty interest payments, they have the liberty to use profits to grow their business.

Let us dive into these two stocks to see if they are worthy of being added to the Watchlist 2026.

#1 Jyoti Resins: The Adhesive Underdog Outpacing the Giants

Incorporated in 1993, Jyoti Resins and Adhesives Ltd is a manufacturer of synthetic resin adhesives which manufactures diverse types of wood adhesives (white glue), under the brand name of EURO 7000.

With a market cap of Rs 1,336 cr, the company’s brand Euro 7000 is the 2nd largest wood adhesive white glue brand in India in the retail segment, giving stiff competition to Pidilite’s Fevicol.

The company has a current return on capital employed (ROCE) of 50% while the current industry median is just 15%. Simply put, for every Rs 100 the company uses as capital, it makes a profit of Rs 50 on it, while its peers in the same industry average just about 15%.

Even the 5-year average ROCE of the company is 55%, which again is higher than the industry median for the same period which is 17%. This means the company has been capital efficient in a sustainable fashion.

Add to this that the company is currently debt free, which gives it the freedom to use the profits for giving back to investors or for growth purposes, as it is not bogged down by hefty interest payments.

But does the company have all it takes to sustain these numbers in 2026 and beyond? Let us look at the financials to try and find out if it does. We are looking at the stand-alone numbers for the company and not consolidated, so that we have a slightly longer period to look at.

The company’s sales have grown from Rs 74 cr in FY20 to Rs 284 cr in FY25, logging a compound growth of 31%. And for H1FY26, sales of Rs 149 cr have been recorded.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) grew from Rs 12 cr in FY20 to Rs 89 cr in FY25, recording a 49% CAGR. And for H1FY26, EBITDA was Rs 41 cr.

As for the net profits, the company has logged a compound growth of 56% from Rs 8 cr in FY20 to Rs 74 cr in FY25. And for H1FY26, the profits recorded were Rs 34 cr.

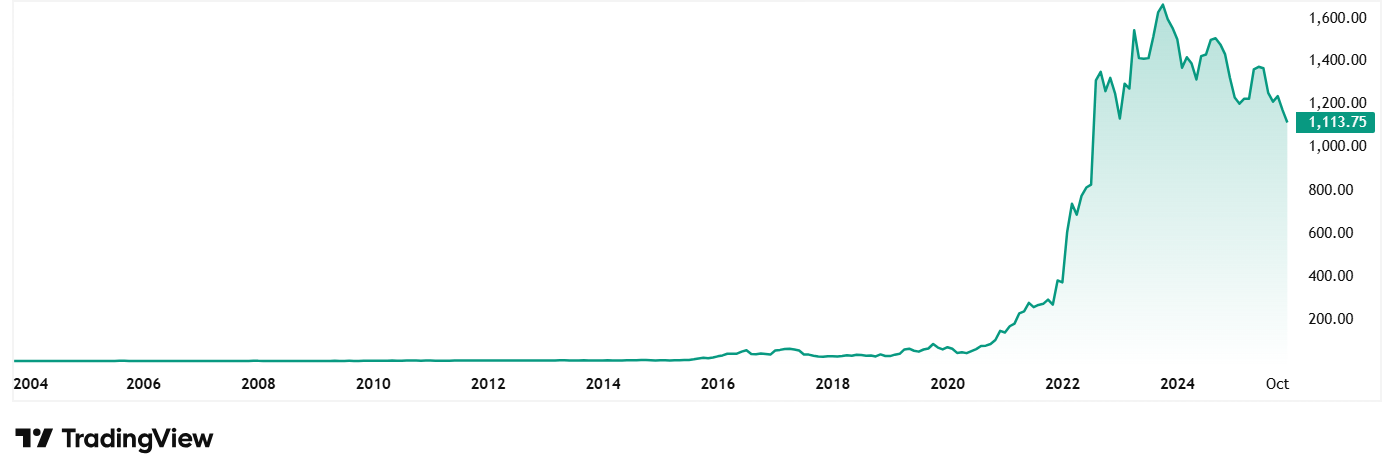

The share prices for Jyoti Resins and Adhesives Ltd were around Rs 120 in December 2020 and as of closing on 26th December 2025 it was Rs 1,114. A jump of almost 830% in 5 years. Rs 1 lakh invested in the stock 5 years ago would have been over Rs 9.25 lakhs today.

At the current price of Rs 1,114 the company’s share is trading at a discount of 39% from its all-time high price of Rs 1,818, creating a possible entry point for investors who missed the earlier rally.

As for valuations, the company’s current PE is a modest 18x, while the current industry median is 29x. The 10-year median PE for the company is 25x and the industry median for the same period is 29x.

With a clear focus on expanding its national presence and reaching a revenue threshold of Rs 500 cr in the next three years, the company has a strong growth plan. By extending its distribution network into new states and upholding a disciplined financial profile, the company intends to strategically increase its market share. This entails avoiding debt while aiming for remarkable return ratios, particularly +30-40% ROE and +40% ROCE, which are fuelled by robust operating cash flows and effective working capital management.

#2 Garuda Construction: Engineering High Margins in a Crowded Sector

Incorporated in 2010, Garuda Construction provides end-to-end civil construction for residential, commercial, residential cum commercial, infrastructure, and industrial projects.

With a market cap of Rs 1,832 cr the company specializes in civil construction services that include project planning, resource mobilization, detailed engineering, and the complete execution of construction projects.

Just like Jyoti Resins, Garuda Construction is also highly capital efficient, with a current ROCE of 30% and the 5-year average of a strong 52%. Which means, for every Rs 100 it uses as capital currently, the company makes a profit of Rs 30 which is probably one of the highest when compared to industry peers. The current Industry median ROCE is 18%.

The company is also almost debt free, free from big interest payments.

Looking at the financials (Standalone), the company’s sales jumped from Rs 124 cr in FY20 to Rs 225 cr in FY25, logging a compound growth of 13% in the last 5 years. For H1FY26, the sales recorded were Rs 241 cr.

EBITDA grew at a compound rate 75% from Rs 4 cr in FY20 to Rs 66 cr in FY25. And for H1FY26 EBITDA of Rs 70 cr was recorded.

As for the net profits, the company has shown solid growth from Rs 1 cr in FY20 to Rs 50 cr in FY25 logging in compounded growth of 118%. For H1FY26, profits of Rs 55 cr were recorded already, hinting at a much stronger financial year.

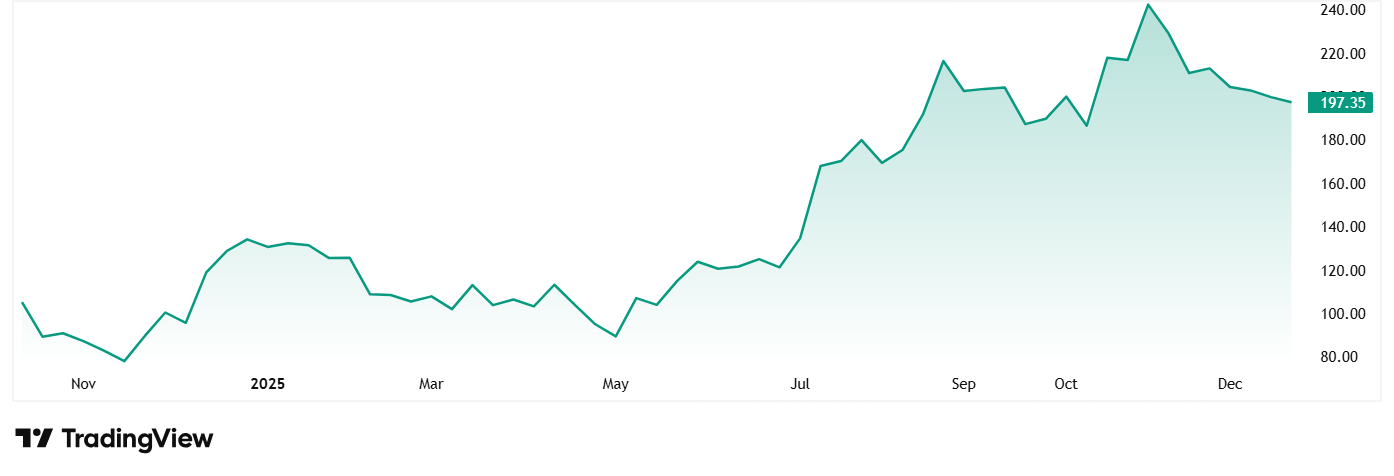

The share price of Garuda Construction and Engineering Ltd was about Rs 104 when it was listed in October 2024. And as of closing on 26th December 2025 it was Rs 197, which is a jump of 90%.

At the current price of Rs 197, the company’s share is trading at a discount of over 20% from its all-time high price of Rs 249.

Valuation wise, the company’s share is trading at a PE of 21x, while the current industry median is 18x, which means buyers are willing to pay a small premium to own the company’s shares.

As per the company’s last investor presentation from October 2025, its order book has expanded 2.5x, reaching Rs 3,461 crore, up from Rs 1,400 crore at the time of its IPO. In the same presentation, MD and Chairman Pravin Kumar Agarwal said, “Our focus continues to be on niche and high-margin projects. We consciously avoid contracts that could dilute margins and instead prioritize those that align with our profitability benchmarks. We are currently in advanced negotiations for a large project that could further strengthen our growth trajectory.”

Worthy of Watchlist 2026?

Both the stocks we saw today currently shine with no debts and high returns on capital employed, backed by operational expertise and systems in place to ensure enviable capital efficiency.

Add to this that the financials for both look strong steady growth in core figures and their respective managements having sturdy growth plans in place. Not to forget that their zero-debt status enables them to be free of high interest payments and used the money saved to grow the business further.

Whether these stocks be the future multibaggers and be able to sustain these numbers in 2026 and beyond is something we will have to wait and watch. For now, it is recommended to add these stocks to a watchlist and watch them closely.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.