Every company and investor have one thing in common. They are both looking for just one thing – PROFITS! After all, that’s the one goal everyone putting money into a business or into the market as an investor wants to achieve.

So, when some company hits the sweet spot where it is quietly but solidly growing net profits as well as returns on the money it invests as capital in the business, it deserves the attention of all smart investors.

The companies from the power sector we look at today have hit that sweet spot and are hitting those goals consistently for the better part of the last decade, signalling the managements strong hold on tight operations and money management. Let us look at what makes these companies stand out in the crowd.

Transformers & Rectifiers India Ltd

Incorporated in 1994 as Triveni Electric Company Limited, the company changed its name to Transformers & Rectifiers India Limited in 1995.

With a market cap of Rs 14,744 cr, the company is a leading Indian manufacturer of transformers & reactors. Its product portfolio includes Single-phase power transformers up to 500MVA & 1200kV Class, Furnace Transformers, Rectifier & Distribution Transformers, Specialty Transformers, Series & Shunt Reactors, Mobile Sub Stations, Earthing Transformers, etc. It operates on a B2B model, catering to power generation, transmission, distribution, & industrial sectors

When it comes to making a return on the money invested in the business as capital, the company has a current ROCE of 28%, which simply means that for every Rs 100 the company invests as capital, it makes a profit of Rs 28 on it. The 5-Year ROCE for Transformers & Rectifiers India Limited is also a good 15%.

The company’s sales have grown from Rs 701 cr in FY20 to Rs 2,017 cr in FY25, logging in a compound growth rate of 24% in the last 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Transformers & rectifiers grew from Rs 51 cr in FY20 to Rs 327 cr in FY25, recording an enviable 45% compounded growth.

The net profits are what can be termed as the turnaround story worthy of all accolades. The company has logged in a compound growth of a whopping 251% from Rs 1 cr in FY20 to Rs 216 cr in FY25.

These profits can be attributed to a solid order book and order execution. Q1FY26 saw an order inflow worth Rs 665 cr. And as of June 2025, the company has an unexecuted order book of Rs 5,246 cr.

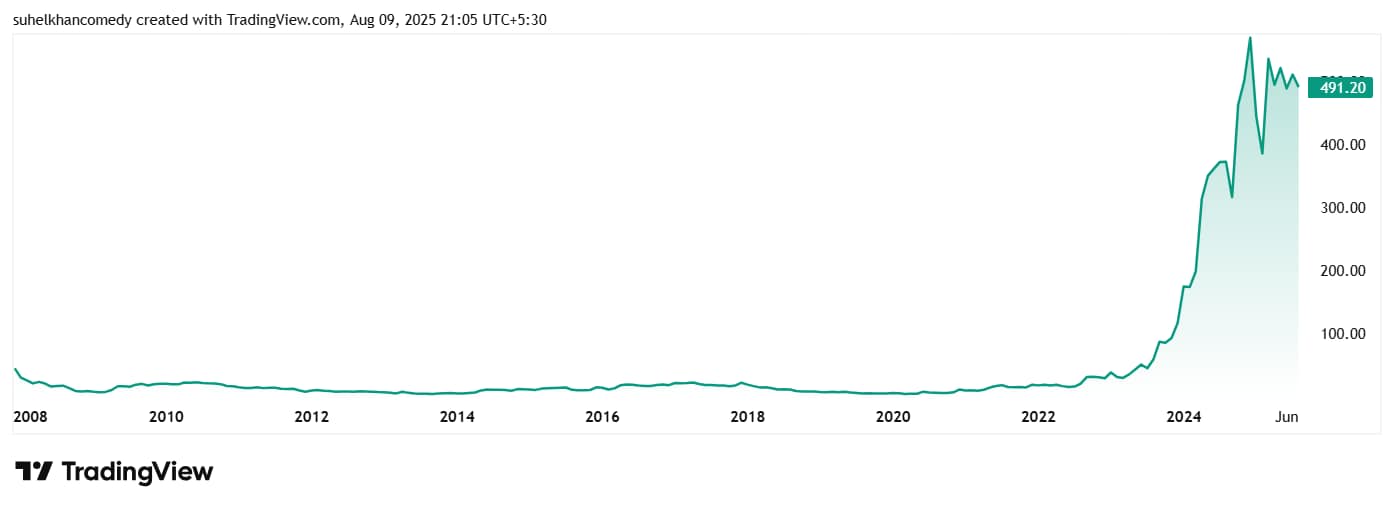

The share price of Transformers & Rectifiers India Limited have seen the effects of this strong growth and went from around Rs 5 in August 2020 to its current price of Rs 491 as of closing on 8th August 2025. That is a growth of an astounding 9,720% in just 5 years. Rs 1 lac invested in the stock 5 years ago would have turned to a little over Rs 98 lacs today.

Even at the current price of Rs 491, the stock is trading at a discount of about 25% from its all-time high price of Rs 650.

As for valuations, the company’s share is trading at a PE of 57x, which is close to the current industry median is 54x. The 10-year median PE for Transformers & Rectifiers is 32x which is lower than the industry median for the same period which is 45x.

According to the latest investor presentation for the company in August 2025, there is a leadership change and Mr. Mukul Srivastava has joined as CEO to drive manufacturing excellence and operational improvements.

Overall, the company’ management remains bullish on medium-term prospects, driven by a strong order book, healthy margins, ongoing capacity expansion, and a selective approach to order intake. The company is leveraging backward integration and operational excellence to drive profitability and is positioning itself to capitalize on the multi-year upcycle in the Indian power and transformer sector. The management sees no major risks or headwinds.

K.P. Energy Ltd

Incorporated as a public limited company in 2015, K.P. Energy Ltd is a part of the KP Group of Surat. It is involved in the development of utility scale wind power generation infrastructure.

With a market cap of Rs 2,968 cr the company’s major activities encompass siting of wind farms, acquisition of lands and permits, EPCC of wind projects, along with balance of plant (BoP) infrastructure. The company also owns and operates WTGs (Wind Turbine Generators) and solar power plant as an IPP (Independent Power Producers).

The company has a current ROCE of 42%, which simply means that for every Rs 100 the company invests as capital, it makes a profit of Rs 42 on it. The 5-Year ROCE for the company is again a strong 32%.

The company’s sales jumped from Rs 75 cr in FY20 to Rs 939 cr in FY25, logging in a compound growth of 66% in the last 5 years.

EBITDA for K.P. Energy Ltd has grown at a compound rate 74% from Rs 11 cr in FY20 to Rs 176 cr in FY25.

As for the net profits for the company grew from Rs 1 cr in FY20 to Rs 115 cr in FY25, logging in a compound growth of 154% in 5 years.

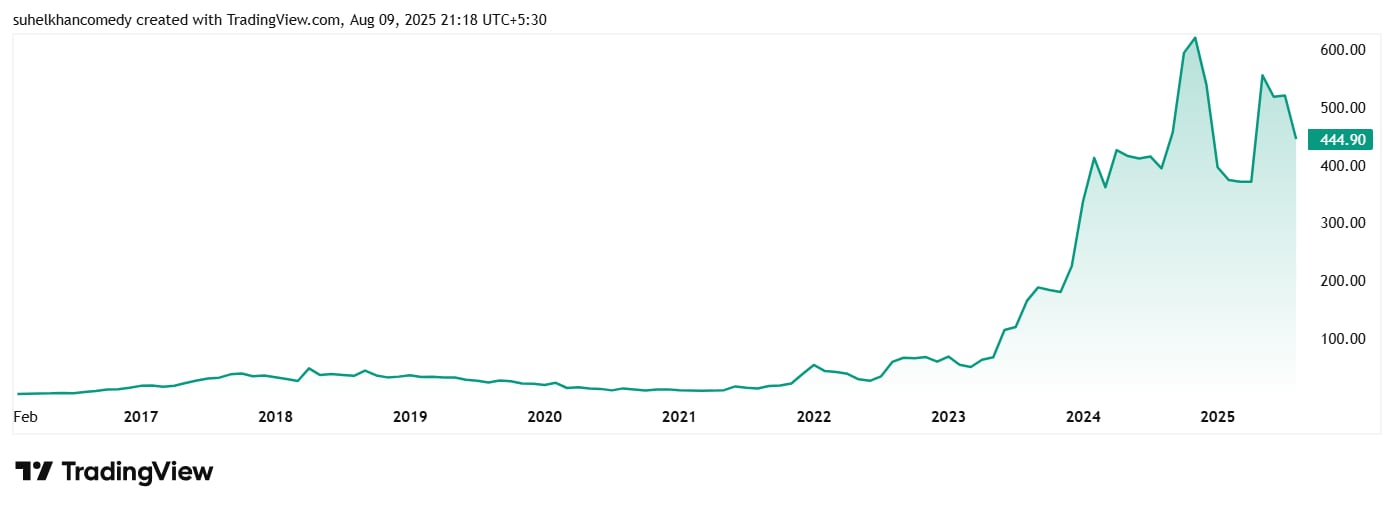

The share price of K.P. Energy Ltd was about Rs 10 in August 2020 and as of closing on 8th August 2025, it was Rs 444, which is a jump of 4,340%. Rs 100,000 invested in the company’s share 5 years ago would have been about to Rs 44.5 lacs today.

The stock is currently trading at a discount of about 35% from its all-time high price of Rs 675.

Valuation wise, the company’s share is trading at a PE of 24x, while the industry median is 40x. The 10-year median PE for K.P. Energy is 20x and the industry median for the same period is 26x.

In the company’s latest investor presentation from August 2025, the company is planning big investments in offshore wind and green hydrogen, while leveraging its strong execution and operational capabilities to sustain the strong growth it has demonstrated.

Plus, it plans to improve profitability and contribute to India’s renewable energy target. The Capex will focus on expanding capacity, offshore wind development, and integrating new clean energy solutions. All in all, K.P. Energy Limited currently looks set for potential growth with a clear roadmap targeting 10+ GW renewable capacity by 2030, supported by technology integration, geographical expansion, and revenue streams from EPC, O&M, and IPP assets.

Time to Power Up Your Portfolio?

Both the companies we saw today, Transformers & Rectifiers India Ltd and K. P. Energy Ltd, have written their own turnaround stories in the last decade and recorded stellar compounded profit growth, making a lot of money for themselves and their investors.

What is to be seen is that will these power companies be able to keep powering this growth and take it to new heights or the surge cause a sudden power failure? We will have to wait and see which way this bet goes.

For now, it seems like a good idea to add these stocks to your watchlist, especially because these companies’ shares are trading at a good discount.

Whatever happens in the near and long-term future, it goes without saying is that these companies deserve attention right now, given where they stand. Adding them to a watchlist and keeping an eye on them sounds like a good plan.

Disclaimer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.